By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Economy Cooling Off

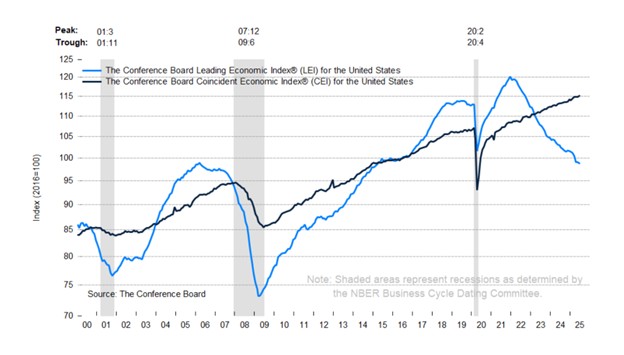

The Conference Board tracks the movement of its Leading Economic Index as it attempts to assess whether the economy is likely to tip into recession. There currently are several signs of economic weakness:

The S&P 500’s surge in June doesn’t fully compensate for the deterioration in consumer expectations and new orders. Still, the Conference Board’s Justyna Zabinska-La Monica suggests that real GDP will slow, growing at only 1.6% this year, rather than tumbling into recession, with slowed growth derived in significant part from the impact of tariffs on consumer spending. The Conference Board also provides a chart with more historical context:

While the LEI’s decline is concerning, its current level remains well above the numbers posted during the 2001 and 2008 recessions.

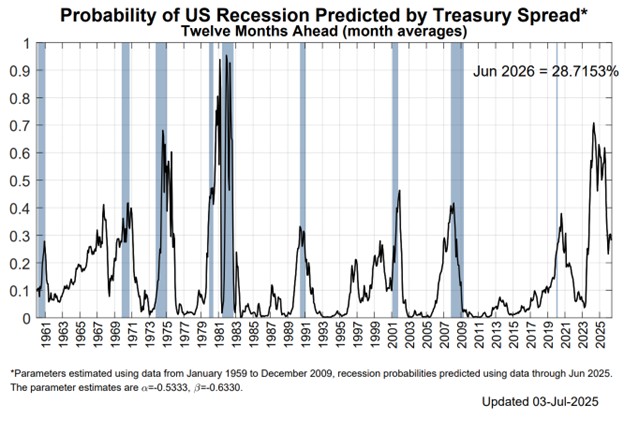

The New York Fed also publishes a recession probability assessment based on Treasury Spreads, and its numbers indicate moderate concern:

Source: New York Fed

Source: New York Fed

A 28.7% recession probability is somewhat elevated by historical standards, but the Fed’s measure showed in 2024 a probability of over 50% for a recession which ultimately never happened.

We are in an unusual economic situation of sharply rising tariffs, in conjunction with tax cuts admist already high deficits. Recessions are notoriously difficult to predict; between the promise of AI, the potential inflationary impacts of tariffs, expansionary fiscal policy, and restrictive monetary policy there’s both positive and negative indicators. Recession risks may be somewhat elevated, but at this point in time, a downturn is far from a sure thing.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

r-img-caption fr-fic fr-dib fr-draggabl

‹ Back