By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

AI’s Quieter Promise

James Pethokoukis discusses both the hype and the more mundane potential of AI over the coming years. He cites the work of Arvind Narayanan and Sayash Kapoor, who are skeptical of the idea of AI as superintelligence and suggest that AI is a more “normal” technology. But even if the rise of AI is akin to the development of the personal computer and the internet, it is still likely to have large economic impacts.

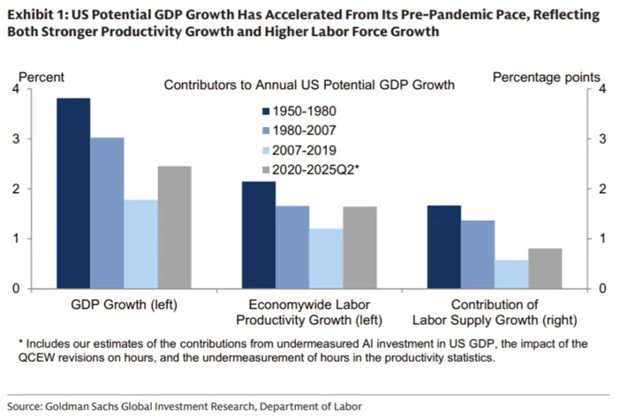

Pethokoukis draws on Goldman Sachs research arguing that AI should help raise potential GDP growth to 2.1% through 2029 and 2.3% afterwards through the early 2030’s; these numbers are higher than the Fed’s long-run estimate of 1.8%. As Pethokoukis notes, due to compounding, the 0.5% difference in growth, if sustained, would represent the difference between the economy doubling in size by the 2050s rather than the 2060s. Improved productivity growth would be a welcome shift from the earlier part of the century, as illustrated in this Goldman chart:

Even if AI doesn’t result in artificial general intelligence, its path could still be analogous to that of the 1990s, with copious capital investment leading over time to broader efficiency gains. AI doesn’t have to be a home run for it to be a hit.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back