By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

4Q 2025 - Key Takeaways

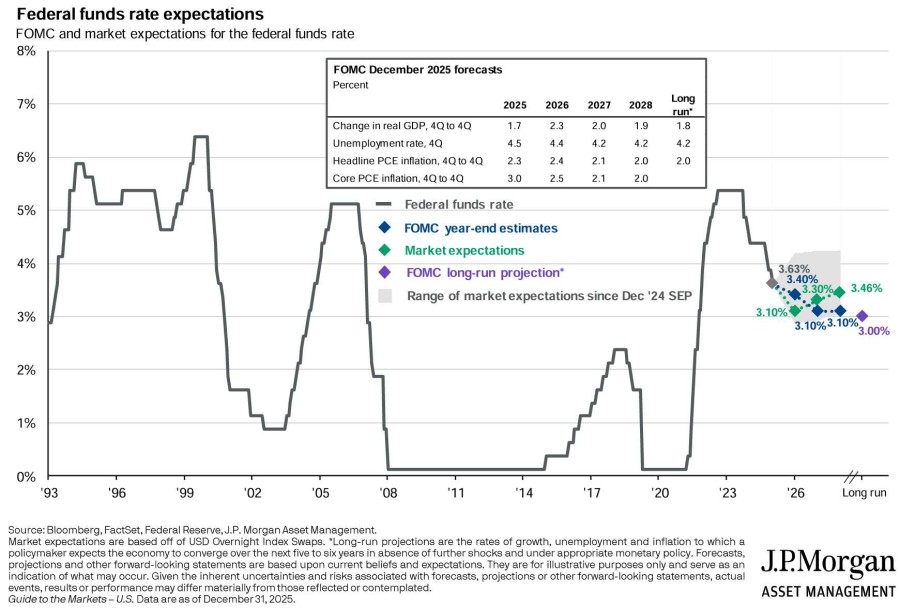

The bull market gallop through the first three quarters of the year settled into more of a trot during the last quarter. Most market areas showed continued strength, and while large cap tech stocks have largely underpinned the current bull market, tech stocks returned a mere 1.4% during Q4, with other market sectors, such as health care, fueling the S&P 500’s gains in the quarter. Corporate earnings have been solid, providing at least some basis for currently high valuations. The Fed made 2 25bp rate cuts over the last quarter, but markets do not currently anticipate much more movement from the Fed—expectations are for an additional 50bp in cuts in 2026—but none in Q1 of 2026—then no further cuts in 2027. While the lengthy government shutdown has made recent economic data more difficult to interpret, the macroeconomy appears to be in a relatively benign state, with good GDP numbers, modestly elevated inflation, and fairly low unemployment (though hiring has slowed significantly). The fate of President Trump’s many tariffs is unclear, as we await a ruling by the Supreme Court as to the legality of much of Trump’s tariff regime.

The S&P 500 jumped 2.7% in Q4 2025, while small caps grew 2.2%. Developed international and emerging markets showed continued strength, rising 4.9% and 4.7%, respectively, in the fourth quarter. On the bond side, the US agg climbed 1.1% in Q4, the 2-year Treasury rate fell slightly, while the 10-year and 30-year Treasury rates were essentially unchanged.

For the year, the S&P 500 rose 17.9%, while small caps gained 12.8%. While these are both excellent numbers, they were significantly outclassed by foreign stocks, as developed international jumped 31.9%, while emerging markets surged 34.2% in 2025. The US agg rose 7.3% for the year, while high yield climbed 8.6%, developed international bonds gained 8.2%, and commodities added 7.1%.

GDP grew 4.3% in Q3, once again fueled by strong consumer spending. Fourth quarter growth is generally projected to be modest but positive, though the Atlanta Fed’s GDP now estimate shows Q4 growth at over 5%. Unemployment ticked up another 0.3% over the past three months, to 4.6%; overall, labor market conditions remained fairly benign, though softening, as unemployment has risen 0.7% over the past year. Core inflation fell in Q4 from 3.1% to 2.6%, and remains modestly above the Fed’s 2% target. After holding rates steady for much of 2025, the Fed made 25bp rate cuts in September, October, and December.

2025 was a terrific year for stocks and bonds, both domestically and internationally. As always, there’s the potential for markets to falter in 2028. Valuations are elevated, US deficits are high and likely to remain so indefinitely, and geopolitical tensions have mushroomed, with Venezuela and Greenland as new areas of concerns. The AI boom, even if successful, may not live up to investors’ sky high expectations. On the other hand, equities tend to rise over time, and this fact has been true for many decades. Though it will be difficult for 2026’s performance to top 2025’s, we would consequently moderate our expectations, rather than try to time when this impressive bull run will end.

4Q 2025 Investment Letter

The fourth quarter of 2025 added to the large gains already accumulated through the first three quarters. The US economy has seen a strong bounceback in GDP, and while unemployment has been slowly rising, and inflation has remained slightly above target, neither unemployment nor inflation are near alarming levels at this point. The Fed may have limited maneuverability, given elevated inflation, but it doesn’t appear to need much flexibility at the moment. Tariffs, while still historically high, may not be large or broad enough to represent a significant drag on markets or the economy. While we still have concerns about an AI bubble, rising earnings and broadening market gains have eased these fears somewhat.

4Q 2025 Market Update

Once again, the rising equities tide lifted most boats in the fourth quarter of 2025. The S&P 500 added 2.7%, while the Russell 2000 gained 2.2%. Developed international and emerging markets posted fourth quarter gains of 4.9% and 4.7%, respectively. For the year, while the S&P 500 returned a healthy 17.9% and the Russell 2000 gained 12.8%, US markets were overshadowed by their foreign counterparts, as developed international climbed 31.9% in 2025, while emerging markets advanced 34.2%. In terms of style, the bull market in domestic equities was broadly distributed in Q4; for the year, while large growth led the way at 18.6%, the “worst” performing style-size combination, mid growth, still finished up 8.7%.

As for sectors, health care led the way with an 11.7% gain in Q4, while communication services rose 7.3%. Real estate and utilities were the only sectors down for the quarter, with modest losses of 2.5% and 1.4%, respectively. For the year, all sectors finished in positive territory; the top 3 performers were communication services, technology, and industrials, which ended 2025 with gains of 33.6%, 24.0%, and 19.4%, respectively.

Bonds had a positive Q4, as the US agg rose 1.1%, and high yield bonds climbed 1.3%, though international developed bonds dipped 1.4% in a rising rate environment. Core inflation fell 0.5%, ending the quarter at 2.6%, which is slightly above the Fed’s 2% target, while GDP growth is projected to be positive, and potentially quite strong, in Q4. Treasury rates remained roughly flat during Q4, as the 2-year Treasury rate dipped from 3.60% to 3.47%, the 10-year Treasury rate rose from 4.16% to 4.18%, and the 30-year Treasury rate increased from 4.73% to 4.84%. Volatility was moderate in the third quarter, mostly staying in the teens.

Update on the Macro Outlook

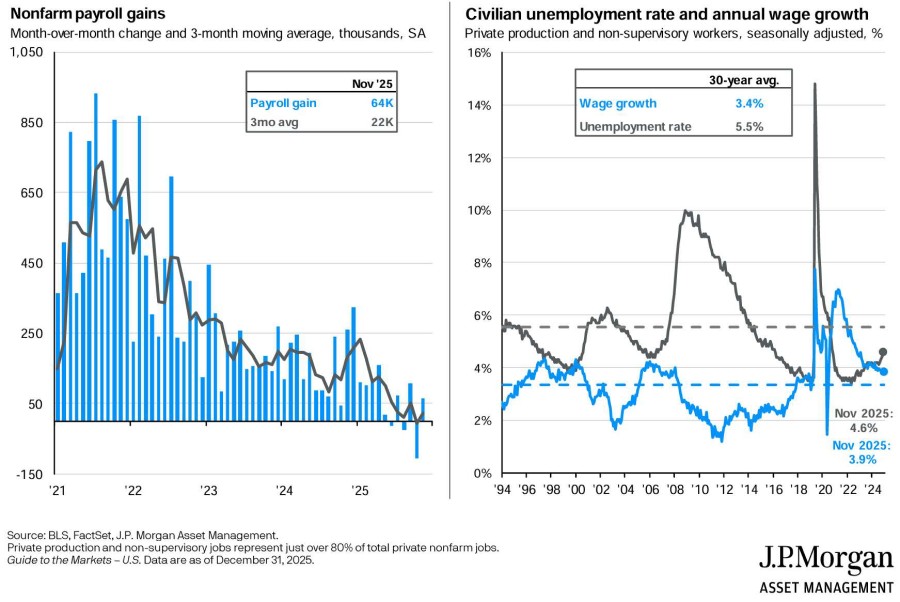

The economy has been settling into a place characterized by modestly elevated inflation along with a sluggish but largely adequate labor market. Core inflation eased to 2.6% in Q4; it remains to be seen whether inflation can make the last plunge down to 2% in 2026. Unemployment has been slowly rising over the past 2-3 years, and reached 4.6% as of November. The US economy isn’t creating as many jobs as it used to, but that’s largely a function of decreased immigration and increased deportations. Payroll growth going forward is likely to continue to be much lower, and expectations should be recalibrated:

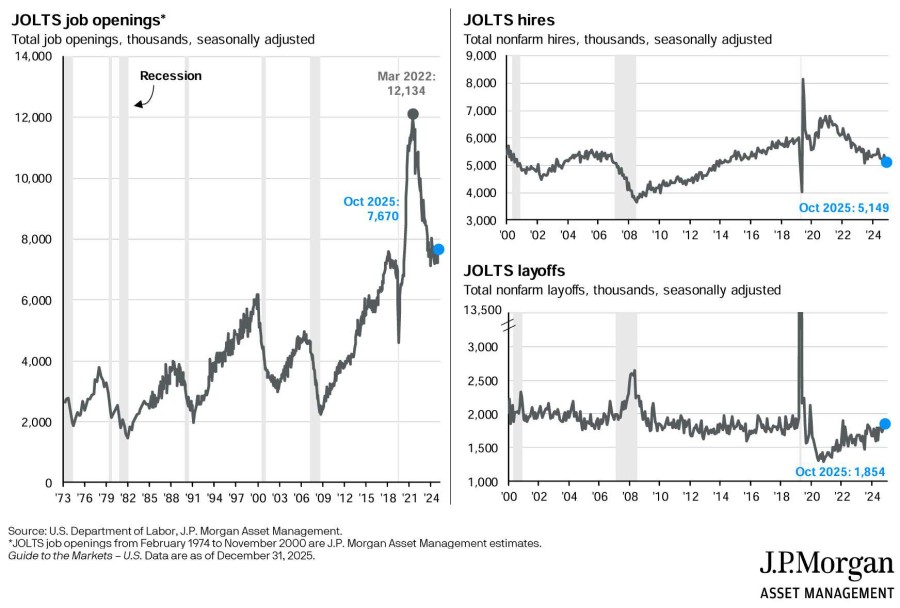

Payroll gains dropped to near zero in Q4, but the unemployment rate only kicked up slightly. Hirings may be low, but so are firings:

The Fed may be inclined to sit on its hands for much of 2026. Inflation isn’t worsening, so there’s no impetus to raise rates. But inflation is high enough, and unemployment low enough, that the Fed may keep rate cuts to a minimum as it waits to see if the economy shifts to another direction. Fed projections for 2026 show moderate unemployment and continued slightly above target inflation:

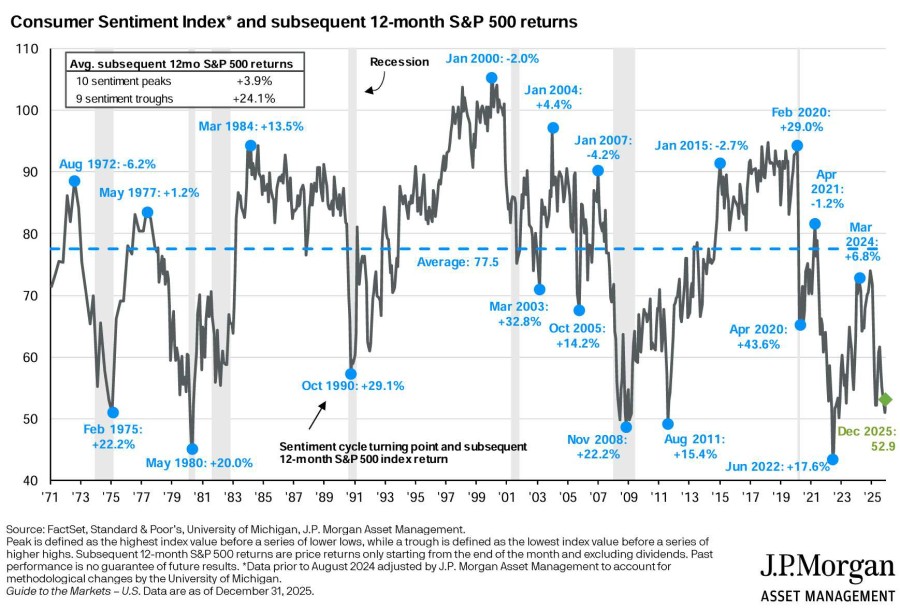

The Fed forecast shows unemployment declining marginally, and core inflation ending 2026 a half a percentage point above the 2% target. Markets and the Fed are aligned in that each expects only 1-2 25bp cuts in 2026. Still, with unemployment under 5% and inflation under 3%, and projected growth at a solid though not spectacular 2.3%, you might think people would be happy with the state of the economy. But you would be wrong. Consumer sentiment, which for many years echoed the hard economic data, has tanked:

Troughs in consumer sentiment have typically occurred when the economy was in recession, but consumer sentiment turned and has stayed sour starting a year after the COVID recession. Much of the slippage through 2022 can probably be attributed to people’s anger at seeing the sharp rise in inflation. But after some recovery, sentiment has bottomed out again. Why? We don’t know. People could still be disillusioned by higher price levels even though inflation has slowed. Mortgage rates have stayed well above the numbers of a decade ago, making housing less affordable. Social media may be engaging more eyeballs by trafficking in negativity. The labor market may be increasingly brittle, so that even though unemployment is low, there may be limited flexibility to shift careers. A key question would be whether consumer sentiment is picking up on something that economic data is missing--but the connection between poor sentiment and recession was also broken in 2011. And GDP growth has

been solid, as has consumer spending, so while the vibes may be terrible, people are not yet tightening their belts.

Portfolio Positioning and Closing Thoughts

The bull market of the past 3 years has heavily depended on a handful of tech stocks. Over time, we would expect a degree of convergence, with either the rest of the market showing catch-up growth, or the Magnificent Seven stocks cooling off. This year, while tech stocks still lead the way, other market segments have also been fruitful participants:

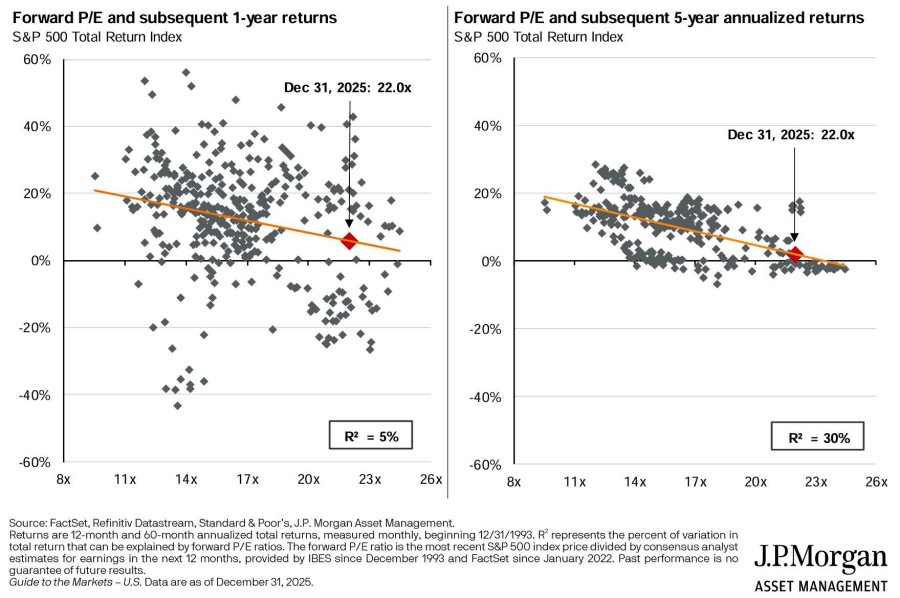

Given forward P/E values, subsequent 1-year returns can be all over the place—while the overall average is modest, the range of historical outcomes goes from gains of 40%+ to losses of 20%+. 5-year returns are less noisy, but even though there’s a large cluster of points around a 0% return, there’s also several points showing returns in the high teens. We would advocate for a balanced portfolio that’s not picking sides too much on whether the tech stock boom will continue or bust.

Stocks generally moved moderately higher in the 4th quarter - but not at the same pace we had witnessed coming off the bottom caused by Liberation Day tariffs in April. While all major stock asset classes moved higher in the final quarter of 2025, small and mid-sized companies lagged their large counterparts again. On the flip side, foreign stocks continued to enjoy their first significant outperformance over U.S. large caps in more than a decade - outpacing U.S. large caps by about 2% in the last 3 months of the year. We would expect the foreign over U.S. to have legs over the coming year. The continued devaluation of the U.S. dollar seems to be a wind at the back of foreign stocks. Plus, the first real momentum in years should entice investors to re-allocate some risk assets overseas. While we can't be sure we will see a second straight year of international superiority in the stock market, we can feel good about the allocation to both developed international and emerging market stocks due to their attractive valuations. While small and mid-sized U.S. stocks can boast of similar valuation discounts to large U.S. stocks, we feel the road ahead may be a bit more difficult for these companies.

While they still have value as portfolio diversifiers, the U.S. macro-economic environment is not set up for these companies to thrive in the coming month. The "Big Beautiful Bill" - passed last year by Congress - may boost U.S. stocks in general over the first half of 2026, but we are cautious for the 2nd half of the year unless we see improvements on the consumer side of the economic ledger.

Bonds finished 2025 strongly. Core bonds were higher by more than 1% - and finished the year with a return in excess of 7%. Short-term bonds, which began 2025 with excellent starting yields, exceeded expectations somewhat for the year by delivering some capital appreciation on top of the healthy yields. The real stars of the year were credit bonds. High-yield bonds delivered over 8% for the year. Emerging market bonds did even better with dollar denominated bonds returning nearly 14% - while local currency bonds were higher by over 17%. The returns in some of these credit categories allowed many multi-sector bond strategies to end the year with high single-digit or low double-digit returns. In 2026, we are tempering our expectations a bit on the credit side. We believe they can still have solid years, but believe returns will be much closer to portfolio yields for many credit categories. The 10-year Treasury finished the year slightly above 4%. Our expectation is that it will remain rangebound for much of 2026. The Federal Reserve appears more likely to remain somewhat cautious in terms of additional interest rate cuts. However, we will need to listen to the comments of the next Federal Reserve Chair to determine if there will be shifts in overall policy. With short-term rates lower than a year ago, we believe it is wise to find a bit more balance between short-term and intermediate bonds - while using the multi-sector strategies to augment yield.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC-registered investment advisor

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back