By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Possible Pitfalls of Market Timing

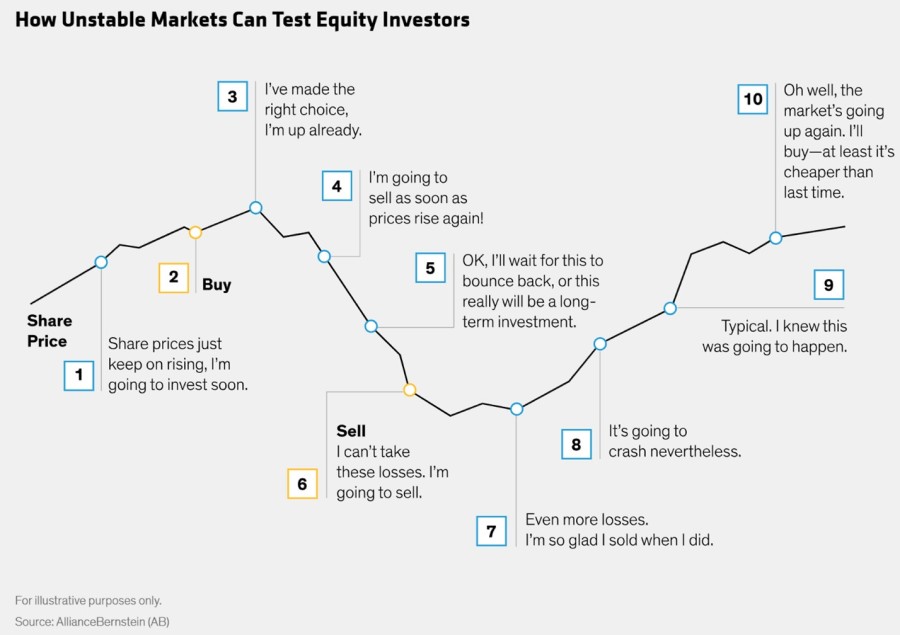

AllianceBernstein published a chart with a plausible psychological timeline of investment decisions:

Given that markets generally rise over time, the sell decision—assuming proceeds are not reinvested—is more problematic than the buy decision. Nobody has a crystal ball that can forecast the short-term movements of stocks. By selling, you may avoid some additional down days, but you may also miss out on upside—and again, as markets generally rise over time, the upside gains are likely to be larger than the downturn losses.

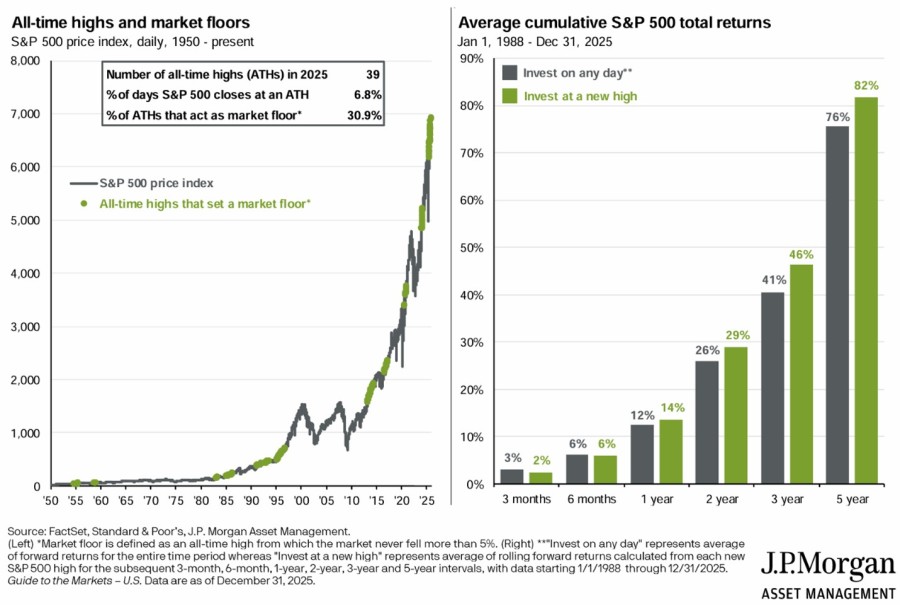

The AllianceBernstein article suggests an allocation to defensive equities so as to mitigate losses and the psychological pressure arising from them. That’s one possible solution to the challenge of staying invested. It’s also worth noting that trying to time the market by “buying low” is a risky strategy, as you may miss out on significant gains while waiting for the “right time” to buy. JPMorgan has a counterintuitive chart that looks at buying the S&P 500 at high points:

Over the past 38 years, buying the S&P 500 at an all-time high has shown better long-term returns that buying on an ordinary day. The outperformance is not large, so the result is probably not statistically significant. But the chart does illustrate that you’re likely to do better by investing and staying in markets than by worrying about buying at peaks.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back