By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Rise of International Stocks

International stocks over the past decade have been overshadowed by their counterparts from United States, as large cap tech companies dominated the landscape. As Schwab’s Jeffrey Kleintop notes, the investing landscape may be shifting back towards international.

In fact, for Europe, the shift may have begun with the onset of the bull market in 2022:

European stocks surged ahead of their US brethren in late 2022 and early 2023, then after US stocks caught up in 2024, the EMU index again surged this year while domestic equities stumbled.

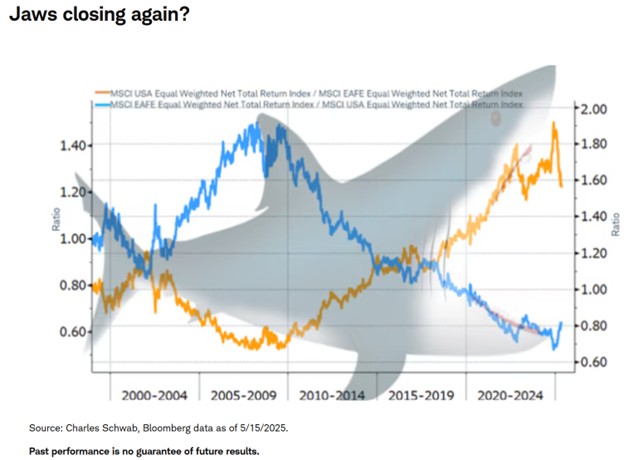

Over the long haul, relative performances of market indices have tended to be cyclical; such is the case of US vs International:

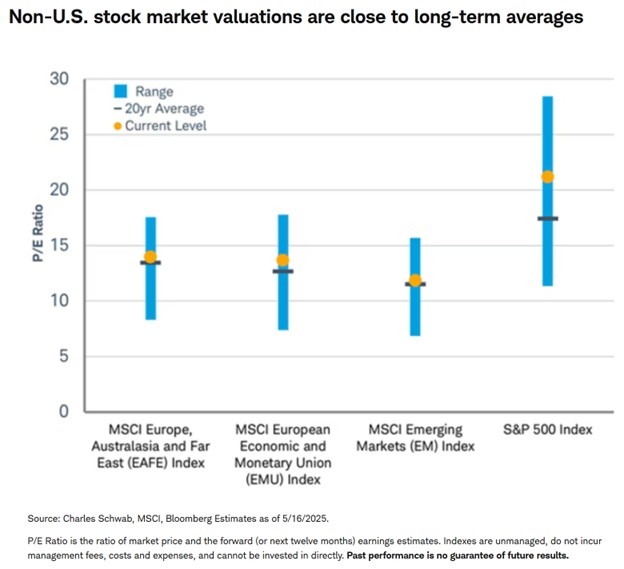

Kleintop also points out that even with the recent surge, international stocks still maintain relatively attractive valuations:

Kleintop also argues that the markets of individual countries often behave similarly to certain sectors. He connects Canada to the Financial Sector, Australia to Materials, France to Industrials, and the United States to Tech:

Kleintop suggests that US “exceptionalism” over the past decade may largely boil down to US exposure to tech stocks. He notes that if Tech turns from leader to laggard, as it did when the 1990’s tech bubble burst in the 2000’s, then investors may glean diversification benefits via exposure to countries and sectors that are not so closely tethered to Tech.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back