By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Fed’s Pause

As expected, the Fed left the federal funds rate unchanged at its meeting last week. In its statement, the Fed notes that the economy was still solid, but that the risks of higher inflation and higher unemployment have risen. Fed Chair Jerome Powell characterized President Trump’s tariffs as potentially delaying the Fed from achieving its unemployment and inflation goals, but noted the high level of uncertainty with respect to the scope, scale, and timing of tariffs.

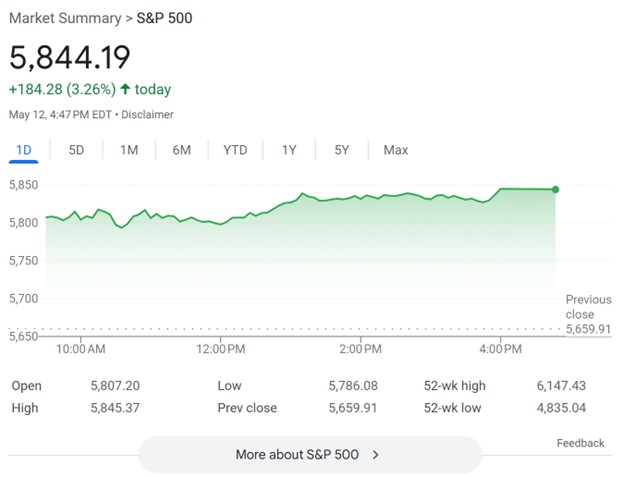

And within a few days, President Trump made a major adjustment to tariffs of China. Reciprocal tariffs between China and the United States were cut on Monday from 125% to 10% for the next ninety days. Market reaction was quite positive:

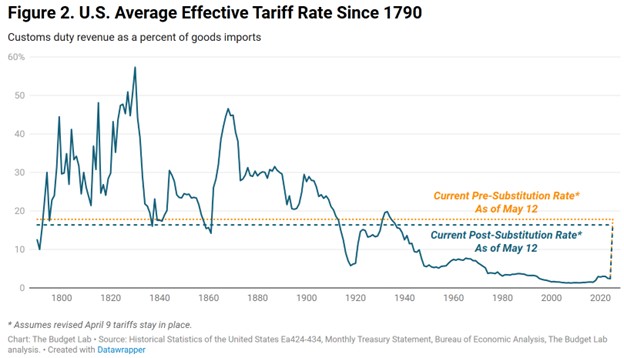

It’s not surprising that the Fed has adopted a wait-and-see approach to the economy, since today’s tariffs can be very different from tomorrow’s tariffs. And even with the major reduction in tariffs with respect to China, tariffs remain very high by historical standards:

Even assuming that Americans shift some purchases away from goods made in high tariff countries, The Budget Lab estimates the current post-substitution average effective tariff rate as 16.4%, the highest since 1937. While markets have understandably celebrated the Trump Administration’s climbdown on draconian tariffs on China, there’s still likely to be a lot of tariff drama ahead. The Fed may be looking at elevated uncertainty for quite some time.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back