By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Commentary

3Q 2025 - Key Takeaways

The bulls continued their run in the third quarter of 2025, as equities, both domestic and global, saw continuing gains that added to an already strong year. While AI and tech stocks have been a large part of the story, small caps and value stocks also performed well in Q3. Corporate earnings have been strong, and the Fed has resumed its rate cuts amidst a softening labor market. GDP estimates have picked up, while potential headwinds from tariffs appear to be outweighed by other market factors.

The S&P 500 jumped 8.1% in Q3 2025, while small caps grew 12.4%. Developed international and emerging markets showed continued strength, rising 4.8% and 10.9%, respectively, in the second quarter. On the bond side, the US agg climbed 2.0% in Q3, while the 2-year, 10-year, and 30-year Treasury rate each fell slightly.

GDP grew 3.8% in Q2, largely fueled by consumer spending, and partially for technical reasons—the pre-tariff surge in imports lowered GDP in Q1 while the subsequent post-tariff decline in imports raised GDP in Q2. Third quarter growth is generally projected to come in at a bit over 2%, though the Atlanta Fed’s GDPnow estimate shows Q3 growth at nearly 4%. Unemployment ticked up another 0.1% over the past three months, to 4.3%; overall, labor market conditions remained fairly benign, though softening, as unemployment has risen 0.4% over the past year. Core inflation climbed in Q3 from 2.8% to 3.1%, and remains above the Fed’s 2% target. After holding rates steady for much of 2025, the Fed cut rates by 25bp points in September.

For all the constant activity of the Trump Administration, markets have been quiescent, with a steady upward drift and low volatility. As always, there is always something to monitor under the hood—US-China relations are strained, trade skirmishes could flare up, and the AI surge could prove to be a bubble that pops over the coming year. But corporate earnings could also remain healthy, while elevated valuations may reflect a new normal rather than a mounting concern.

3Q 2025 Investment Letter

Markets had a broadly strong third quarter of 2025, with both domestic and foreign equities making significant gains, as well as domestic and high-yield bonds. The economy has continued to show resilience in the face of elevated interest rates. While inflation hasn’t surged, it has drifted higher, challenging the Fed’s ability to thread the needle between keeping inflation low and keeping unemployment low. Markets have sometimes plummeted when President Trump has threatened massive tariffs, but recovered once such threats were pulled back or a trade understanding was reached. High valuations are still a concern, as is the possibility of an AI tech bubble, but it’s difficult to predict if the bubble will burst, let alone when. So, the economy and markets are in good shape as of this writing, but there is the possibility of tremors underneath the surface--and given that valuations already reflect tech optimism layered on a strong economic base, we would moderate our

3Q 2025 Market Update

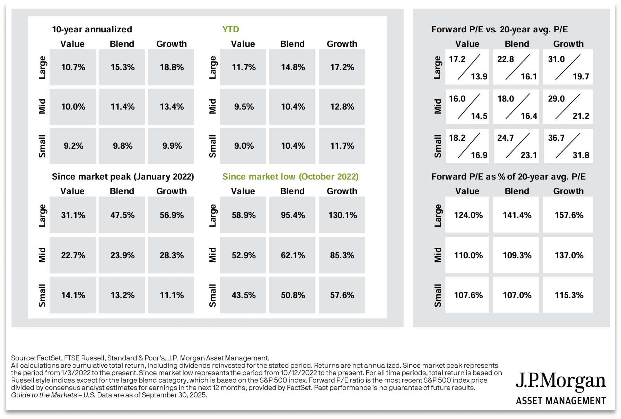

The rising equities tide lifted most boats in the third quarter of 2025. The S&P 500 leapt 8.1%, while the Russell 2000 gained 12.4%. Developed international and emerging markets posted second quarter gains of 4.8% and 8.9%, respectively. As of September 30th, developed international and emerging markets have each posted gains of over 25%. In terms of style, the bull market in domestic equities was broadly distributed in Q3; year-to-date, while large growth leads the way at 17.2%, the “worst” performing style-size combination, small value, is still up 9.0% as of September 30th. The year-to-date chart, coincidentally, shows the same pattern as does the 10-year annualized chart, with large growth leading the way, but all areas posting near-double-digit returns or better.

As for sectors, technology led the way with a 13.2% gain, while communication services rose 12.0%. Consumer staples was the only sector down in Q3, with a 2.4% loss. Year-to-date, all sectors are in positive territory, with technology and communication services leading the way with gains of 22.3% and 24.5%, respectively.

Bonds had a positive Q2, as the US agg rose 2.0%, and high yield bonds climbed 2.5%, though international developed bonds dipped 0.8%. Core inflation jumped 0.3%, ending the quarter at 3.1%, which is above the Fed’s 2% target, while GDP growth is projected to be solid in Q3. Treasury rates eased downward marginally during Q3, as the 2-year Treasury rate slid from 3.72% to 3.60%, the 10-year Treasury rate declined from 4.24% to 4.16%, and the 30- year Treasury rate fell from 4.78% to 4.73%. Volatility was low in the third quarter, mostly staying in the teens.

Update on the Macro Outlook

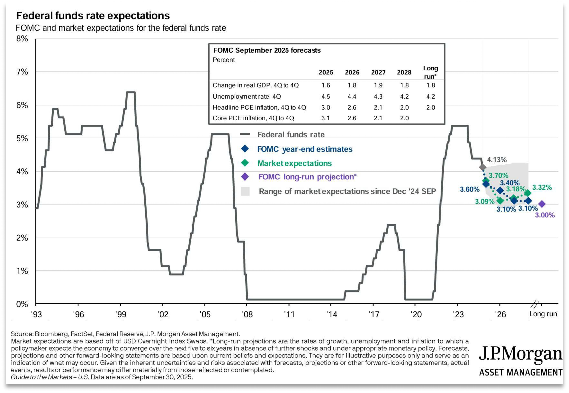

For equities, the third quarter largely added to the trends of the second quarter, with a broad based rally highlighted by continued tech gains. Similarly, the macro themes of Q3 largely echo the successes and concerns of Q2. Once again, US economic statistics are solid, though perhaps softening a touch—unemployment is moderate, though rising slowly; inflation is only slightly elevated, but has started rising again. The Fed is now in a very delicate spot. Rates are still restrictive, and the gradual increase in unemployment would typically induce the Fed to cut rates. However, inflation crept back up to over 3% during the third quarter, and the Fed doesn’t want to let inflation become persistent. Short-term inflation expectations have wobbled up a bit, and while longer-term expectations are stable, the Fed may adopt a cautious approach to rate cuts so as to limit the likelihood of an inflation spike. Fed projections are for core inflation to stay at 3.1%, and for unemployment to rise to 4.5%, by year’s end:

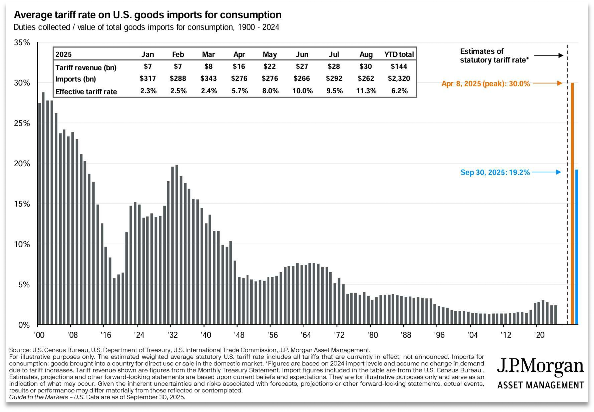

Markets and the Fed are in general agreement that the Fed will cut rates another 1% over the next 18 months or so. More aggressive action may not be needed. The challenge is that inflation remains high enough that the Fed may be reluctant to cut rates too much, while the labor market is softening enough that the Fed may be reluctant to leave rates where they are. If the economy slumps or inflation surges, the Fed will be in the unhappy position of robbing Peter to pay Paul—actions that ameliorate unemployment/inflation pose the risk of aggravating already elevated inflation/unemployment. While ever-changing tariffs have almost become background noise at this point, it is worth noting that the effective tariff rate has risen to 19% (up from 15% last quarter):

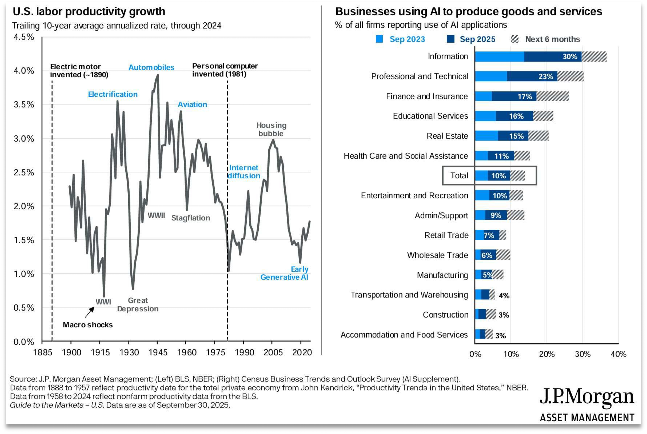

Although the potential negative effects of tariffs may be delayed or accrue over time, so far, tariffs have proven to be more bark than bite. There may be enough exemptions and workarounds to blunt their impact. But other factors, such as the AI boom, may simply dwarf whatever effects tariffs would have:

If AI-induced labor productivity growth mimics the path following the 1981 introduction of the personal computer, we would expect to see the US economy accumulate a lot of productivity growth over the coming decades. Though tariffs are widely derided by economists as inefficient, they may end up being relatively trivial compared to other macroeconomic movements.

We would be remiss if we did not mention the additional complication of the ongoing government shutdown, which has stopped the release of some economic data, so that the Fed is currently trying to navigate while partially blind. Previous government shutdowns have typically been brief and so had minimal long-term impact. A shutdown lasting months rather than weeks would be uncharted territory, but that’s a hypothetical that’s still some time away from becoming a reality.

Portfolio Positioning and Closing Thoughts

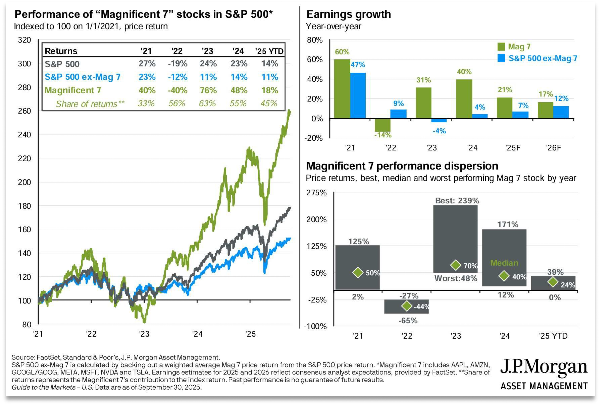

The bull market of the past 3 years has heavily depended on a handful of tech stocks. Over time, we would expect a degree of convergence, with either the rest of the market showing catch-up growth, or the Magnificent Seven stocks cooling off. This year, while tech stocks still lead the way, other market segments have also been fruitful participants:

The earnings growth gap between the Mag 7 and the remaining 493 has shrunk greatly in 2025, as has the return gap. And while it’s true that the Mag 7 still accounted for 45% of the S&P 500’s price return as of 9/30, this number is not exceptionally high given that top companies comprise a huge share of the S&P 500’s market cap:

Though the weight of the top 10 market cap has grown sharply, top 10 earnings have risen sharply in tandem, providing a degree of reassurance to these companies’ market valuations. The obvious risk to stocks is that the upsurge in tech stocks reflects an expectation that the benefits of AI will be sky-high, which means that if AI performance is merely good and not a game-changer, we would likely see a correction in valuations of these equities.

Despite continued drips of negative news on the economic front in Q3 2025, the stock market was undeterred. On the back of AI tunnel vision, the S&P 500 moved a full 8% higher in the quarter. Large company stock returns have been all over the board in 2025. Technology, unsurprisingly, led the markets higher with Communication Services running second on the backs of Google and Meta. While the thirst for AI exposure has allowed some large U.S. stock segments to thrive, others have largely been left stuck in the mud. Sectors like Consumer Staples, Real Estate, Energy, Health Care and Materials showed paltry gains in comparison through three quarters. The market’s short-to-mid-term future is quite dependent on earnings coming from large growth names and their willingness to continue to throw massive amounts of money toward capital expenditures in AI. While not shunning these names, we prefer a bit of balance in the large cap space – pairing the high growth segments with some quality/dividend areas that offer more reasonable valuations. Many small and mid-sized companies will be facing the darkening economic realities without the AI wind at their backs. We remain largely underweight these asset classes. International stocks, however, have seen a bit of a breakthrough in 2025 as U.S. dollar weakness has paired with some renewed investor interest in overseas names to diversify against the tariff reality. With the U.S. tariff rate near 20% and up significantly from the start of the year, it is difficult to know where the winners and losers will be domiciled over the coming year.

Bonds have provided a nice balance to portfolios for most of 2025. As the Federal Reserve has cut rates, yields have lowered in numerous fixed income segments. The core bond space has delivered returns of more than 6%, while still offering the equity ballast to broad portfolios. Short-term bonds have been predictable – but solid. They are looking to see some price appreciation to pair with the attractive starting yields and, for the most part, should end the year between 5% and 6% with little volatility. High-yield bonds have enjoyed a smoother ride since early April and have provided returns near 7%. Emerging market bonds have been even better, with many strategies clearing 10% for the year. Multi-sector bond strategies, which can dip into several categories, have been quite strong as well. It is common to see high single-digit returns. As tariff costs are more broadly passed along to consumers, we expect to see some tick up in inflation data. So, we prefer an approach that tilts toward short-term maturities over intermediate terms – while being overweight multi-sector bonds for diversification and to drive yield in portfolios.

- JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 412-415-1177 | jmscapitalgroup.com

An SEC-registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy.

Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back