By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

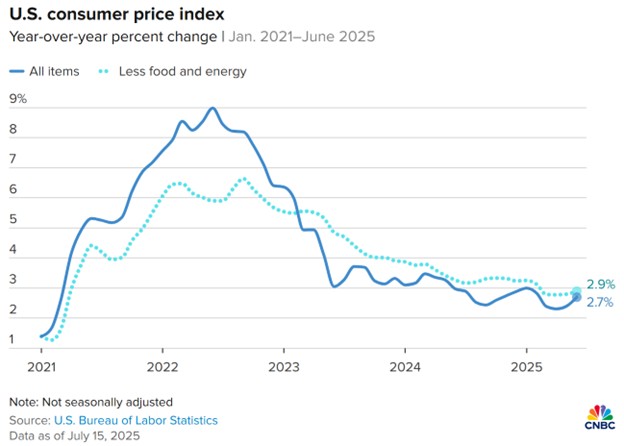

Inflation is Starting to Rise

Inflation climbed 0.3% in June, as expected, and was up 2.7% year-over-year, which is the highest mark since February. While far off post-COVID peaks, inflation has yet to make it to the Fed’s 2% target, and for the moment is heading in the wrong direction. Core inflation rose 0.2% for the month and 2.9% year-over-year, in line with market expectations. CNBC’s Jeff Cox has a useful chart on recent inflation history:

The big question going forward is to what extent higher tariffs will cause a spike in inflation. Apparel prices and household furnishings prices, which are both sensitive to tariffs, increased last month by 0.4% and 1.0%, respectively. It’s not clear, though, whether this kind of cherry-picked data is just statistical noise or the start of a trend.

In this atmosphere of uncertainty regarding tariffs and economic growth, it is not surprising that markets expect the Fed to leave the federal funds rate unchanged at its meeting later this month. And while Fed officials generally believe they will be cutting rates at some point this year, the timing and scope of any cuts remains murky. Until there’s greater clarity on tariff policy and impact, the Fed may remain in wait-and-see mode.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back