By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

1Q 2025 - Key Takeaways

Markets turned in a mixed performance during the first quarter of 2025, with domestic equities tumbling during the first quarter while their foreign counterparts rose. While the labor market remained strong,

economic growth appears to be dimming. The onset of tariffs imposed or threatened by President Trump has heightened uncertainty among consumers and businesses. The Fed, too, seems caught in a holding pattern, as it tries to assess to what extent tariffs may hurt growth (in which case it would cut rates) and to what degree tariffs may increase inflation (in which case it would maintain high rates). The Fed kept rates flat through the first quarter, but markets are expecting some cuts over the course of the year. It’s too early to say whether the large-cap tech-stock fueled bull market is over; after all, the collapse in tech stocks in 2022 was followed by a resurgence in 2023 and 2024. The Trump Administration and Congress are fairly likely to renew the Trump tax cuts from his first term, though legislative progress on that front has been limited so far. Tariffs have been the big story of March and April; the scale of tariffs Trump has sought has been quite large, but the details of tariff policy—rates, countries affected, industries affected, carveouts, etc.—are in flux. The future is even more murky than usual.

The S&P 500 fell 4.3% in Q1 2025, and small caps fared even worse, plunging 9.5%. On the other hand, developed international and emerging markets rose 7.0% and 3.0%, respectively, in the first quarter. Domestic bonds benefitted from a decline in rates, as the US agg climbed 2.8% in Q1. Treasury rates dipped in the fourth quarter, with the 2-year rate, 10-year rate, and 30-year rate all sliding 15-40bp.

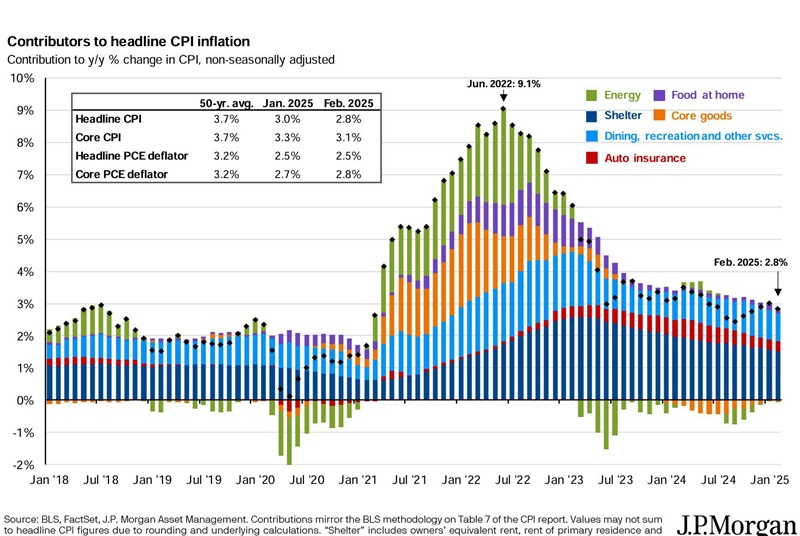

GDP remained strong in Q4 2024, as it grew at an annual rate of 2.3%. However, growth in the first quarter of 2025 is likely to slow, perhaps even dipping into negative territory. Labor market conditions continued to be benign, as the unemployment rate dipped slightly to 4.1% over the past three months. Core inflation eased in Q1 from 3.3% to 3.1%, but remains above the Fed’s 2% target. Despite 100bp in cuts during Q4 2024, the Fed’s policy is restrictive, and the Fed has the flexibility to adjust rates as circumstances warrant.

Although Republicans swept the Presidency, the House, and the Senate, we have not seen much legislation so far this year; nonetheless, extension and potential expansion of the Trump tax cuts of 2017 is likely, along with some spending cuts. If legislative action has been minimal, executive action has not—President Trump has issued a large and wide-ranging set of executive orders. The main executive actions we’ll address later on is tariffs, although on that front there are still many more questions than answers. High deficits and elevated long-term interest rates may constrain fiscal legislation to an extent. Valuations remain elevated, but less so than three months ago. Tariffs—whether ramping up, scaling back, or pausing—have led to large market reactions, and so long as tariff policy remains a work in progress, we would expect higher volatility and market fluctuations to be increasingly common. As of this writing, markets appear to view tariffs negatively; we may get greater understanding of the impact of tariff policy in the coming months, as we start to see downstream effects on supply chains, markets, and the US and global economy.

1Q 2025 Investment Letter

First, the good news--the S&P 500 gained over 20% in 2023 and repeated the feat in 2024; the 4% drop in Q1 2025 puts only a modest dent in those gains. The economy has already made a semi-soft landing—inflation has fallen and stayed under 4% without the accompanying pain of a recession. However, the Fed is in a tricky position with respect to tariffs, which risk both spurring inflation and slowing growth. Valuations and market concentration remain high as well. Given the chaotic rollout of tariffs and uncertain business climate, it will be difficult for US equities to maintain the remarkable run they’ve had over recent years, even with the potential of tax cuts and deregulation during a Trump presidency. Without policy clarity and a diminishing of tariff headwinds, our expectations going forward will be somewhat subdued.

1Q 2025 Market Update

While US stocks have outperformed their foreign counterparts for the past decade, the first quarter of 2025 saw a reversal of fortune. The S&P 500 dropped 4.3%, while the Russell 2000 declined 9.5%. In contrast, developed international and emerging markets posted first quarter gains of 7.0% and 3.0%, respectively. In terms of style, both small caps and growth got hammered in Q1 2025; large growth finished down 10.0%, small growth plummeted 11.1%, and small value dropped 7.7%. Large value posted a small gain of 2.2% for the quarter. Whether the tech stock plunge represents a temporary blip or a rotation from growth into value remains to be seen. As for sectors, energy finished the quarter up 10.2%, while consumer discretionary and technology posted double digit losses of 13.8% and 12.7%, respectively.

Bonds had a solid Q1, as the US agg rose 2.8%, international developed bonds climbed 2.7%, and high yield bonds gained 1.0%, while municipal bonds fell 0.2%. Inflation dipped slightly to 3.1%, which is still above the Fed’s 2% target, while GDP growth looks likely to slow in Q1. Treasury rates fell modestly during Q1, as the 2-year Treasury rate slid from 4.25% to 3.89%, the 10-year Treasury rate fell from 4.58% to 4.23%, and the 30-year Treasury rate declined from 4.78% to 4.59%. Volatility was calm and in the teens for most of the quarter, but rose in March into the twenties and spiked in April after President Trump’s tariff announcement. As of this writing volatility is back in the twenties.

Update on the Macro Outlook

Before discussing tariffs, we’ll take a current snapshot of the macroeconomy. While markets are forwardlooking and thus have already reacted significantly to tariffs, the macroeconomy will more gradually absorb whatever impact tariffs will have in 2025. As of quarter’s end, core inflation remains moderately elevated, at 3.1%:

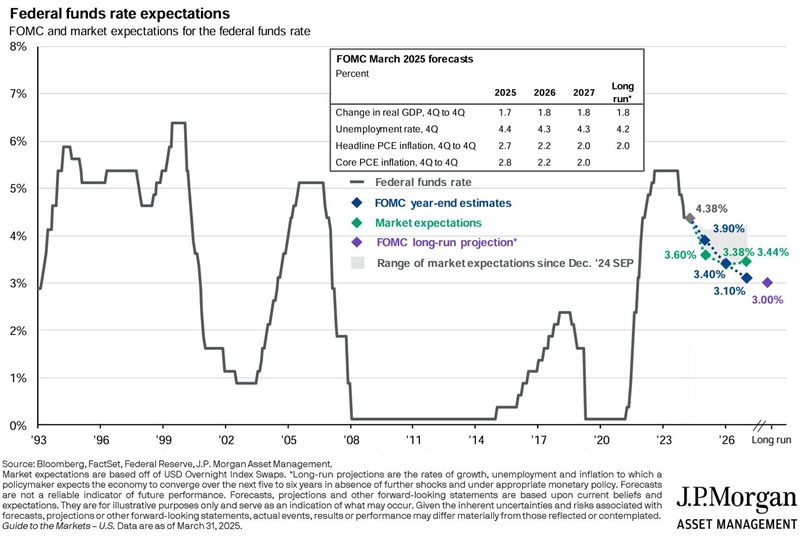

Although the Fed cut the federal funds rate by 100bps in the last half of 2024, it has not made any rate cuts so far in 2025, and anticipates only 50bp in cuts over the rest of the year. Market expectations are slightly more aggressive at 75bp in cuts projected for 2025:

Why might markets expect the Fed to cut more aggressively than it projected in March (and we should note here that during April market expectations have increased to 100bp in Fed rate cuts for 2025)? It likely has to do with GDP growth concerns. GDP forecasts have become increasingly pessimistic over the past few months, as analysts expect tariffs in the short run to raise inflation and slow growth. If the economy stalls out, or tips into recession, the Fed may feel it necessary to stimulate the economy with rate cuts even if it raises inflation risks. The Fed would likely also take into account whatever fiscal legislation Republicans pass this year. Depending on the tax cut and spending cut mix that makes its way through Congress, the Fed may feel the need to have tighter monetary policy, given already high deficits and above-target inflation.

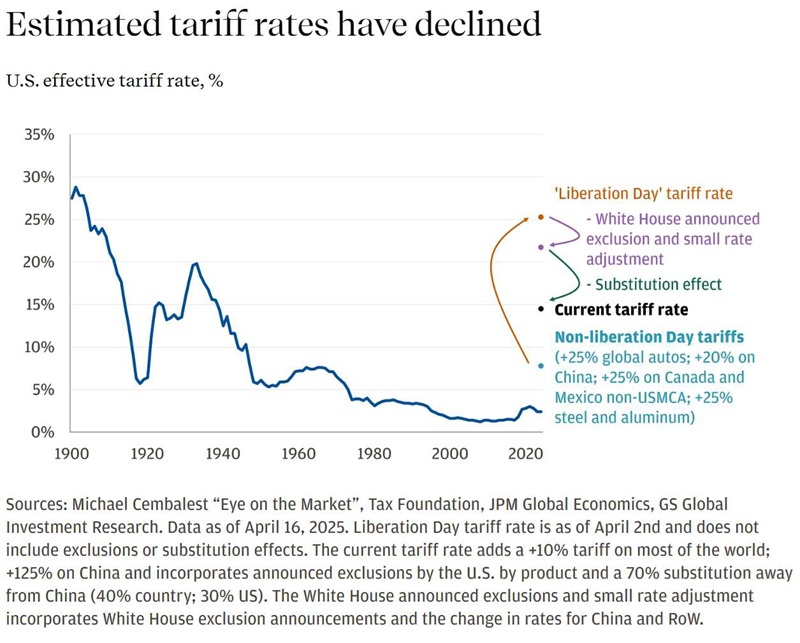

But the elephant in the room, so to speak, has been tariffs. President Trump has imposed tariffs far beyond anything we’ve seen for nearly 100 years. President Trump has also adjusted tariffs, postponed tariffs, and offered exemptions and carveouts, so the tariffs in place now may not be the tariffs businesses and countries face next month, or even next week. But to get a sense of how dramatically tariffs have risen this year, we offer this chart via JPMorgan:

Markets reacted quite unfavorably to the “Liberation Day” tariffs announced on April 2nd, although the S&P 500 has recovered much of its April losses since then. Tariff adjustments have blunted the potential impact of tariffs to an extent, while the substitution effect (if tariffs stay in place, US consumers and firms will shift purchases from China, which faces extremely high tariffs, to other countries) should also lower the effective tariff rate. Michael Cembalest’s effective tariff rate estimate as of mid-April was about 15%, which while not as severe as announced “Liberation Day” rates, nonetheless is more than triple the highest rate we’ve seen since 1980.

Consumer and business sentiment have soured over the past three months, but it remains to be seen how these views will translate into hard economic data. In short, there’s a great deal of uncertainty about tariffs, which means there’s elevated uncertainty with respect to the domestic and global economy, as well as equities and bonds. Until a more stable tariff policy emerges, we may be in for a bumpy ride.

Portfolio Positioning and Closing Thoughts

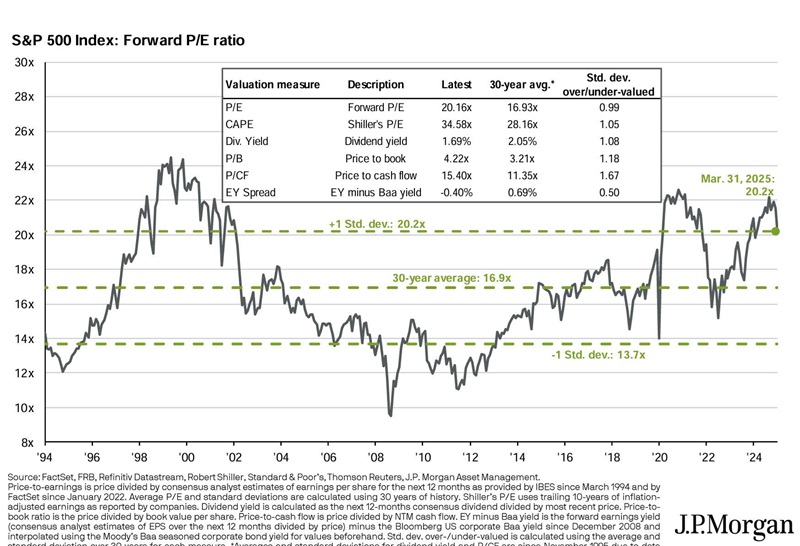

Valuations have eased but remain above their historical norms:

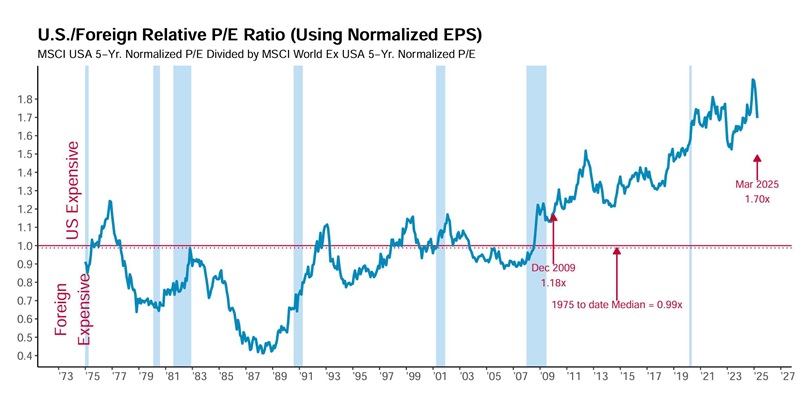

Even with foreign stocks’ strong Q1 and a US equity pullback, foreign stocks remain relatively cheap, though less so than three months ago. The larger question is whether the recent rotation from US to foreign equities is a harbinger of a longer-term shift:

The pullback in stocks after the “Liberation Day” announcement was swift as the market moved lower by more than 10% over two trading days. Not long after, a delay in the tariff implementation allowed stocks some relief as markets clawed back more than half the early April losses. Since that time, the markets have been trying to find their feet. Even with the “pause” on many of the larger tariffs, there are baseline tariffs in place and the tariffs on China remain significant. It is difficult to predict what the path forward looks like. The Trump Administration has promised a flurry of deals heading into the summer – solving many of the issues created by the initial rollout that spooked the markets. However, while we wait to see what deals are consummated and how they compare to the first look levels, the economy will have difficulty shrugging off the major shocks the initial tariffs have created. Consumer confidence is at levels not seen since the depths of the COVID decline in April 2020. Volatility has increased. The U.S. dollar has weakened. Shipments from China have nearly come to a halt. Even if these policies are reversed, it will likely take time for the economy to normalize.

For large U.S. companies, growth stocks have been hit hardest. The Mag-7, which drove the markets higher for the better part of 15 years, has seen deeper pullbacks. Valuations had drifted higher in recent years and the contribution of those stocks to the major indices’ returns make the overall market decline a bit deeper. Value and dividend stocks have proved more durable to start the year. While we anticipate volatility to remain relatively high and growth stocks to have their moments, we would tilt allocations toward value given the road ahead. Small and mid-sized companies have been hit harder to start the year. These companies typically have less cash and are often more sensitive to moves in interest rates. Although they are attractively valued versus large U.S. stocks, we would not use this pullback to add to these areas. Their pain could extend into the year if policies remain anything close to what we have today. Foreign stocks have been the stalwarts of early 2025. The flight from U.S. assets – for a multitude of reasons – has benefited developed international stocks. These stocks have been cheap for the better part of a decade, but the general trend of nations moving money away from the United States has benefited the category. We expect this trend to continue in the short-term with both developed foreign stocks and emerging markets stocks.

Bonds had a decent start to 2025. For the first quarter, things were uneventful. Core bonds moved higher as interest rates fell. Foreign bonds participated as well. Even high-yield bonds moved past the stock market volatility and gained 1%. Municipal bonds was the only area of weakness. Concern (which we believe to be unfounded) over the possibility of municipals losing their tax exemption caused a rush of issuance and brought down prices. Tariffs also spooked the bond market. Yields rose quickly following the end of the first quarter as money flowed from intermediate and longer dated Treasuries. The “pause” announcement brought some calm back to bond markets and rates settled. Moving forward, we want to be careful in terms of exposure to interest rates. While the Fed is usually likely to cut as signs of an economic slowdown mount, tariffs make the Fed’s job more difficult. The inflationary nature of tariffs will give the Fed pause as they do not want to contribute to another round of higher inflation. While we will hold core bonds, we prefer to have a greater focus on short-term instruments which allow you to collect the still attractive yield while not playing the guessing game on rates. We also continue to have exposure to international and/or emerging markets bonds in portfolios to diversify yield sources. Finally, the multi-sector basket of fixed income approaches remains intact. These strategies help to

augment overall yield and provide exposure to some opportunities for capital appreciation.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC-registered investment advisor

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back