By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Updating the Economic Narratives of the Cost of Goods and Services

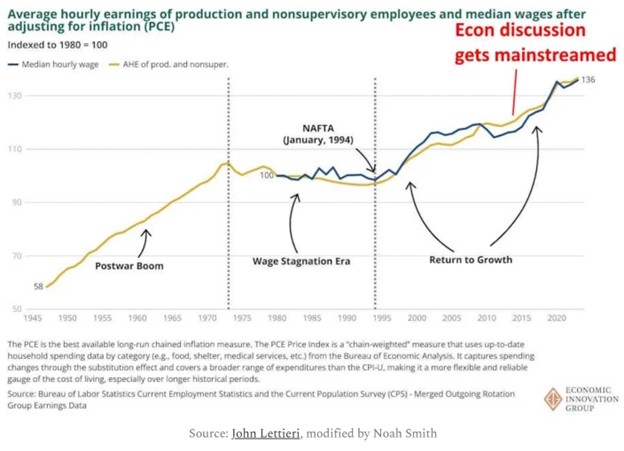

Noah Smith reassesses economic conventional wisdom from a decade ago and finds that in many instances, what used to be true no longer is. For instance, the middle-class wage stagnation that indeed troubled the country from the 1970s through the mid-1990s hasn’t held true over the past decade:

Fifteen years ago the upturn in wages in the mid-1990s looked like an outlier, but strong wage growth over the past decade suggests that the late 90s marked the onset of a positive trend.

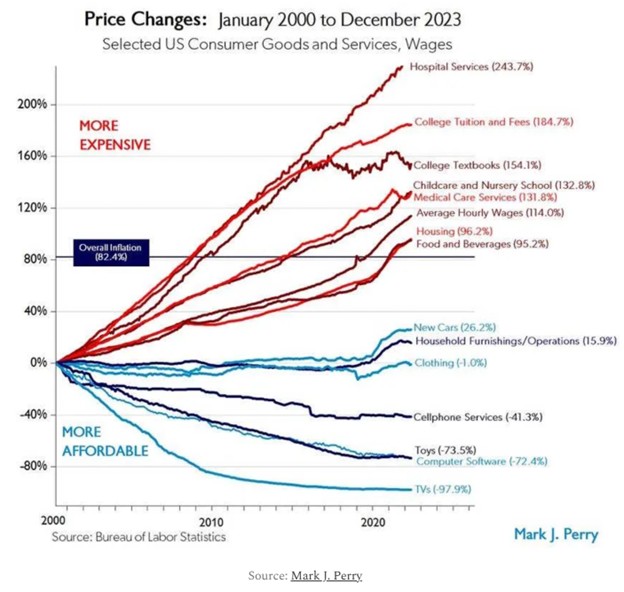

Smith also assesses a famous chart delineating the massive spike in services cost in tandem with a large relative decline in goods prices:

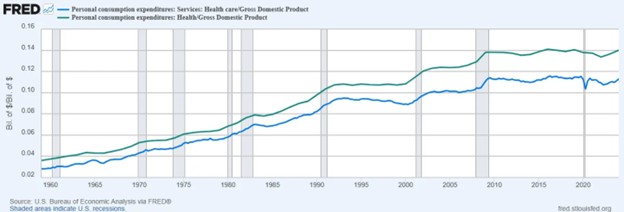

However, as Smith argues, the big picture of sharply rising health care and education costs during the 21st century misses the fact that inflation in these areas have cooled considerably over the past decade:

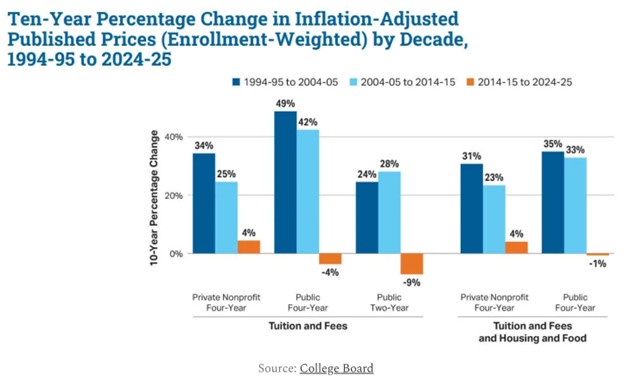

Over the past decade, spending on healthcare has stopped growing relative to GDP. After adjusting for inflation, the cost of college, which grew enormously from 1994-2014, has been roughly flat over the past ten years.

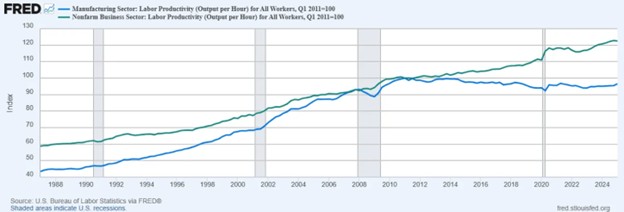

Smith delves into much greater detail regarding healthcare and college costs, and suggests that the manufacturing productivity boom ended around 2008, while a services productivity boom took off from there:

Smith argues that technological developments, such as via IT in healthcare, and AI in education, could enable these services to become increasingly affordable, diminishing the need for large government subsidies that were sought (though mostly not passed) by the Biden Administration. At the very least, the services cost problem has become less severe than previously feared, and proposed solutions should take into account the changed nature of this problem.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back