By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Main Street vs Wall Street

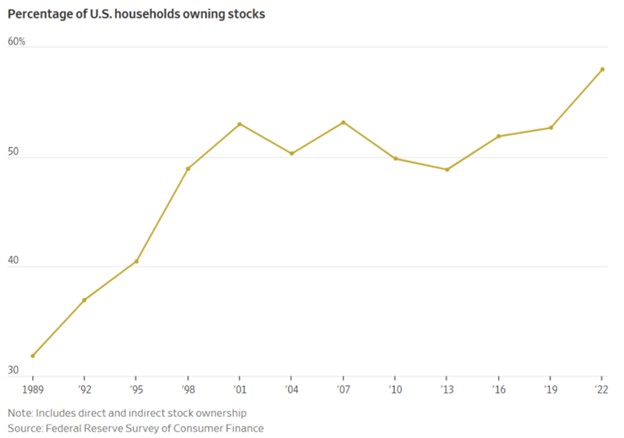

Ben Carlson asks whether the stock market could cause a recession. As he notes, an ever rising percentage of American households are invested in equities:

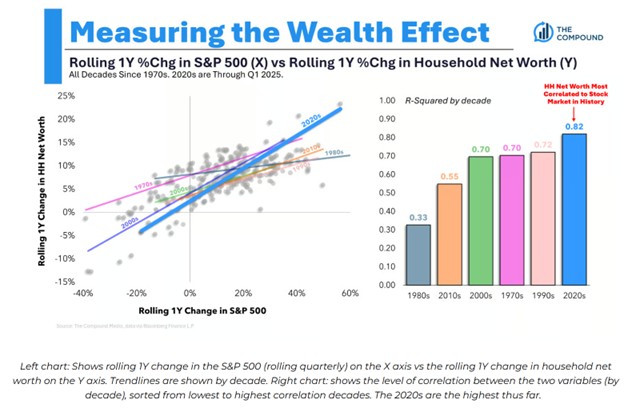

And as Matt Cerminaro notes, household net worth has become increasingly correlated with the S&P 500:

Carlson also cites evidence that stocks now comprise 36% of household financial assets, which is the highest number since this data was tracked, starting in the 1950s. Although stock ownership has broadened considerably, Carlson observes that the “top 10% own nearly 90% of the stock market.” Not surprisingly, the bull market revival of the past 3 years has seen consumer spending increase most by those with high incomes.

The vulnerability of the economy would be if markets fall, consumer spending by the wealthy may fall significantly with it (and if consumer spending falls, markets are likely to decline). The broadening and deepening of the relationship between household wealth and stocks means that the fates of markets and the broader economy may be more intertwined than ever.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back