By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

2Q 2025 - Key Takeaways

Markets shrugged off the threat of tariffs during the second quarter of 2025, as domestic equities recovered from a poor first quarter, while foreign stocks added to their gains. The large-cap tech stocks that had fueled the recent bull market reversed their first-quarter losses and then some, suggesting that the S&P 500 still has room to run. International stocks continued their strong year, in large part due to the falling dollar. Labor markets continued to hold up despite the headwinds of restrictive monetary policy and increased tariffs, while growth, though forecasted to slow, doesn’t appear to be tipping into recession territory. The Fed continued to leave the federal funds rate unchanged, as it waits to see the consequences of President Trump’s tariffs and trade disputes with a plethora of countries. Markets are still expecting rate cuts to resume before the end of the year. The Republican Congress passed, and Trump signed, the One Big Beautiful Bill Act (OBBBA), which contained large tax cuts only partially countered by spending cuts, and is expected to significantly raise already high deficits. For all the dramatic change from the Biden Administration to the Trump Administration, equities’ upward trajectory continued apace.

The S&P 500 jumped 10.9% in Q2 2025, while small caps grew 8.5%. Developed international and emerging markets showed continued strength, rising 12.0% and 12.2%, respectively, in the second quarter. On the bond side, the US agg climbed 1.2% in Q2, while Treasury rates showed mixed movements, with the 2-year rate falling modestly, the 10-year rate remaining flat, and the 30-year rate rising modestly.

GDP fell slightly in Q1 2025, largely for technical reasons, as imports surged in an attempt to procure goods and materials before tariffs took hold. Second quarter growth is projected to come in around 2% annualized. Unemployment ticked up 0.1% over the past three months, to 4.2%, but overall labor market conditions remained benign. Core inflation eased in Q2 from 3.1% to 2.8%, but remains above the Fed’s 2% target. After 100bp in cuts during Q4 2024, the Fed has held rates steady in the face of tariff concerns; though current Fed policy is restrictive, the Fed has the flexibility to adjust rates should circumstances warrant.

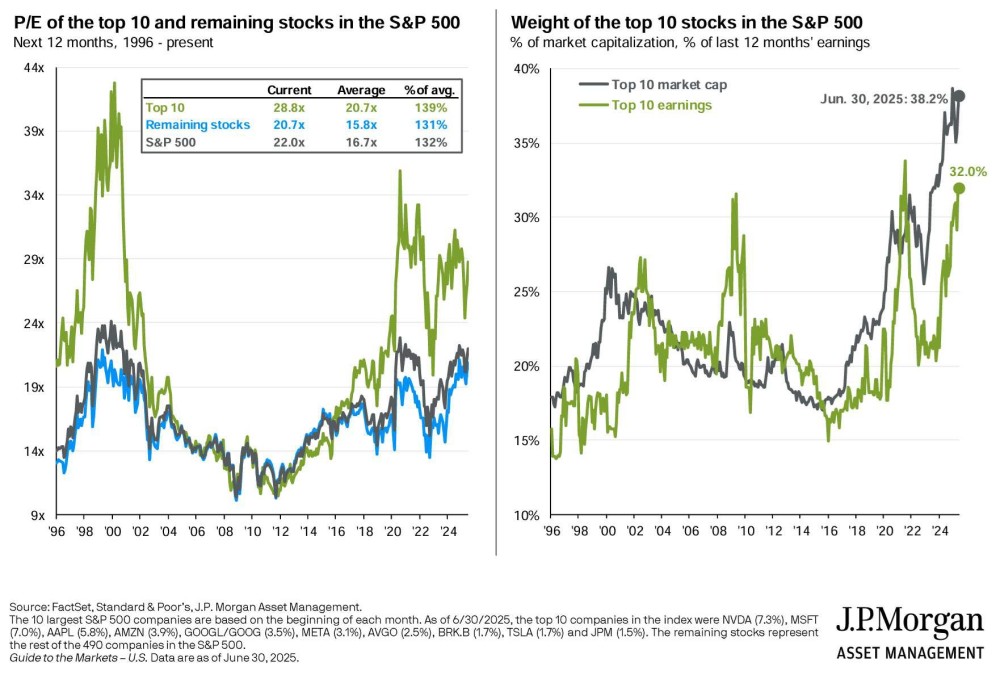

The threat of more extreme tariffs seems to have passed, though it’s likely that tariffs in the intermediate future will be at levels not seen in decades. Further major Congressional legislation appears unlikely in the near term, as such legislation would likely require Democratic support in the Senate to overcome a potential filibuster. Both the fallout from tariffs and the OBBBA are likely to accrue increasingly over time; it’s premature to assess the short-term, let alone the long-term, impact from tariffs. After easing during Q1, valuations and market concentration have again spiked to historically high levels, and while we have a degree of uneasiness over such circumstances, AI adoption, tax cuts, and the prospect of a lighter regulatory touch may indeed justify such valuations.

2Q 2025 Investment Letter

Markets had a broadly strong second quarter of 2025, with both domestic and foreign equities making significant gains, as well as domestic, foreign, and high-yield bonds. The economy continued to look like it will nail the soft landing of normalizing inflation (less than 1% away from the 2% target) without enduring a recession. While the Fed is understandably delaying rate normalization due to tariff concerns, it is able to do so because the economy has been so resilient. We’ll need to wait and see what trade agreements are made, how robust any trade agreements prove to be, and to what extent inflation shifts over the coming months. Overall, the economy and markets are in good shape as of this writing, but given that valuations already incorporate this optimism, we would moderate our expectations going forward.

2Q 2025 Market Update

The rising equities tide lifted most boats in the second quarter of 2025. The S&P 500 leapt 10.9%, while the Russell 2000 gained 8.5%. Developed international and emerging markets, aided by a weakening US dollar, posted large second quarter gains of 12.0% and 12.2%, respectively. In terms of style, after falling 10.0% in Q1, large growth ended Q2 up 6.1% year-to-date; small growth also showed great improvement, with a 11.1% loss in the first quarter nearly eliminated by the end of June. The rotation of growth into value in Q1 reversed in Q2, however, as value’s gains were muted, with both large and small value posting moderate gains of about 4% for the quarter. As for sectors, technology led the way with a 23.7% gain, while communication services rose 18.5% and consumer discretionary added 11.5%. Energy fell 8.6%, while health care dropped 7.2%.

Bonds had a positive Q2, as the US agg rose 1.2%, international developed bonds, aided by the weaker US dollar, climbed 7.6%, and high yield bonds gained 3.5%, while municipal bonds fell 0.1%. Core inflation cooled to 2.8%, which is still above the Fed’s 2% target, while GDP growth is projected to be modest but positive in Q2. Treasury rates didn’t move much during Q2, as the 2-year Treasury rate slid from 3.89% to 3.72%, the 10-year Treasury rate rose from 4.23% to 4.24%, and the 30-year Treasury rate increased from 4.59% to 4.78%. After spiking in April following President Trump’s tariff announcement, volatility fell steadily, ultimately ending up in the teens by quarter’s end.

Update on the Macro Outlook

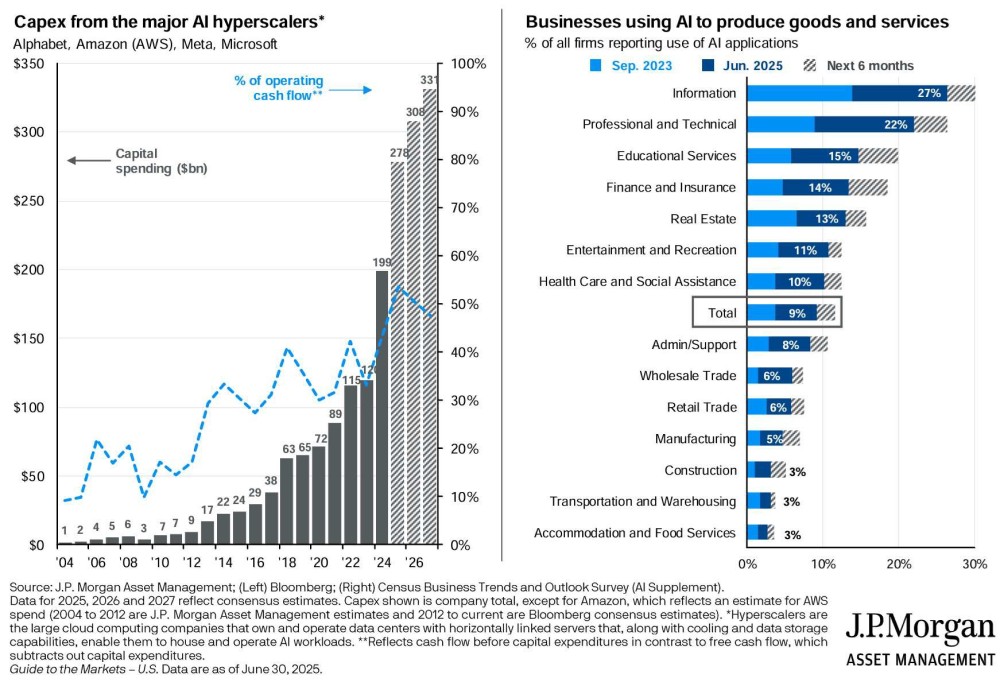

US economic statistics are solid--unemployment is moderate, inflation is only slightly elevated, and growth, while somewhat slow, is still in positive territory. But there’s lots of activity beneath the service, which perhaps means more uncertainty than normal going forward. First, AI adoption is occurring at an astonishing pace:

AI could provide a boost to GDP by increasing productivity. It could also cause a spike in the unemployment rate by enabling few to do the work of many. It could also create jobs for those who can apply AI tools to their fields of expertise. AI is likely to be disruptive to economies and labor markets, but the timing and scale of such disruptions is difficult to predict.

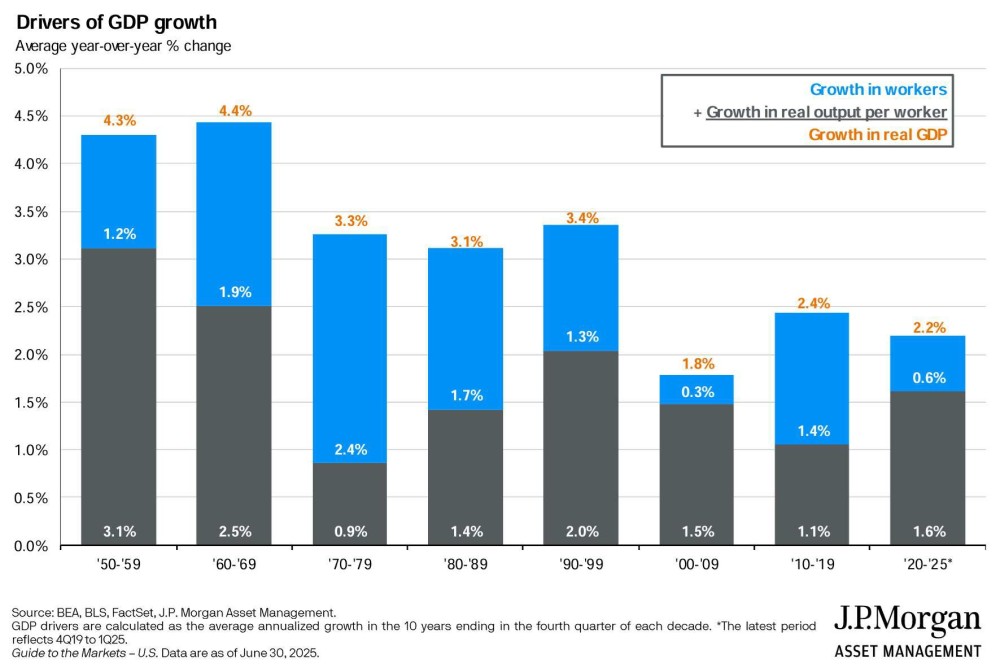

And speaking of productivity and labor markets, JPMorgan also has charts on these subjects:

Productivity growth can be divided into two pieces— growth in workers and growth in real output per worker. During some decades increases in the number of workers has been the primary driver of productivity growth; during other decades, increases in individual productivity has dominated. AI may enhance productivity per worker. However, the growth in workers may be limited by President Trump’s immigration policies.

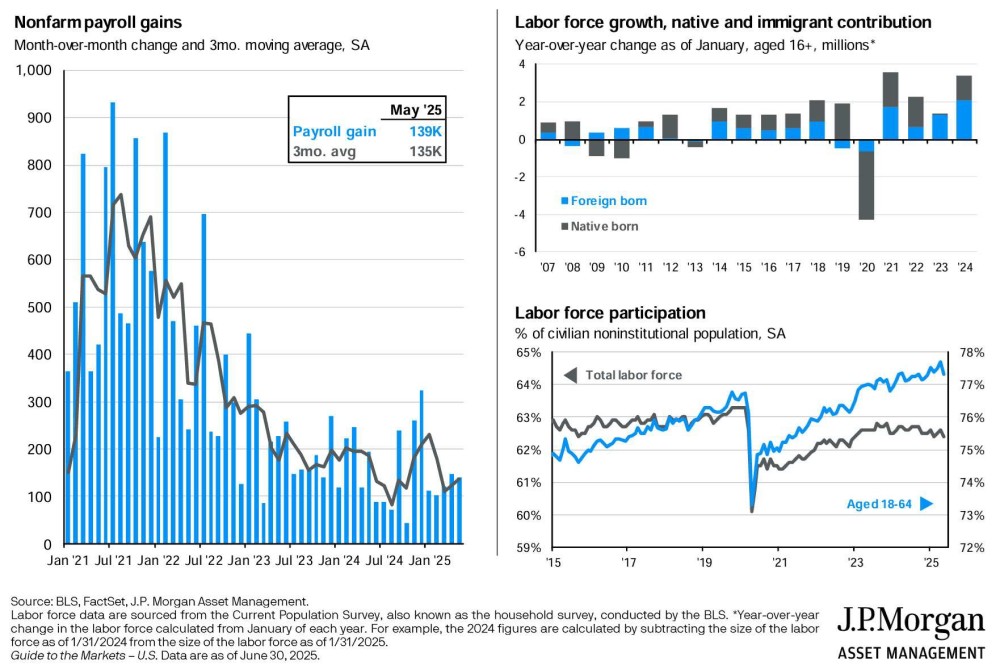

For better or for worse, recent growth in labor markets has largely been due to foreign-born workers, as indicated by the upper-right chart below:

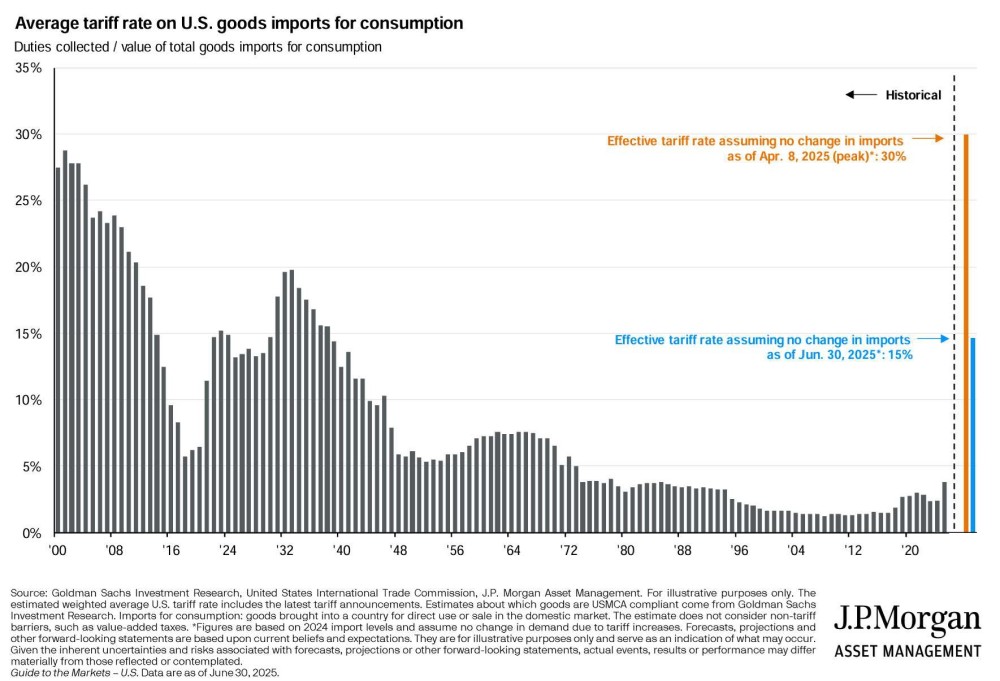

President Trump has also added tariffs into the economic mix, and while current tariffs are lower than the numbers threatened in April, they are still extremely high by historical standards:

The effective tariff rate is at its highest point in nearly a century, at about 15%. Time will tell as to how this tariff burden is split between foreign producers, domestic businesses, and domestic consumers. Analysts expect that tariffs in the short run will increase inflation and unemployment, and indeed, the Fed’s current economic projections anticipate a slight uptick in those numbers:

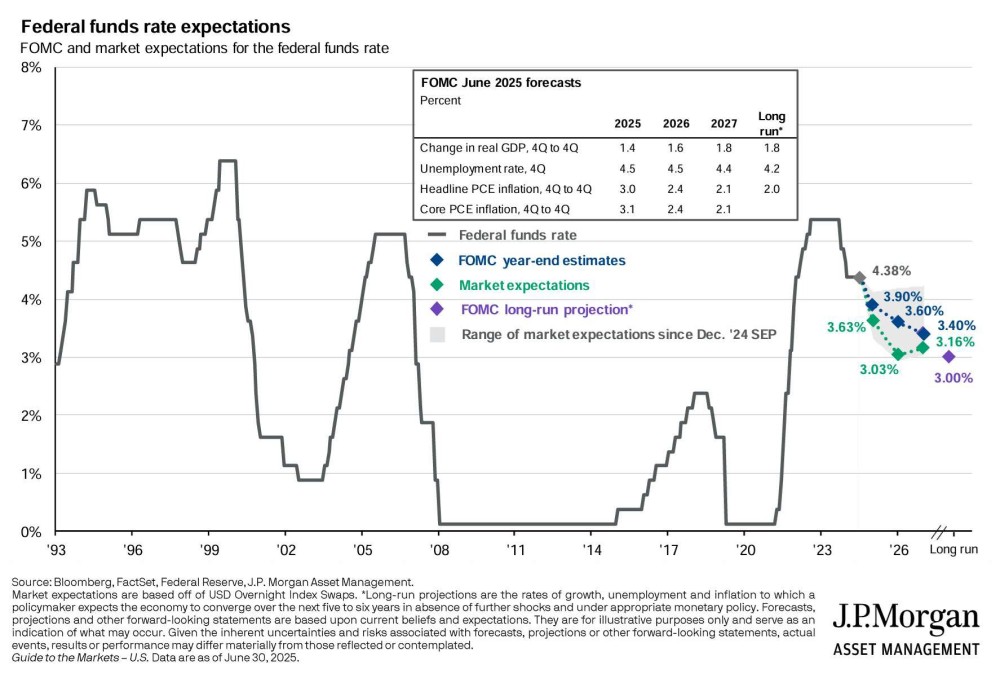

Unemployment is expected to rise to 4.5% by year’s end, and core inflation to 3.1%. Growth, meanwhile, is forecast to be positive but somewhat sluggish at 1.4%. The Fed is trying to balance its twin priorities of low inflation and low unemployment, and it’s not surprising that it’s waiting to see how the economy responds to several new circumstances before taking action.

Markets are anticipating more rate cuts than the Fed during 2025 and 2026, but only by about 25-50bp. The longer term federal funds rate is projected to be 3%, which could reflect both normalization as compared to the ultra-low rates of the 2010s, as well as a tightening response to loose fiscal policy.

Portfolio Positioning and Closing Thoughts

For markets, it appears the benefits from AI adoption, along with the passage of the OBBBA, have overcome lingering concerns about tariffs. Tech stocks have taken off once again, which is certainty good for people’s portfolios. Once again, though, the S&P 500 is characterized by high valuations and heavy concentration:

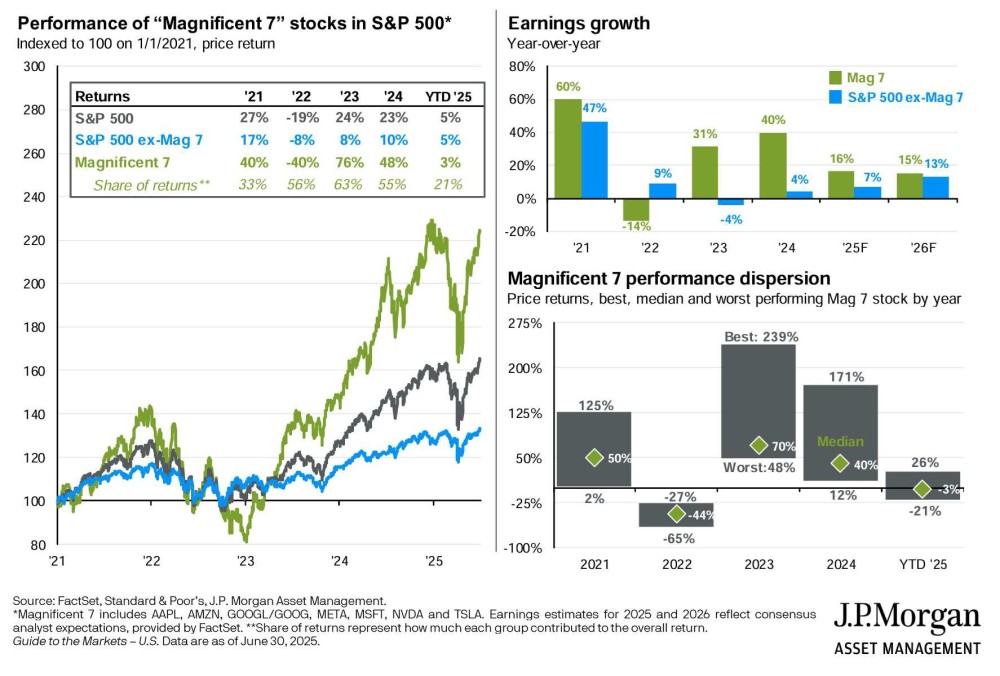

One silver lining is that unlike in 2023 and 2024, earnings growth and price returns have been more broadly distributed:

The stock market became more comfortable with the “TACO” trade as the second quarter moved forward. Deadlines were pushed. Short-term framework was put in place. The market found its feet and rallied higher. The rally only strengthened as timelines were extended and, by summer, the market no longer seemed concerned with the impact of tariffs. In this run up from the April lows, the market also rediscovered its love with Artificial Intelligence (AI) and capital expenditures in the space. This focus may be masking larger issues in the economy – at least in the shortterm. Wage growth looks to be slowing a good bit. Even though tariffs have been lowered and delayed, they are still much larger than at the start of the year. This should prove to be inflationary – even if it is difficult to predict when it

may begin to leak into economic data.

The tech/AI trade may prove to be immune to these concerns in the near-term, but as prices rise for these stocks they also become more levered to the next market pullback. We prefer to be more neutral between growth and value stocks in the large cap space given current valuations and obtain exposure to the Magnificent Seven through run-ofthe-mill market cap weighted exchange-traded funds. The more dividend focused names may provide a ballast if the second half of 2025 is more choppy. We are somewhat negative on small- and mid-sized U.S. companies and are generally not adding to them at this time. These companies are more sensitive to interest rates and have less flexibility to work within the uncertainty around tariffs. International stocks have enjoyed a great first half of 2025 on the back of strong flows into the space and a weakening U.S. dollar. While we would expect the performance gap versus large U.S. stocks to close a bit, foreign names remain attractive on a valuation basis and may continue to benefit from positive momentum.

Bonds delivered a solid first half of 2025. While the bond market struggled after the Liberation Day tariff announcement and with the debt being taken on through the “Big Beautiful Bill,” the Aggregate Bond Index finished the quarter near its high for the year. Short-term bonds, as anticipated, have been steady. We anticipate they will earn their coupons for the year with some capital appreciation as a kicker. We still believe an overweight to this asset class makes sense given the continued foggy outlook on the direction of interest rates. To help raise overall yield, multi-sector bonds are still our preferred choice. The category has run ahead of the bond index in terms of returns so far in 2025. Foreign bonds – and emerging market debt in particular – have been additive to bond portfolio returns for the first half of the year as the weak dollar has proven a wind at their backs.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC-registered investment advisor

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back