By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary 2023

Third Quarter 2023 Key Takeaways

After a quiet summer in markets, we’ve had an eventful fall. Despite the September swoon that left widespread losses in its wake, many areas of the market have performed strongly over the first three

quarters of the year. Most equity benchmarks, both domestic and foreign, remain in positive territory through September, with US large caps leading the way with double digit returns year to date. Are the most recent losses an aberration, or a sign of things to come? Was the recent surge in interest rates an ominous sign of the future, or markets internalizing the Fed’s message of higher rates for longer? It’s not hard to find recessionary omens—historically speaking, the Fed’s efforts to curb high inflation typically results in a recession. But if a recession is imminent, somebody forgot to tell the labor market. As much as we can read the historical tea leaves, the fact remains that we have not experienced high inflation for several decades, and the underlying circumstances—a global pandemic, a sharp recession, supply chain shocks, and massive government spending—are unprecedented. So far, inflation has cooled significantly without the economy tipping into recession. We’ll see whether continued tight monetary policy prevents an inflation relapse, or brings economic pain. In these uncertain times we are not inclined to bet too heavily on any one outcome.

The S&P 500 fell 3.3% in Q2 2023 and but remained up 13.1% through September 30th. Developed international and emerging markets posted similar losses for the quarter of 4.1% and 2.9%, respectively; these segments of the market gained 7.5% and 2.0%, respectively, through the end of Q3. The Russell 2000 showed a similar pattern, losing 5.1% in Q3 but still in positive territory, up 2.5%, through quarter’s end. Bonds, unfortunately, did not fare well amidst the interest rate spike—the US agg dropped 3.2% while developed international bonds fell 4.9% for the quarter, putting these areas of the market in negative territory for the year. High yield bonds, however, rose 0.5% in Q3. Short‐term treasury rates were roughly flat over the quarter, but longer‐term rates rose significantly.

Once again, GDP growth proved surprisingly resilient. GDP growth was 2.1% in Q2 2023 and is expected to move even higher in Q3. The labor market may be cooling slightly, but remains tight, with the September unemployment rate coming in at 3.8%. Core inflation has fallen, though headline inflation is rising due largely to an increase in energy prices. In many respects the prospects for a soft landing for the US economy improved over the past 3 months.

However, despite generally good inflation news in Q3, bond markets suffered as long‐term yields rose. While the Fed’s message of higher rates for longer is a potential factor, an extension of higher rates over the intermediate term doesn’t explain a significant rise in 10‐ or 30‐year Treasury rates. The bond market turmoil is yet another unusual feature of the post‐pandemic economy, and we have yet to see the full impact of higher long‐term rates and any potential aftershocks. So far, markets and the economy have taken the Fed’s rate increases in stride, but with much economic optimism already priced in, we are vulnerable to negative shocks, whether from unexpected movements in fixed income, slippage in the macroeconomy, or emerging geopolitical crises.

Third Quarter 2023 Investment Letter

The third quarter of 2023 saw a pullback in the recovery that began in the fourth quarter of 2022. The Fed raised rates once, by 25bp, and appears to be nearing the end of its hiking cycle. Core inflation fell, but remains elevated, while headline inflation rose in Q3. The decline in US equities in Q3 was broad based, with the energy sector as the notable exception. The market’s gains for the year are still concentrated in a handful of firms within the technology and communication services sectors. The fight against inflation remains a prominent story, but additional fronts have opened that could have major impacts on markets and the economy. The spike in long‐term interest rates will likely help cool the economy and inflation to a degree, but should they stay high these elevated rates should impact markets for years to come. Moreover, the surge in geopolitical instability, with Russia’s invasion of Ukraine, Hamas’s attack on Israel, and Israel’s response, could escalate further, should the Palestinian‐Israeli conflict widen into the broader region, or China initiate actions against Taiwan.

Third Quarter 2023 Market Update

The third quarter of 2023 trimmed the recovery begun in the fourth quarter of 2022. The S&P 500 fell 3.3%, developed international 4.1%, emerging markets 2.9%, and the Russell 2000 5.1%. In terms of style, growth stocks, which bore the brunt of the bear market last year, have accounted for virtually all of this year’s gains. As of September 30th, large cap growth was up 25.0%, midcap growth 9.9%, and small cap growth 5.2%. In contrast, value was roughly flat for the year with large, mid, and small value posting returns of 1.8%, 0.5%, and ‐0.5%, respectively, through Q3. Most sectors fell during Q3, with real estate and utilities each dropping over 9%. Energy and communications services were the only sectors showing gains, gaining 12.2%, and 3.1%, respectively. Year to date, communications services, technology, and consumer discretionary are the drivers of this year’s gains, with positive returns of 40.4%, 34.7%, and 26.7%, respectively, through quarter’s end. Most other sectors have either single digit gains or single digit losses, with utilities the one unfortunate exception, down 14.4% through Q3.

Rising Treasury rates were bad news for many bondholders in Q3, as the US agg fell 3.2% for the quarter, and developed international bonds dropped 4.9%. The US agg and developed international

bonds slid into negative territory for the year, down 1.2% and 3.3%, respectively, through Q3. High yield fared better, with a 0.5% gain for the quarter, and a 5.9% gain through Q3, but municipal bonds dropped 4% over the quarter, falling into negative territory for the year at ‐1.4%. Shorter term interest rates increased modestly, with the 2‐year Treasury rate rising from 4.87% to 5.03%. Long term rates moved much more sharply, as over the quarter the 10‐year rate climbed from 3.81% to 4.59%, and the 30‐year rate increased from 3.85% to 4.73%. At these higher rates, long‐term bonds have significantly more appeal, particularly with inflation showing signs of cooling, but given how much the bond market has been roiled over the past 2 years, bond investing may be in for a choppier ride than we have been historically accustomed to. Volatility remained modest and in the teens in Q3, though it did rise somewhat during that span.

Update on the Macro Outlook

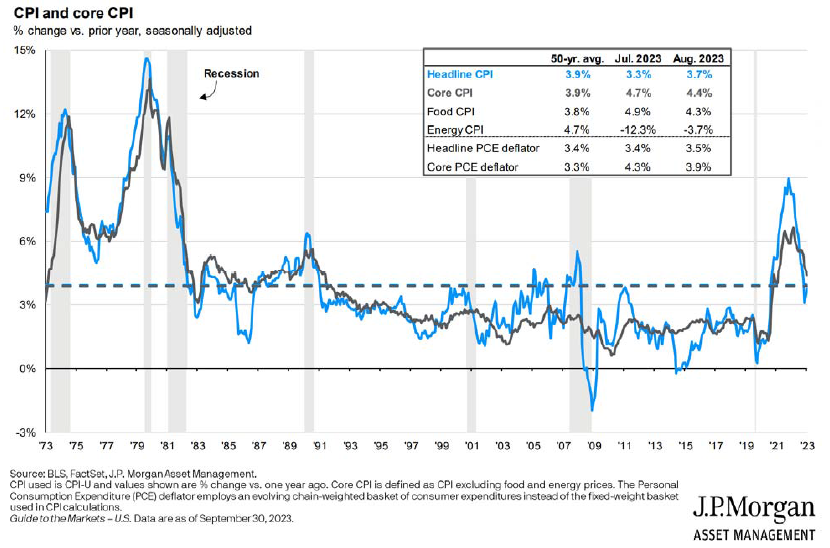

We’ll begin again with an update on inflation. While headline inflation started to rise again, largely due to higher energy prices, core inflation showed significant progress in Q3. Core inflation fell from 5.3% in May to 4.4% in August. While inflation remains significantly above the Fed’s 2% target, it has been trending in the right direction:

After a 25bp rate increase in July, it appears the Fed is near the end of its hiking cycle, with markets anticipating at most one more 25bp rate hike over the coming months. The more critical question is how long the Fed will maintain a high federal funds rate, and on that question the Fed has continued to take a hawkish stance, emphasizing its willingness to keep rates higher, for longer. The Fed may have runway to maintain high rates, as labor markets, despite some signs of cooling tight, remain tight, and they, along with strong GDP growth, have continued to make a mockery of recession predictions. Whatever the pathway to normalizing inflation, markets still expect that the Fed will get the job done:

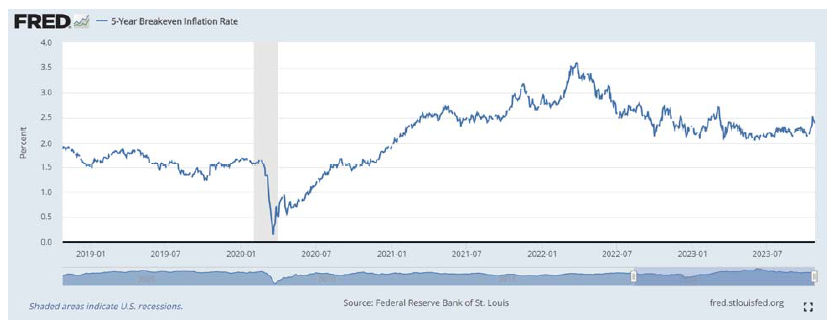

Market inflation expectations, as illustrated by the 5‐year breakeven inflation rate, have consistently supported the belief that inflation will normalize. This number ended Q3 at 2.22%, though it has increased slightly during the first weeks of October. The 10‐year breakeven inflation rate of 2.35% as of September 30th tells a similar story about cooling inflation.

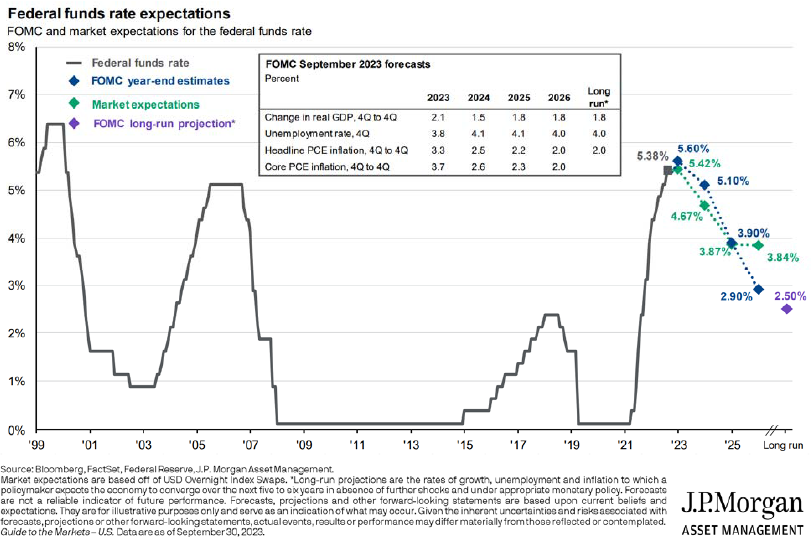

But while core inflation is trending downwards, and the economy could plausibly be said to be heading towards a soft landing (or a mild recession, if the outlook is a little darker), we have nonetheless seen sharp movements in long‐term Treasury rates. The 10‐year and 30‐year Treasury rates increased 78bp and 88bp, respectively, during Q3 and have climbed further in October, hovering around the 5% mark. These long‐term rates are the highest we’ve seen since the early part of this century. What’s prompted the recent runup? Fed and market projections are reasonably aligned for the next 2 years:

As of September 30th, markets have a slightly more dovish outlook on rates for 2024, as compared to the Fed. But there’s a significant divergence in 2026, when the Fed believes it will take the federal funds rate below 3%, while markets foresee the downward trend stalling at slightly under 4%. While the Fed has emphasized its willingness to sustain higher rates for longer, higher rates appear likely to be limited to a total increase of 25bp‐50bp from June 2023 onwards, and longer elevated rates appear likely to last only another 2‐3 years. The movements we’re seeing in the bond market are on a much longer horizon, and don’t appear to be tied closely to an inflation battle that markets are assuming will be won over the intermediate and longer term.

There are various theories explaining the rise in long‐term Treasury rates, but none are wholly satisfactory. Although government debt is high and increased polarization and government dysfunction makes addressing the debt difficult, this circumstance has been true for many years. Inflation fears are possible, but the inflation problem has receded somewhat as the year has progressed. The surprisingly strong economy may be a culprit, whether directly by fueling spending or indirectly by inducing the Fed to keep rates higher to control inflation.

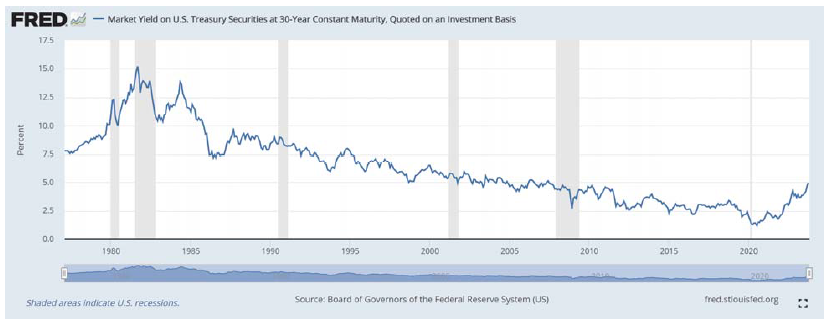

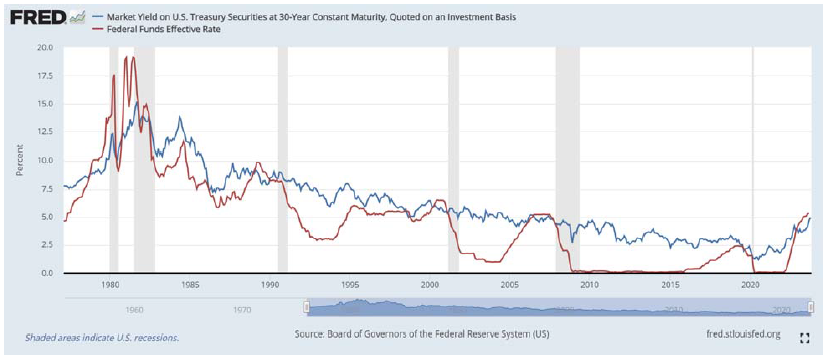

Will rates normalize? This begs the question as to what normal Treasury rates are. Below we have a chart of the 30‐year Treasury rate for recent decades:

Until this post pandemic era, rates fell relentlessly for over 40 years. Are we now seeing mean reversion to the rates of the 2000’s, or even the 1990’s? Is the low growth and secular stagnation era of the 2010s gone, or lurking nearby, ready to reassert itself once the inflation dust settles. Is the Treasury rate surge part of an ongoing trend, or has the snapback been overdone? We’ve made a chart of the same graph as above, with an additional line showing the federal funds rate over time:

Over recent decades, when the Fed lowered rates, the 30‐year Treasury rate fell modestly. When the Fed hiked rates, the 30‐year Treasury rate usually didn’t move very much. But the post‐pandemic rapid rate hikes of the past 2 years have been accompanied by rapidly rising long‐term Treasury yields. Whether these yields herald a new economic era or represent markets overextrapolating the weirdness of the COVID‐impacted economy remains to be seen.

Despite the economy’s surprising resilience, there is still a chance that the Fed’s tightening eventually pushes the economy into a recession. Given the progress already made against inflation, the Fed

probably has more room to cut rates should dark economic clouds emerge, or maintain high rates should inflation’s downward movement stall. Geopolitical risks have also increased somewhat with Hamas’s attack on Israel and Israel’s counterresponse, largely due to the risk of the conflict widening across the broader Middle East. The US also has its own political dysfunction, in which passing a short‐term government funding measure cost House Speaker Kevin McCarthy his job. Given recent chaos in the House, a government shutdown in November is quite possible, and while past shutdowns

have had minimal impact on markets, political polarization that fuels a longer shutdown could challenge previous history.

Portfolio Positioning and Closing Thoughts

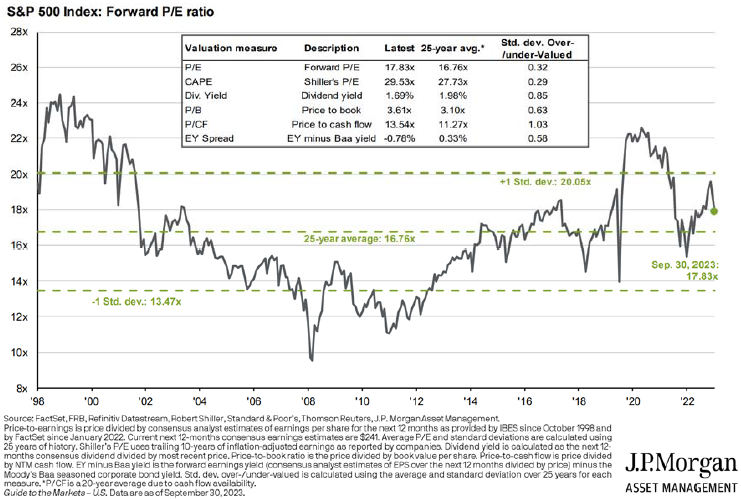

The Q3 dip in stocks brought valuations for the S&P 500 closer to their historical norms:

However, the runup in stocks over 2023 has been heavily concentrated in just a few companies.

Through August, the top 10 stocks were responsible for over 80% of the S&P 500’s gains for the year. The majority of S&P sectors are negative for the year or have produced minimal gains. Aside from

market cap weighted index exposure, 2023 has been much more of a struggle for stocks. Through September 30th, small and mid cap stocks have produced paltry gains when compared to their large cap brethren. However, small and mid cap stocks look significantly more attractive on a valuation basis, with both of the lower capitalization categories trading at levels not seen since the technology bubble of 1999. These categories only get more compelling as the valuation gap between large and smaller caps widens. A similar story can be told when comparing foreign stocks to their domestic large cap counterparts. While developed foreign stocks have had a decent 2023, they have lagged US stocks. Emerging market companies have had even more of a struggle, barely producing positive gains for the first three quarters. As has been the case for the last several years, valuations of foreign and emerging market stocks are enticing on a relative basis versus large US companies. So, even though diversification has been a headwind to stock returns in 2023, we maintain exposure to these (cheap) segments of stock markets.

After a solid start to the year, bonds have come under additional pressure as the 10‐year Treasury rate moved from 3.81% to 4.59% during the third quarter. The movement in rates brought the US agg down 3.2% for the quarter, putting pressure on fixed income products that carry duration. We continue to underweight duration in our bond portfolios, instead focusing on short‐term bonds which now offer yields around 5% annualized, and multisector approaches which can take advantage of opportunities in credit, and be more tactical in their duration positioning. While rates are likely to drift higher in the short term, we believe we are nearing the end of the tightening cycle. While it is hard to predict when the Fed will begin easing by cutting interest rates, we believe it is prudent to add some duration back to most fixed income strategies in the coming months.

While the economy continues to prove resilient, we would expect some weakness in late 2023 or the first half of 2024 and increased volatility in the stock market. It would be prudent to harvest some gains in stronger areas of stock portfolios. With short‐term yields around 5%, investors can pivot to stable fixed income and earn an attractive yield while waiting for a cheaper entry point for stocks.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC-registered investment advisor

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back