By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Weekly Market Commentary

The Markets

The coronavirus (COVID-19) continued to spread across the United States last week.

On Friday, March 13, the Centers for Disease Control (CDC) reported there were 1,629 confirmed and presumptive cases and 41 deaths. Last Friday, March 20, the numbers had increased to 15,219 cases and 201 deaths.

Governments in several states – including California, Colorado, Connecticut, Florida, Georgia, Idaho, Illinois, Louisiana, Maine, New Jersey, and New York – have issued shelter-in-place orders that apply to the entire state or one or more counties within the state. The intent is to enforce social distancing and slow the spread of COVID-19, reported Wired.

Mandates varied by region. Many included closing non-essential businesses and required residents to stay home unless they were buying groceries or gasoline, filling prescriptions, seeking medical care, or exercising outdoors (while practicing social distancing).

The shape of many Americans’ daily lives has changed significantly. Last week, Barron’s reported initial claims for unemployment benefits in the United States increased sharply, while U.S. manufacturing productivity dropped significantly.

The impact of measures taken to fight the spread of COVID-19 on companies, financial markets, and the economy is difficult to quantify at this point. However, there is reason to hope it will be relatively brief. The Economist reported:

“Despite stomach-churning declines in GDP [gross domestic product, which is the value of goods and services produced in a nation or region] in the first half of this year, and especially the second quarter, most forecasters assume that the situation will return to normal in the second half of the year, with growth accelerating in 2021 as people make up for lost time.”

Monetary stimulus will have a significant impact on outcomes around the globe. Central banks have been implementing supportive monetary policies. Last week, the Federal Reserve lowered its benchmark rate to near zero, announced a new round of quantitative easing, and took additional steps to inject liquidity into markets.

Fiscal stimulus – the measures implemented by governments – will also be critical. To date, the United States has passed two stimulus measures. The first provided $8.3 billion in emergency funding for federal agencies to fight COVID-19. The second is estimated to deliver about $100 billion for testing, paid family and sick leave (two weeks), funds for Medicaid and food security programs, and increases in unemployment benefits. The third stimulus is currently being negotiated in Congress and may provide more than $1 trillion dollars in relief to individuals and companies, reported Axios. On Sunday, Reuters reported the Senate planned to vote on the bill on Monday, March 23, 2020.

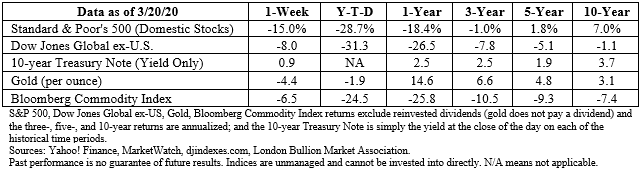

Major U.S. stock indices finished last week lower, reported CNBC.

We hope you and your family are well and remain so. Please take the precautions advised by your city, state, and federal governments to limit the advance of COVID-19.

FINANCIAL HELP DURING COVID-19 CRISIS. The temporary closing of non-essential businesses, shelter-in-place orders, and other changes that have come with efforts to keep COVID-19 from overwhelming hospital and healthcare facilities are creating economic challenges for many families. Here are four support and stimulus measures that may help.

1. Financial support from banks and financial companies. Americans who find themselves without work or working fewer hours may want to contact their banks. CNBC reported some banks and financial companies are willing to provide support during this difficult time, including:

- Deferring payments on mortgage, auto, and other personal loans

- Deferring payments on small business loans

- Waiving customer overdraft, expedited check, and debit card fees

- Waiving customer fees on excessive savings account withdrawals

- Waiving penalties for early withdrawals from certificates of deposit

- Refunding overdraft, insufficient funds, and monthly maintenance fees for bank and small business customers

- Pausing foreclosures, evictions, and repossessions

- Offering economic disaster loans

Customers must contact their banks to request support.

2. Tax Day postponement to July 15. The Internal Revenue Service pushed the 2019 tax filing deadline from April 15, 2020 to July 15, 2020. The three-month delay is intended to help Americans cope with the financial effects of COVID-19, reported CNBC. If you expect a refund, you may want to file sooner.

It is unclear whether 2019 contributions to IRAs must be made by April 15, 2020. Also, the deadline for filing taxes in your state may remain unchanged. Check with your state’s treasury office.

3. Stimulus checks from the government. The details are not yet available, but it appears the bill currently being debated in Congress may include stimulus checks for Americans. The proposals vary so it is impossible to provide specifics right now, according to Kiplinger.

4. Paid and family sick leave. On March 18, the Families First Coronavirus Response Act was passed. The new law requires employers with fewer than 500 workers to provide up to 80 hours of paid sick leave to employees affected by COVID-19. You qualify to receive your full wages (up to $511 per day) while on paid leave if you are sick or quarantined.

If you are caring for someone who is ill with coronavirus, or you are home caring for children, then you qualify to receive two-thirds of wages (up to $200 a day).

Go to Kiplinger.com to see if any other assistance may apply to you.

Weekly Focus – Think About It

“In the midst of every crisis, lies great opportunity.”

--Albert Einstein, Physicist

Sources

https://www.cdc.gov/coronavirus/2019-ncov/cases-updates/cases-in-us.html (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-23-20_CDC-COVID-19_Cases_in_United_States-Footnote_1.pdf)

https://www.wired.com/story/whats-shelter-place-order-whos-affected/

https://www.barrons.com/articles/washington-must-go-all-in-now-on-fiscal-aid-or-america-will-pay-later-51584746071?refsec=economy-and-policy (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-23-20_Barrons-What_Washington_Needs_to_Do_Right_Now_to_Spare_America_a_Second_Great_Depression-Footnote_3.pdf)

https://www.economist.com/briefing/2020/03/19/governments-are-spending-big-to-keep-the-world-economy-from-getting-dangerously-sick (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-23-20_TheEconomist-Governments_are_Spending_Big_to_Keep_the_World_Economy_from_Getting_Dangerously_Sick-Footnote_4.pdf)

https://www.federalreserve.gov/newsevents/pressreleases/monetary20200315a.htm

https://www.axios.com/coronavirus-stimulus-packages-compared-7613a16f-56d3-4522-a841-23a82fffcb46.html

https://www.reuters.com/article/us-house-coronavirus-usa-mcconnell/u-s-senate-to-vote-on-coronavirus-relief-bill-on-monday-mcconnell-idUSKBN2190TB?il=0

https://www.cnbc.com/2020/03/19/stock-market-futures-open-to-close-news.html

https://www.cnbc.com/2020/03/20/what-banks-are-doing-to-help-americans-affected-by-coronavirus.html

https://www.cnbc.com/2020/03/20/ccoronavirus-mnuchin-says-irs-will-move-tax-filing-deadline-to-july-15.html

https://www.kiplinger.com/slideshow/spending/T065-S001-coronavirus-stimulus-measures-that-could-help-you/index.html

https://www.goodreads.com/quotes/tag/crisis?page=2

Certain material in this work is proprietary to and copyrighted by Carson Coaching and is used by JMS Capital Group Wealth Services LLC with permission. | Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. | Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.| The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.| All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.| The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index. | The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.| Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.| The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998. | The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.| The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.| International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.| Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.| Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.| Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.| Past performance does not guarantee future results. Investing involves risk, including loss of principal.| You cannot invest directly in an index.| Stock investing involves risk including loss of principal.| The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.| There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.| Asset allocation does not ensure a profit or protect against a loss.| Consult your financial professional before making any investment decision.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

‹ Back