By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Short- and Long-Term Interest Rates

Alex Harring notes that when the Fed cut short term rates in September, longer-term rates, such as mortgage rates, actually rose. As Harring remarks, inflation is a major risk to long duration bonds, and with inflation still running above the Fed’s 2% target, the Fed’s decision to trim rates may be heightening fears about the future path of inflation. In brief, longer-term rates are determined by many factors, and the Fed’s decision to slash the short-term federal funds rate represents only one piece of the puzzle.

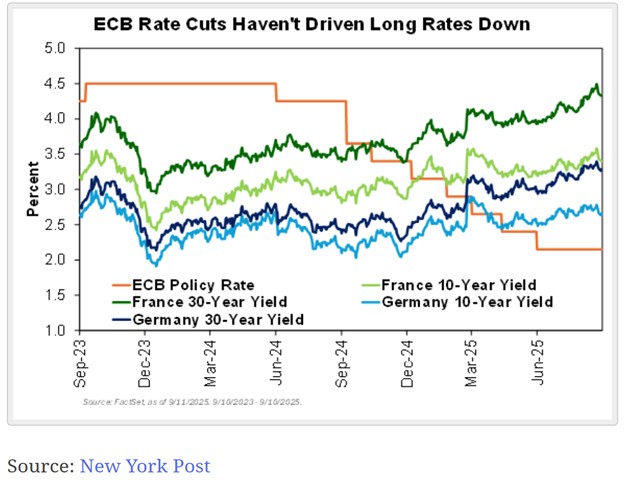

Barry Ritholtz also asserts that short-term rate movements tell you nothing about long-term rates, and includes an excellent chart from the New York Post’s Ken Fisher supporting his thesis:

Europe’s Central Bank has slashed rates by 2% over the past two years, but long rates in France and Germany have trended up rather than down.

President Trump has been urging the Fed to more aggressively lower the federal funds rate in the hope that mortgage rates would fall. However, such a plan may backfire, as the risk of raising inflation fears, as well as potentially compromising the Fed’s independence, may cause longer-term rates to rise rather than fall.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back