By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Rate Cuts Resume

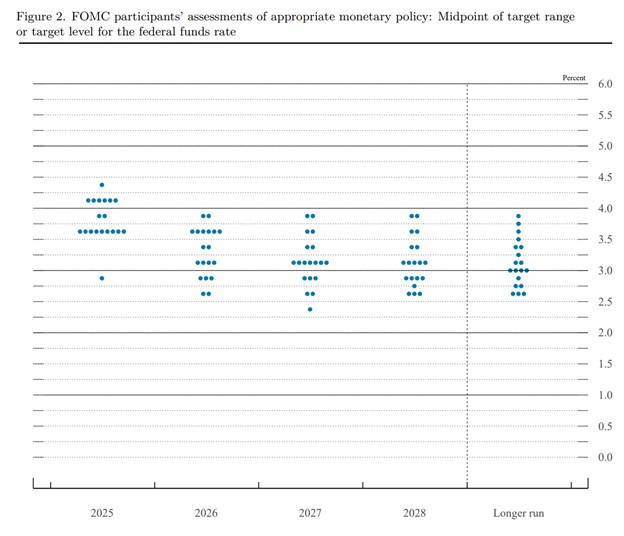

After an 8 month pause the Fed restarted rate cuts, as it slashed the federal funds rate by 25bp, to 4.00%-4.25%. Further reductions are likely in store, as indicated by the Fed dot plot:

Source: Federal Reserve

Source: Federal Reserve

Of 19 FOMC voters, 9 expect an additional 2 25bp cuts over the rest of the year, while 1 calls for 1.25% in additional cuts. The median voter expects 2 cuts this year, and 1 additional 25bp reduction next year, so while we’re likely to see some further downward movement, as of now rates are projected to settle at around 3% over the medium and longer term. As of this writing, markets expect slightly more aggressive rate reductions, with 2 more 25bp cuts this year, and 2-3 more 25bp cuts in 2026.

CNBC’s Jessica Dickler discusses some of the practical implications of the Fed’s move. Rate cuts are likely to result in lower interest rates for savers, but also lower interest rates on credit cards. Mortgage rates already priced in the expected Fed cut, so they’re unlikely to shift in the immediate future. However, mortgage rates have already come down from over 7% in January to 6.13%, and could fall further if rate cuts are relatively aggressive over the next year, potentially leading to additional mortgage refinancing beyond the recent spike.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back