By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Perspectives on Market Concentration

October 27, 2025

Perspectives on Market Concentration

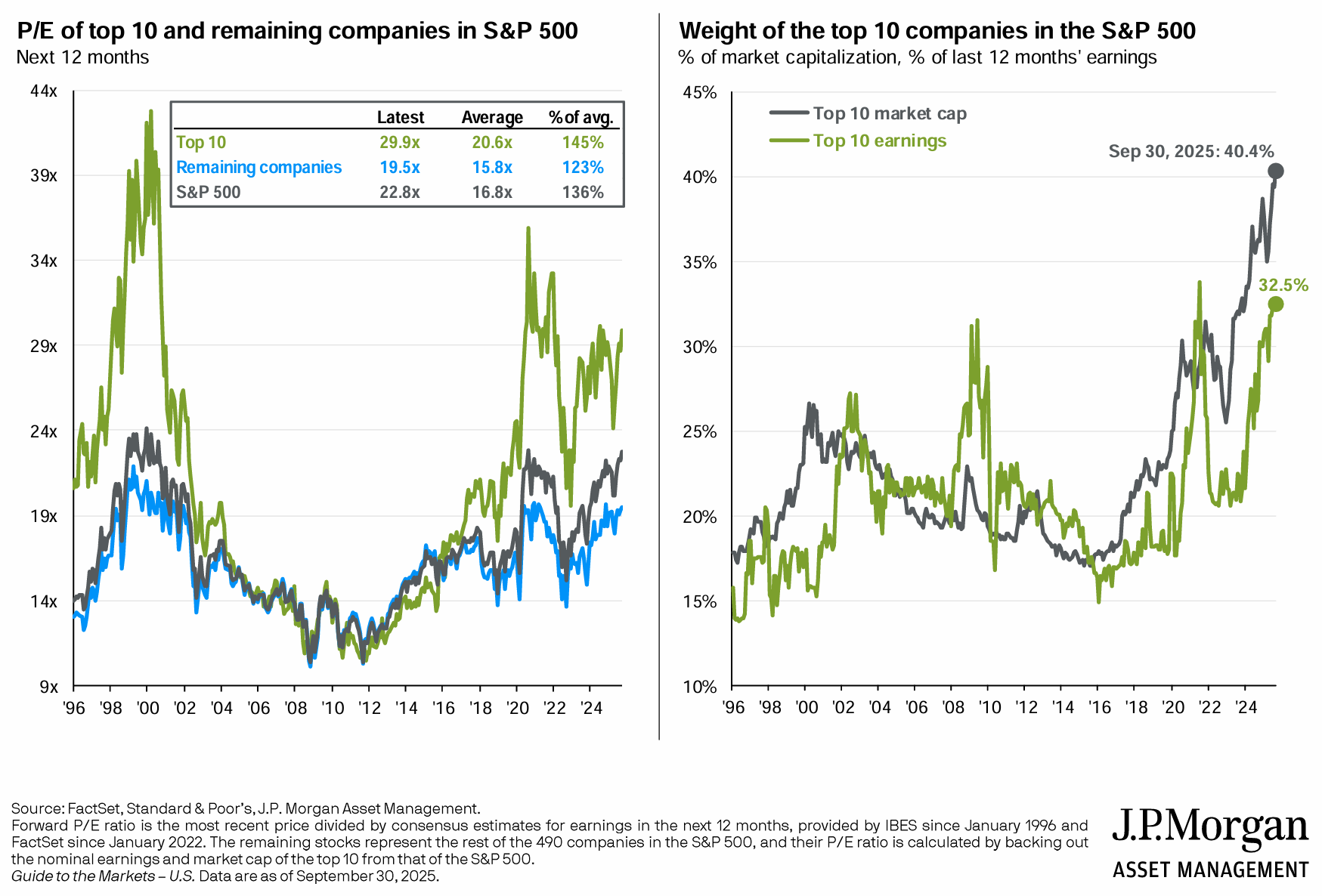

The S&P 500’s surge over the past 3 years has been led by a handful of stocks, resulting in an index that is unusually concentrated relative to recent history. JPMorgan has a pair of useful charts illustrating the S&P 500’s current top heavy nature:

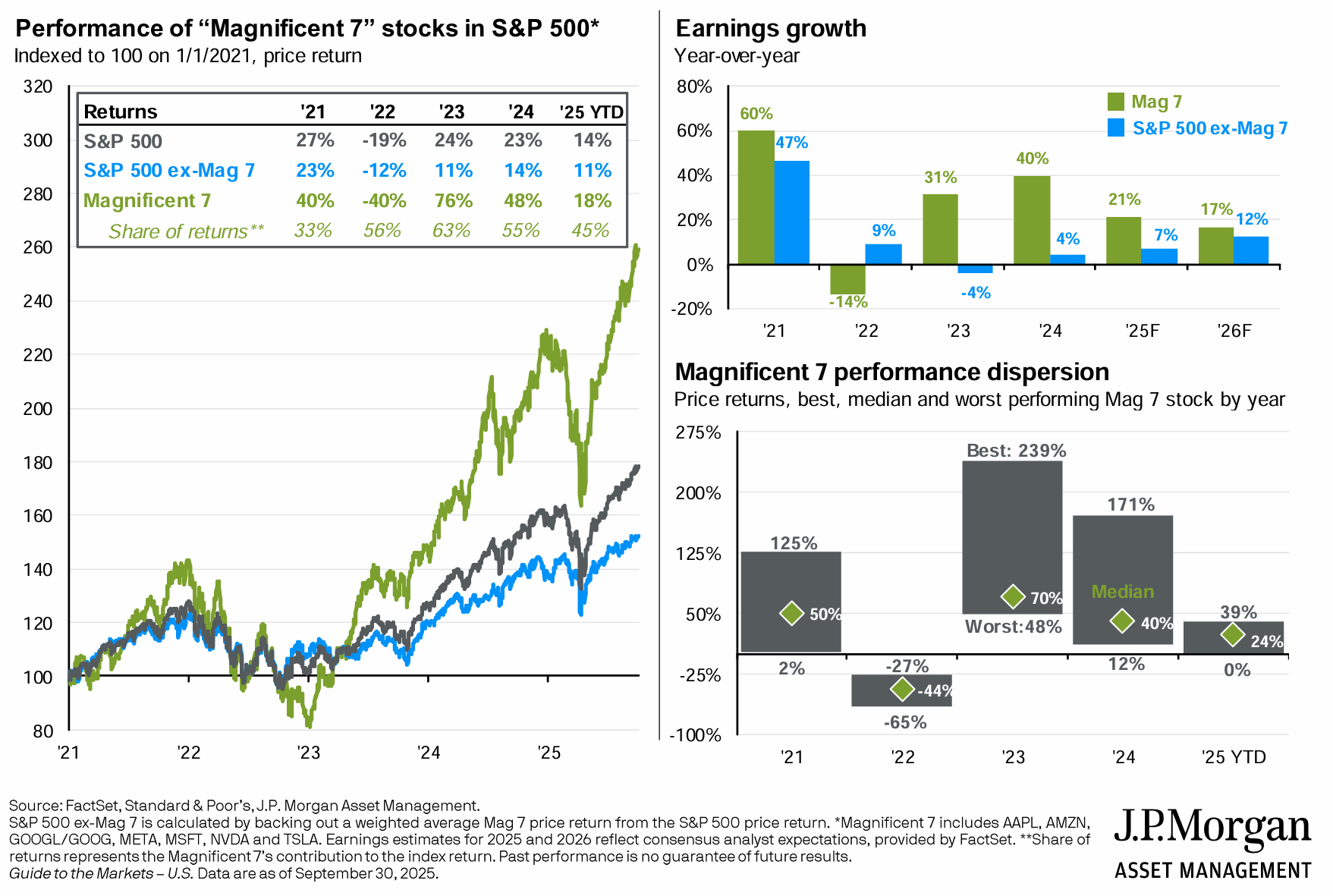

The weight of the top 10 firms by market cap is higher than it’s been for the past 30 years, surpassing the late 90s tech bubble by a significant margin. Not surprisingly, top tech stocks have had enormous price growth as well:

The gap between the Magnificent 7 stocks and the rest of the S&P 500 has narrowed in 2025, but over the past 3 years the share of returns from the Magnificent 7 has roughly equalled the share of returns from the less magnificent remaining 493. It’s not surprising that there’s talk that we may be in an AI bubble.

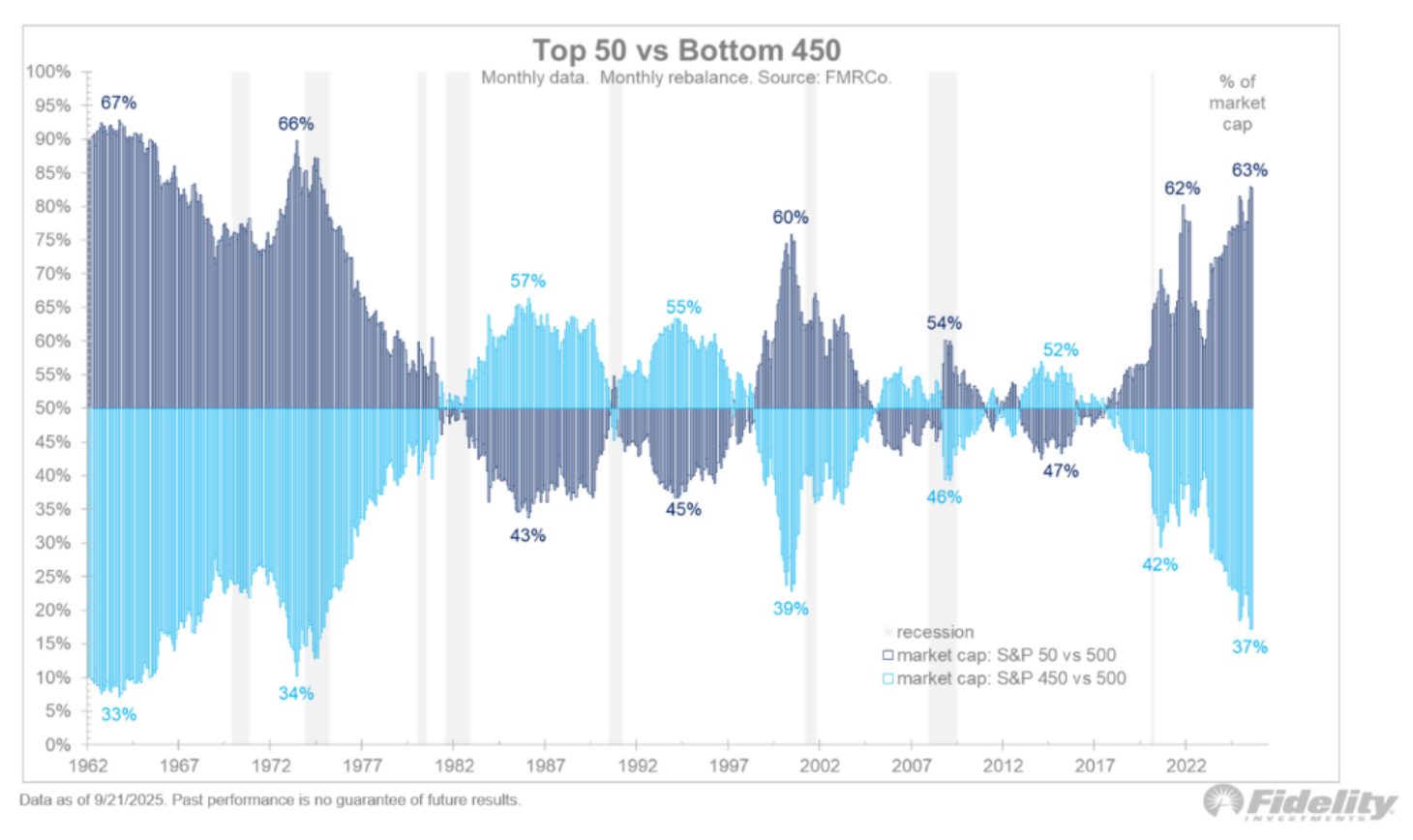

However, Ben Carlson points out, via work from Justin Timmer, that if we go back in time we find that in the 1960s and 1970s there was even greater concentration, as measured by the top 50 versus the remaining 450, than there is today:

As Carlson notes, while the bursting of the late 90s tech bubble quickly led to lower market concentration, the high concentration of the early 1960s persisted for well over a decade. Even if we’re in an AI bubble right now, that bubble could last for a long time.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back