By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Lost Debt Opportunity

As Republicans are working to pass President Trump’s “Big Beautiful Bill,” the nonpartisan Congressional Budget Office has issued its assessment that the bill, as passed by the House of Representatives, would raise the federal debt by $2.4 trillion over the next decade. The bill may change as it works its way through the Senate, but as it stands the bill would likely add significantly to debt that is already high, even relative to GDP:

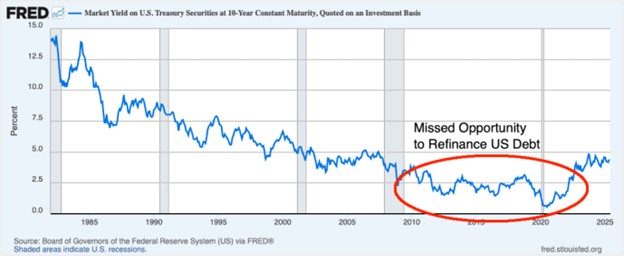

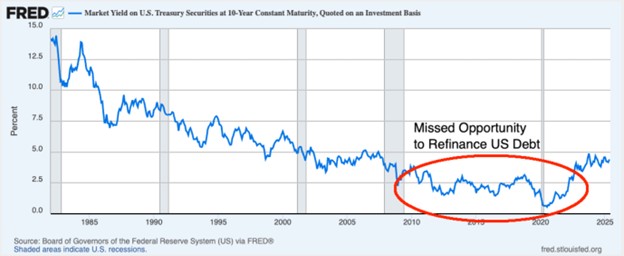

Sadly, as Barry Ritholtz observes, the US missed its opportunity over the past decade to finance its debt under the ultralow rates of the 2010s:

As Ritholtz notes, numerous homeowners and companies refinanced their debt to take advantage of lower rates. Other countries issued more longer-term bonds to finance their outstanding debt. But during the 2010s, even with Democrats and Republicans each controlling the Presidency and both houses of Congress at various points, debt refinancing never got done. As Ritholtz argues, the cost of inaction a decade ago will have fiscal consequences for decades, as longer-term interest rates have ballooned. Fiscal priorities of the Trump Administration and future administrations will be more costly to enact for the foreseeable future.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back