By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary 2023

Fourth Quarter 2023 Key Takeaways

Markets shrugged off third quarter losses and steamed ahead in the fourth quarter of 2023, with most sectors and regions posting substantial gains for the quarter and for the year. Inflation has cooled significantly, and the Fed looks poised to transition away from “higher rates for longer” and into rate cutting mode. Tech stocks bore the brunt of the 2022 downturn, but led the bull charge in 2023. The macroeconomic soft landing—a slowdown in the economy rather than a negative turn—appears increasingly likely, though there are still indicators pointing to a recession. Growth and labor markets have continued to show surprising resilience in the face of the Fed’s 525bp increase in the Federal Funds rate over the past two years. The S&P 500 ended 2023 roughly in the same place as it ended 2021, meaning that 2023’s gains essentially reversed 2022’s losses. Bond markets also regained much of the previous year’s losses, but elevated rates limited the recovery. 2024 could be a year in which markets and economies finally reach equilibrium after enduring a pandemic, a recession, supply chain snarls, government stimulus, inflation, and interest rate hikes. Or 2024 could be a chaotic year, with global conflicts ratcheting up, and a potentially tumultuous presidential election in the US. We’re hoping that some of the normalization we witnessed in 2023 continues in 2024—cooling inflation, lower (but not too low) interest rates, steady growth, low unemployment, and continued technological development would be a nice combination. But recent years have been full of surprises, and at this point we have become conditioned to expect the unexpected.

The S&P 500 paved the way in 2023, ending up 11.7% for Q4 2023 and up a hefty 26.3% for the year. Developed international and emerging markets finished strong as well, with gains of 10.4% and 7.8%, respectively, over the last quarter, and 18.8% and 10.0%, respectively, for 2023. The Russell 2000 also posted double-digit gains for the year, with its 16.9% gain mostly derived from a 14.0% increase in the fourth quarter. The fall in longer term rates spurred bonds in Q4, as the US agg increased 6.8% and developed international bonds rose 9.9%, enabling each to climb out of negative territory for the year and post gains of about 6%. High yield bonds ended up 7.2% last quarter and up 13.4% for all of 2023. While the 3-month treasury rate barely moved in Q4, the 2-year rate and long-term rates fell, with the potential of rate cuts on the horizon.

Yet again, GDP growth proved surprisingly resilient. GDP growth was at a 5.2% annualized rate in Q3 2023 and is expected to slow, but stay in positive territory, in Q4. The labor market may be softening, but remains tight, with the December unemployment rate coming in at 3.7%. Core inflation has fallen below the 4% mark and, while still well above the Fed’s 2% target, is expected to decline further in 2024. The prospects for a soft landing for the US economy improved over the past 3 months.

The increase in long-term interest rates in Q3 dissipated in Q4, leaving the 10-year and 30-year Treasury rates only marginally higher than they were on June 30th. While we’re not banking on US and developed markets posting returns of 15% or more again in 2024, and have concerns about the concentration of market gains, the potential frothiness of markets, and the longer-term impact of the Fed’s rate increases, we’re not betting on gloom and doom either. The worst case inflation scenarios appear quite unlikely at this point, and declining volatility suggests the possibility that the economic tumult of recent years may be receding.

Fourth Quarter 2023 Investment Letter

The fourth quarter of 2023 turned an already respectable year for markets into an excellent one. The backdrop is that inflation has cooled significantly without the economy slipping into recession, thereby raising the prospects of a Fed pivot from maintaining high rates to cutting them in 2024. Inflation remains elevated, so it would be premature to declare victory, but what has been achieved is that inflation has been reduced with, as of now, minimal economic pain. The market rally occurred across numerous sectors, regions, and asset classes. While gains have been robust, there is, as always, the potential for unpleasant events causing a reversal of fortunes. The inverted yield curve could foretell a recession, as the Fed’s rate hikes kick in more fully. The overperformance of a handful of tech stocks may crumble, dragging broader markets down with them. Or the surge in geopolitical instability, with Russia’s continued war in Ukraine, Hamas’s attack on Israel, and Israel’s harsh response, could escalate further, should the Palestinian-Israeli conflict widen into the broader region, or China initiate actions against Taiwan.

Fourth Quarter 2023 Market Update

The fourth quarter of 2023 brought significant gains to most markets. The S&P 500 climbed 11.7%, developed international 10.4%, emerging markets 7.8%, and the Russell 2000 14.0%. In terms of style, the rising equities tide lifted many boats in Q4, with both value and growth stocks as beneficiaries. For the year, large value rose 11.5%, mid value 12.7%, and small value 14.6%, with most of these gains coming from a 10%-15% jump in Q4. Growth stocks, already having a strong year, continued their upward journey, with small, mid, and large growth each posting double digit Q4 gains en route to returns of 18.7%, 25.9%, and 42.7%, respectively, for 2024. Most sectors landed in positive territory during Q4, with real estate and technology leading the way with gains of 18.8% and 17.2%, respectively; energy, down 6.9% for the quarter, was the only sector to fall. For the year, technology finished up 57.8%, communication services up 55.8%, and consumer discretionary up 42.4%; utilities and energy were the only two sectors underwater for 2023, with losses of 7.1% and 1.3%, respectively.

The rise in long-term Treasury rates in Q3 largely reversed in Q4, and bondholders benefitted from declining rates. The US agg rose 6.8% and developed international bonds increased 9.9% in Q4, and finished 2023 up 5.5% and 6.2%, respectively, for the year. High yield bonds added 7.2% in Q4, and municipal bonds gained over 7% as well. For the year, high yield increased 13.4% and municipal bonds 6.4%. Interest rates shifted downwards in Q4 as the Fed’s rate hiking cycle appeared to be coming to an end (with the promise of rate cuts in 2024); the 2-year Treasury rate fell from 5.03% to 4.23% during Q4, and longer-term Treasury rates dipped as well--both the 10-year and 30-year Treasury rates see-sawed over the second half the year, with the 10-year rate rising from 3.81% to 4.59% in Q3, then dipping to 3.88% in Q4, and the 30-year rate climbing from 3.85% to 4.73% in Q3, then plunging down to 4.03% in Q4. At still enticing rates relative to the low-yield environment of a few years ago, long-term bonds have significant appeal, particularly if inflation continues to cool and if rates have peaked (with the ifs doing some heavy lifting here). Volatility, already modest in Q3, slid further in Q4, falling to the low teens by the end of the year.

Update on the Macro Outlook

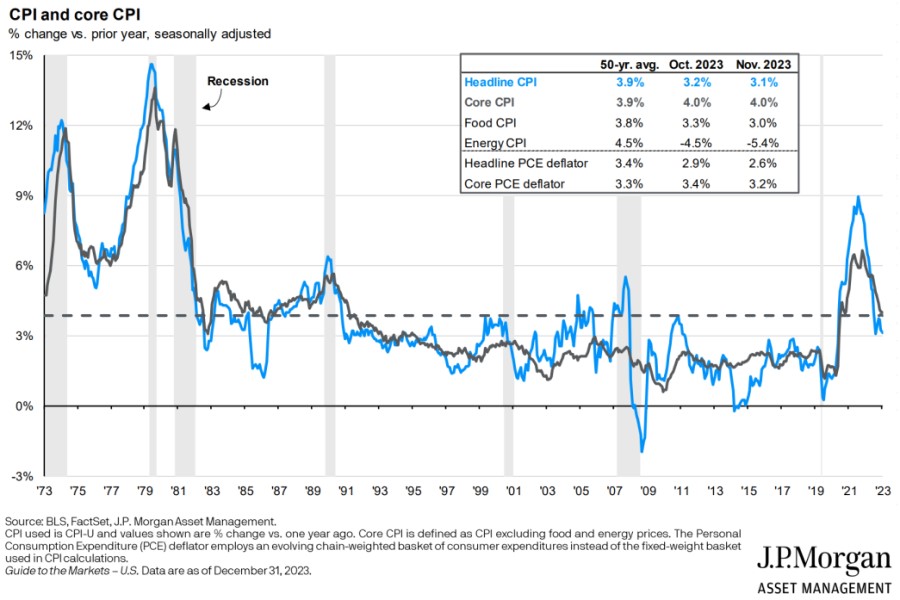

Let’s start again with an inflation update, with the hopes that by later in 2024 inflation concerns will have receded even further. Inflation continued to fall in the fourth quarter of 2023; core inflation declined from 5.3% in May to 4.4% in August and to 4.0% in November. Falling energy prices helped headline inflation ease down to 3.1% in November. Core inflation remains above the Fed’s 2% target, but is well off its 6.6% peak in September of 2022. The obvious hope is that 2024 will continue to build on the progress made in 2023.

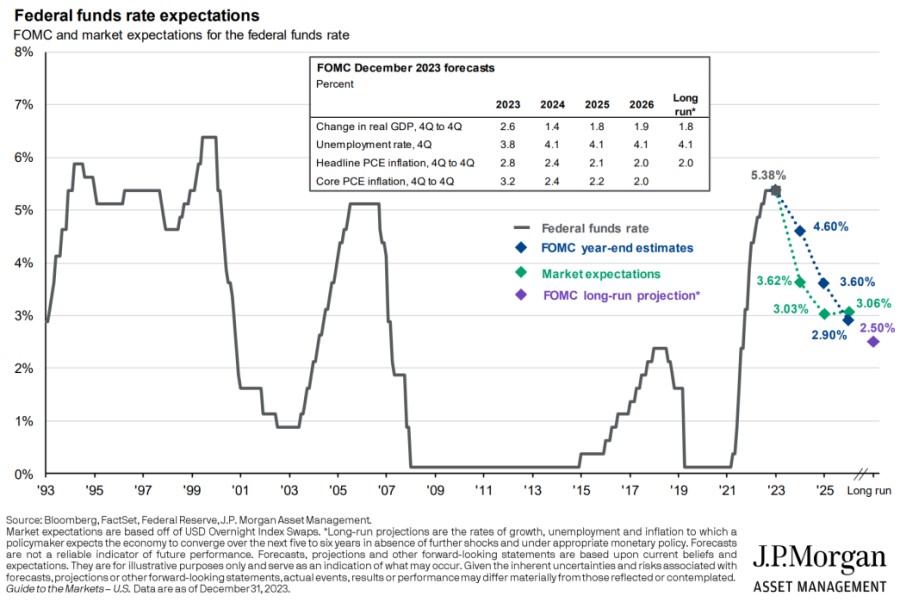

As of December, the Fed no longer anticipates additional rate hikes, and most members of the Federal Open Market Committee (FOMC) are projecting 50bp-100bp in rate cuts in 2024. The FOMC is also anticipating for 2024 core inflation falling to 2.4%, unemployment rising slightly to just over 4%, and growth slowing but remaining positive, with a 1.4% median projection. In other words, the Fed believes that it will be able to stick the soft landing for the economy, wrangling inflation near the 2% target without inducing a recession. Markets also expect the Fed to cut rates in 2024, but are anticipating more substantial rate cuts than does the FOMC:

While Fed projections have the federal fund rate falling to 4.60% in 2024, market expectations are for that rate to decline to 3.62%. This 1% gap indicates markets expect the Fed to cut rates much more aggressively than their official December projections would indicate. Why is there such a striking differential? One possibility is that markets believe that inflation is on a glide path to the 2% target, and that the Fed will be able to declare victory and slash rates more aggressively than previously thought. This view would be consistent with a soft landing.

Another possibility is that markets believe that the full brunt of the Fed’s 5.25% rate hike over the past two years has not been fully felt by the economy, and that the economy is likely to topple into a recession sometime in 2024, which would then spur the Fed to cut the federal funds rate more aggressively. In either case, the balance of risks for the Fed would have shifted from controlling inflation to supporting the economy.

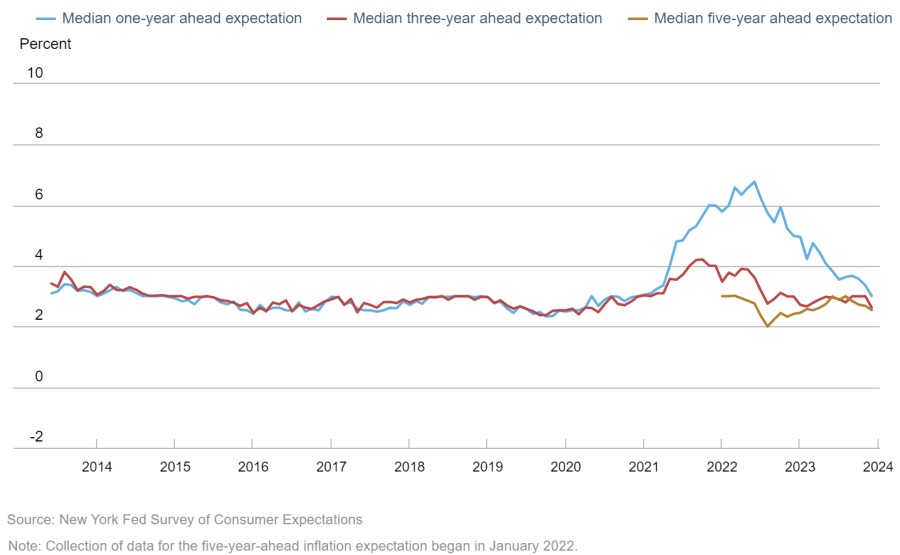

Inflation expectations continue to remain in check for consumers:

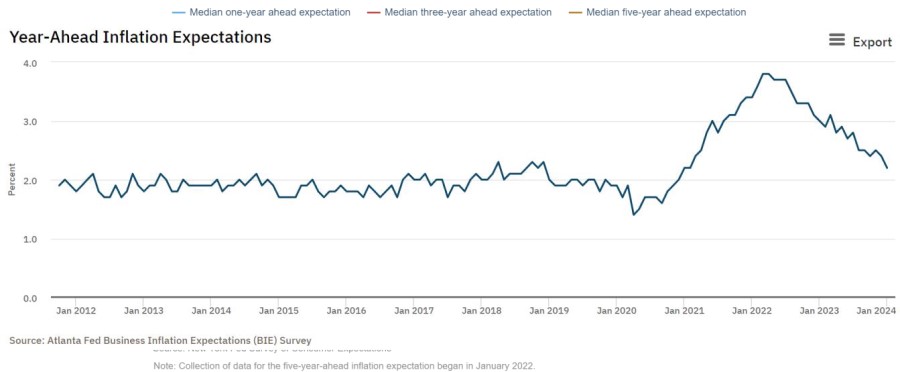

1-year inflation expectations are 3%, which is consistent with pre-COVID expectations from 2014-2019. Businesses also see inflation as largely returned to normal:

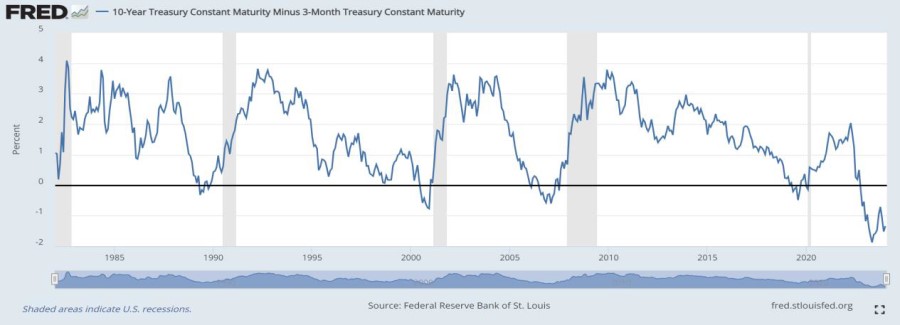

For the moment, inflation appears to be under control. But at what cost? So far the US economy has achieved significant disinflation while maintaining low unemployment and a solid growth rate, defying widespread predictions of a recession in 2023. By some measures, such as Leading Economic Indicators, we are still due for a recession in 2024. The yield curve, another harbinger of recessions past, remains inverted as well:

Typically, when the yield curve inverts—when longer-term Treasury rates fall below shorter-term rates--a recession has followed. But the pattern has not held this time—at least not yet. However, for the spread between the 10-year and 3-month Treasuries, it’s noteworthy that recessions (in gray) of the past 30 years all started after the inversion ended. On the other hand, during the last four recessions the 10-year rate was flat or falling, potentially indicating fearful investors seeking out the relatively safe haven of long-term bonds. This time is different, as the 10-year rate has risen sharply—but due to the Fed’s rate hikes, shorter-term interest rates have risen even more. The fact that the 10-year rate is well below the 3-month rate could simply reflect investor expectations that the Fed’s higher rate regime is winding down, leading to more moderate interest rates over the longer term.

In short, it’s not difficult to find evidence for and against an impending recession. The steady slide in inflation in 2023 does enhance the likelihood that a potential 2024 recession would be on the mild side, in part because the Fed has considerable room to cut rates aggressively should it deem such an action necessary. Geopolitical risks, including disruption in shipping in the Red Sea, the ongoing Ukraine-Russia and Israel-Hamas conflicts, and US-Chinese tensions, could heighten as well. In addition, the US also has its own political dysfunction -although Congress did manage to fund the government for a few months, measures with significant bipartisan support, such as Ukraine aid, Israel aid, and border tightening, continue to be gridlocked.

Portfolio Positioning and Closing Thoughts

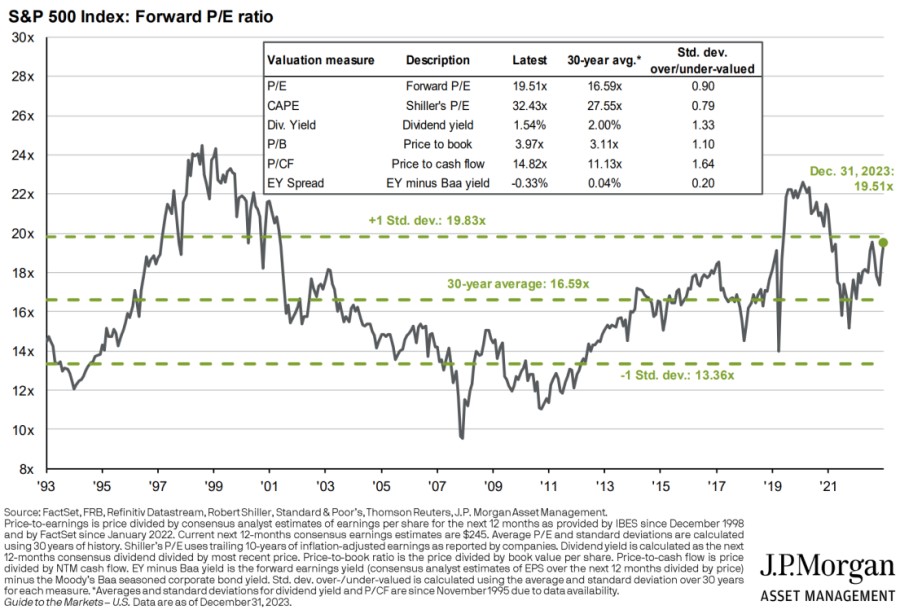

As is often the case, a surge in equities has pushed valuations into frothier territory.The fact that the S&P 500 is a bit expensive at the moment doesn’t tell much about short term returns; it is still an area of the market we want exposure to. Presidential election years have also tended to see positive performance by the S&P 500; since 1928, the S&P 500 has risen during 20 out of 24 presdiential election years, with gains averaging over 11%. Although much of 2023’s equities surge was characterized by heavily concentated gains in just a few companies, we were heartened to see widespread growth across numerous segments of the market in Q4. Overall, we are seeking balance, with a degree of emphasis on small caps, mid caps, and developed international, given their attractive relative valuations.

In the bond market, rates normalized significantly in Q4, with the bond market rallying as the 10-year Treasury rate dropped from above 5% to less than 4% by year’s end. Although the short term savings rate is likely to fall, given that rate cuts by the Fed are expected as early as March (butmore likely May), the rate decline should give core bonds a wind at their back. We have exited our floating rate positions and only have corporate high yield bond exposure through strategic bond funds, as we have shifted to areas of more promising value, such as corporate bonds, mortgage backed bonds, and core bonds in general. These strategic adjustments have added and will likely continue to add some duration to portfolios over the coming year.

The economy’s resilience continues to surprise, and while we would expect some cooling this year, the economy has sloughed off much of its excess inflation without significantly compromising growth or labor markets. A soft landing or mild recession are both far from the bad-case scenarios that seemed plausible a year or two ago. The hopeful case would be balanced gains across many areas of equities markets, continuing the trend begun in Q4, along with rising bond values amidst declining rates. With much economic optimism already priced in, we believe a vanilla year is more likely than a gangbusters one for markets, and vanilla, if it is the case, would be a welcome flavor for 2024.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC-registered investment advisor

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back