By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Fourth Quarter 2018 Key Takeaways

What stands out about 2018 is the breadth of negative returns across almost every asset class and financial market. It was a very challenging year for our globally diversified active portfolios, primarily driven by sharp declines in foreign stock markets. Across the board, it was an extremely difficult year to make money in the financial markets.

But as students of financial market history, we know the headwinds our portfolios have faced over the past few years will eventually turn to tailwinds. Sticking to our process may feel uncomfortable at times, but it’s exactly what’s necessary to achieve long-term success and avoid the pitfalls of performance chasing and emotionally driven investing.

Our portfolios are positioned to perform well over the medium to long term and have the diversification attributes to be resilient across a range of potential scenarios. We are optimistic about their potential for strong relative performance in the years ahead as the headwinds and trends shift.

Over the short term, if the current recession fears are overdone, we expect to generate strong relative returns. Outperformance should come from our foreign equity positions, active managers, and flexible bond funds.

On the other hand, if U.S. stocks slide into a full-fledged bear market, our portfolios have allocations to lower-risk fixed-income and alternative strategies that should hold up much better than stocks. We can then put this capital to work more aggressively at lower prices that imply much higher expected returns.

Our alternative strategies, despite strong outperformance during the fourth quarter relative to equities, also finished the year negative overall. However, they performed as we would expect during a sharp selloff in stocks and limited losses to less than one quarter of the drop in equities. The environment during the fourth quarter is a reminder of why we own these strategies to begin with, to mitigate overall portfolio volatility and provide downside protection during periods of market weakness.

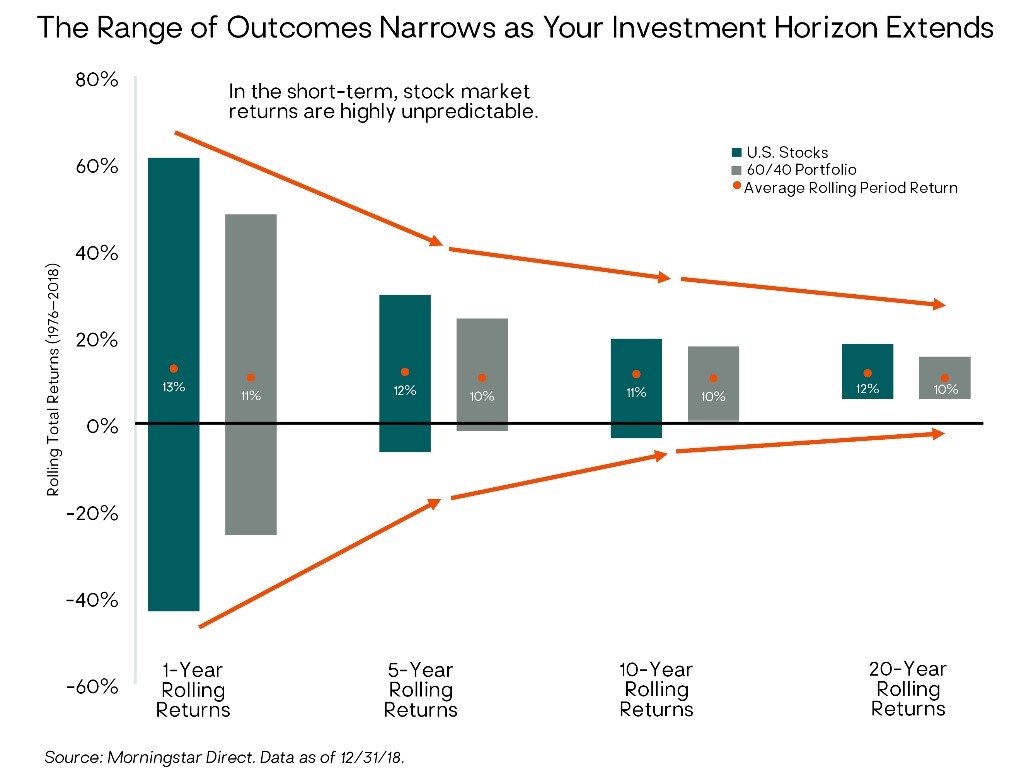

Throughout the history of our firm, we’ve emphasized the importance of having a long-term perspective. As your time horizon lengthens, the range of reasonable expected outcomes narrows, the shorter-term cyclical spikes and dips are smoothed out, and the underlying fundamental/economic drivers of financial asset returns play out. Over the long term, we are highly confident of the benefits from owning a globally diversified portfolio.

Successful investing is a process of consistently making sound, well-reasoned decisions over time, and across market and economic cycles. We believe our diversified, fundamental, valuation-based investment approach meets this definition. As long as we continue to execute our approach with discipline and remain patient during the inevitable periods when it is out of favor, we have no doubt we will achieve successful and rewarding long-term results for our clients.

Fourth Quarter 2018 Investment Letter

Market Recap

From a return perspective, 2018 could largely be considered the year that wasn’t. Despite a few half-hearted rallies leading into the closing day, global financial markets ended December with the worst annual returns since the great financial crisis. Larger-cap U.S. stocks fell nearly 14% in the fourth quarter, wiping out year-to-date gains and ending down 4.4%. Smaller-cap stocks fared worse, falling 20% in the quarter and 11% for the year. Foreign stocks suffered through most of the year, with mid-double-digit year-end losses for both developed international and emerging-market stocks (despite their relative outperformance versus U.S. stocks in the fourth quarter).

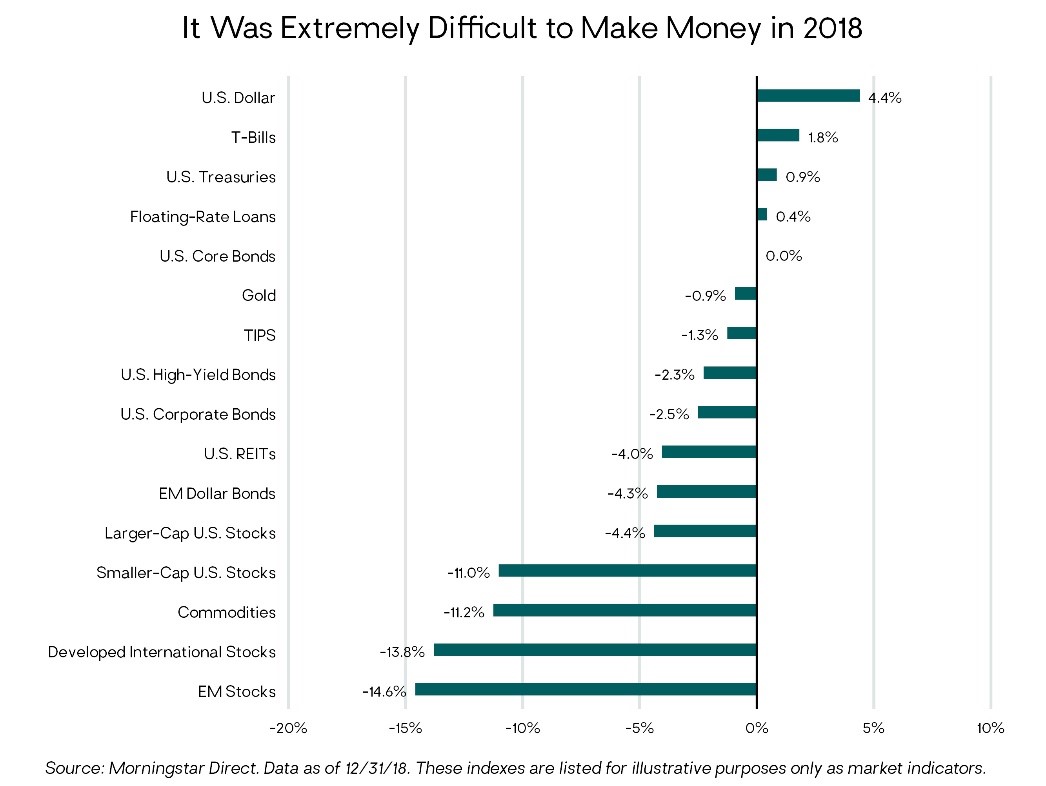

In addition to the equity market declines, what stands out about 2018 is the breadth of negative returns across almost every type of asset class and financial market, whether bonds, equities, or commodities. Even core investment-grade bonds were in the red until the final weeks. As evidenced by the chart below, it was extremely difficult to make money in the financial markets last year.

The lackluster performance of so many asset classes, culminating with the fourth quarter’s dramatic U.S. equity decline, is largely due to the uncertainty that prevailed throughout much of 2018. As the year wore on, early positive market indicators such as still-solid U.S. economic growth and declining unemployment numbers were swamped by investors’ fears surrounding ongoing U.S.-China trade tensions, political uncertainties in Europe, and continued Fed tightening, among others.

It was a challenging year for our globally diversified active portfolios, driven by sharp declines in international and emerging stock markets. In absolute terms, most investments were negative for the year. However, several of our actively managed bond funds and floating-rate loan funds as well as our two primary large cap growth funds posted positive returns.

Our fourth quarter portfolio performance also demonstrated the potential risk-management and diversification benefits of our lower-risk alternative strategies, as they outperformed U.S. stocks by a considerable margin in the fourth quarter of 2018. In a year in which virtually all asset classes struggled, our merger arbitrage and event driven funds provided us with much-needed steady returns, even overcoming U.S.-China trade tensions and the consequent collapse of key mergers. However, many alternative funds did not fare as well, with the strongest funds from 2017 (and historically) tending to be among the worst performers this past year. While we are not satisfied by the performance of our alternatives sleeve, we are not surprised by it given the derth of positive investment returns for broad asset classes in 2018 (again, see chart above). If we witness many of these risks being mitigated in 2019, we expect many or our alternative strategies to participate to the upside to a much greater degree than what we witnessed during the first three quarters of 2018.

A Consistent Focus

Throughout our history, we’ve succeeded on behalf of our clients by emphasizing the importance of having a long-term perspective. With a long-term perspective comes the necessity of discipline and patience in sticking to your investment process and executing it consistently over time rather than being subject to swings in investor sentiment and market consensus, which more often than not detracts from returns versus enhancing them.

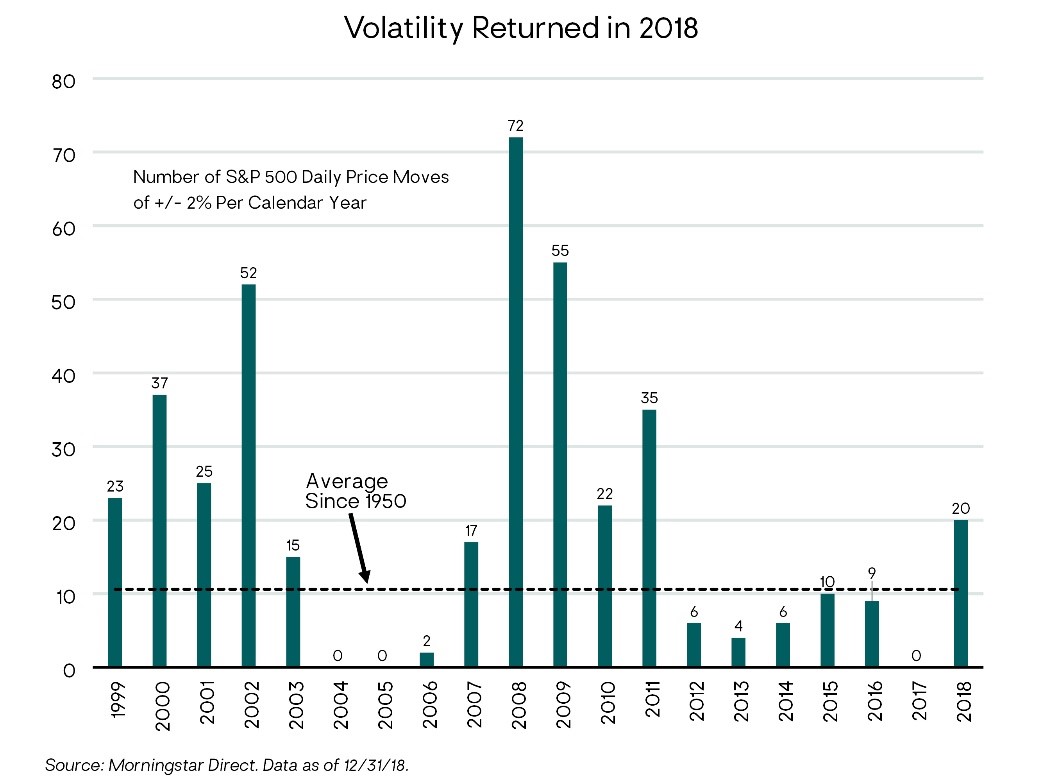

While today’s headlines may be filled with distress signals and warnings of market weakness, it’s worth remembering that just one year ago those headlines boasted 20%-plus global equity gains and historically low market volatility. In fact, most investment strategists expected 2018 would bring a continuation of the synchronized global economic recovery. The sharp market pullbacks witnessed this past year only reinforce our view that no one can consistently predict short-term market moves.

Over the next year, the range of potential equity market outcomes is just as wide as it was going into the 2018. Our approach and preparation remain the same. We construct and manage portfolios to meet our clients’ longer-term return goals, which means successfully investing through multiple market cycles, not just the next 12 months. Given our current investments, we are confident our portfolios are positioned to perform well over the medium to long term and to be resilient across a range of potential shorter-term scenarios.

If the current recession fears are overdone, we expect to generate solid overall returns with outperformance from our foreign equity positions, active managers, and flexible bond funds. On the other hand, if U.S. stocks slide into a full-fledged bear market, our portfolios have “dry powder” in the form of lower-risk fixed-income and alternative strategies that should hold up much better than stocks. We’d then expect to put this capital to work more aggressively; for example, by increasing our exposure to U.S. stocks at lower prices and valuations implying much higher expected returns over our medium-term horizon.

If the current recession fears are overdone, we expect to generate solid overall returns with outperformance from our foreign equity positions, active managers, and flexible bond funds. On the other hand, if U.S. stocks slide into a full-fledged bear market, our portfolios have “dry powder” in the form of lower-risk fixed-income and alternative strategies that should hold up much better than stocks. We’d then expect to put this capital to work more aggressively; for example, by increasing our exposure to U.S. stocks at lower prices and valuations implying much higher expected returns over our medium-term horizon.

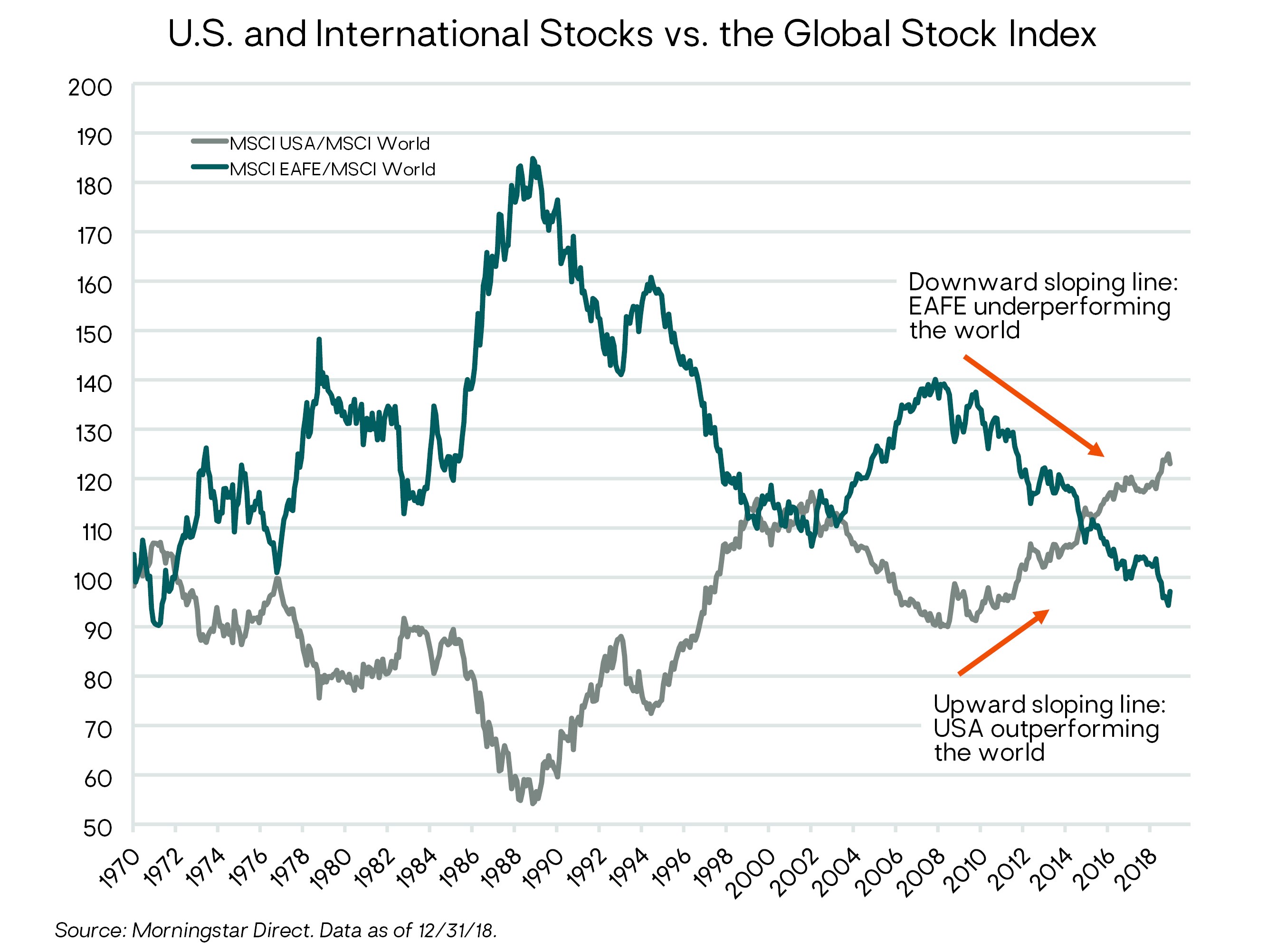

Speaking of U.S. stocks, in the period since the financial crisis, there has seemingly been little need to own anything other than U.S. stocks. But it should be particularly clear after this year (and this past quarter) that isn’t a sound long-term approach. The multiyear period of U.S. stock market outperformance versus the rest of world is reaching an extreme relative to history. We do not believe that the results of the past 10 years are sustainable, and they won’t be repeated over the next 10 or 20 years.

Even after their fourth quarter declines, U.S. stocks remain somewhat expensive. However, many markets elsewhere are oversold, strengthening their appeal for long-term, value-seeking investors like ourselves. Europe is historically cheap, with a lot of the worries (e.g., Brexit, Italy’s political and debt concerns) likely already priced in. And the selloff in Asia has been particularly severe. Here again the market seems to be overreacting to potential risks (e.g., a slowdown in China) rather than reflecting the

true value of emerging markets—a vast investment opportunity set that continues to expand at a faster rate compared to developed markets. Despite the risks we see over the short term, we have high conviction that our investments in developed international and emerging-market stocks will earn significantly higher returns than U.S. stocks over the next five to 10 years.

Our allocations to foreign stocks also provide our portfolios with diversification away from the U.S. dollar. After the dollar’s strong performance the past several years, a U.S. budget deficit not seen outside of recessions or war, and the overvaluation we see in U.S. stocks, we believe the U.S. dollar is a risk factor that investors would be prudent to diversify away from to some degree.

Looking Ahead

As we leave a difficult 2018 behind us and look forward to 2019, there are many reasons to be optimistic but perhaps just as many that give us cause for concern. Most importantly however, is maintaining realistic expectations about the potential range of outcomes over various investment horizons. Shorter-term returns have the widest range of potential outcomes and it is prudent to be patient and stick to your strategy in order to achieve the longer-term returns you expect.

As we leave a difficult 2018 behind us and look forward to 2019, there are many reasons to be optimistic but perhaps just as many that give us cause for concern. Most importantly however, is maintaining realistic expectations about the potential range of outcomes over various investment horizons. Shorter-term returns have the widest range of potential outcomes and it is prudent to be patient and stick to your strategy in order to achieve the longer-term returns you expect.

So, what are the key risks were keeping a close eye on during 2019?

Recession fears – Global growth, while slowing, remains positive. We have not seen any data that suggests a recession is going to come to fruition in 2019. Many market participants point to the short-lived yield curve inversion between three-year and five-year Treasury yields in early December as early signs of a coming recession. We are focusing on the spread between the two-year and ten-year Treasury spread as a more reliable indicator of a recession as its inversion has preceded each of the last seven recessions. There are also fears that the world’s two largest economies will end up in an all-out trade war which would significantly detract from global growth and ultimately lead to a recession. We believe the likelihood of a recession occurring this year is low.

Central bank policy – A change of course by the Federal Reserve, European Central Bank (ECB), or Bank of Japan regarding interest rates could hurt or help markets. Should central banks move too aggressively relative to market expectations, we expect equity markets to respond negatively (as they did in December of 2018). However, if central banks back away from their current pace of tightening, we believe equities will respond positively. Ultimately, we see central banks moving in accordance with their rhetoric so as not to surpise markets in either direction.

U.S.-China trade war – We are also keeping a close eye on the impact of a potential trade war on U.S. businesses and trade–sensitive global economies. Negotiations are currently underway to find resolution between the two countries as both parties realize it is not in their best interest for the situation to escalate beyond what we have already seen. The 90 day negotiation window closes at the end of February; we are hopeful that a positive resolution will be reached before that. If not, the risk of a recession materially increases and the timetable is pulled forward.

Global politics – Outside of the U.S., there are a number of important elections and change in leadership coming, especially in the European Union (EU). In May, voting for the European Parliament will occur which will influence the appointment of the next European Commission, the bloc’s executive arm, which will takeover in November for a five-year period. The European Council elections also take place in November. On October 31st, Mario Draghi’s term as ECB President comes to an end. This is all after the United Kingdom is set to leave the EU at the end of March, coined Brexit, in which substantial uncertaintly remains.

As 2018 reminded us, the markets are often affected by numerous variables. Over time, these variables often create volatility – this is most often the rule and not the exception. Given all of the uncertainty in the world, we expect volatility to remain elevated in the coming months –perhaps not as elevated as we experienced in 2018 but certainly not as low as 2017 brought us.

As 2018 reminded us, the markets are often affected by numerous variables. Over time, these variables often create volatility – this is most often the rule and not the exception. Given all of the uncertainty in the world, we expect volatility to remain elevated in the coming months –perhaps not as elevated as we experienced in 2018 but certainly not as low as 2017 brought us.

In Closing

Successful investing is a process of consistently making sound, well-reasoned decisions over time, and across market and economic cycles. Our goal is never to track or beat a particular benchmark from one year to the next, but rather to provide our clients with the optimal return for the environment we’re given and the risk profile of their particular strategy. Given this approach, it is normal, not unusual, for us to go through periods where we will look a bit out of sorts with the broader market. As we continue to execute our approach with discipline and patience during the inevitable periods when it is out of favor, we will continue to achieve successful and rewarding long-term results for our clients, as we have over the life of our firm.

As always, we appreciate your trust in us and welcome questions.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

‹ Back