By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

A Fed Update

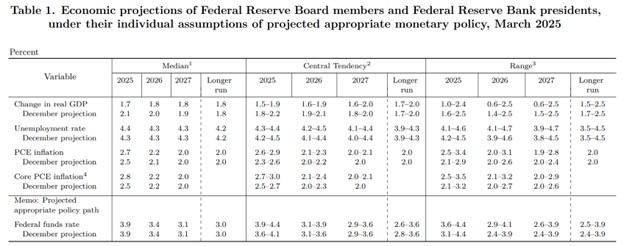

Last week the Fed voted to leave the federal funds rate unchanged at 4.25%-4.50%. And although we’ve seen consumer sentiment sour and recession fears rise, the Fed’s projections for 2025 have only undergone modest changes:

2025 GDP growth projections fell from 2.1% in the December survey to 1.7% in the March survey. Core PCE inflation is expected to be 0.3% higher, at 2.8%, and the unemployment rate is anticipated to be 0.1% higher than previously thought. Overall, the Fed’s outlook has moderately shifted in a negative direction.

Fed Chair Jerome Powell handed out a few nuggets of information during his post-vote press conference. He noted that forecasts are highly uncertain, and suggested that compared to December, the signs of weaker growth, which would lead to Fed easing, were balanced out by higher inflation, which would lead to Fed tightening. The net effect was that the Fed rate cut projections remained unchanged, with two 25bp cuts anticipated for 2025.

Powell also suggested that tariffs had led to increased inflation expectations in the short run, but that the Fed was in a good position to react to future data—while hard data has been strong, survey data has shown more uncertainty and concern. At this point the Fed appears to be in wait-and-see mode, as it digests the impact of Trump policy on the economy. As of this writing markets expect the Fed to leave rates unchanged again in May, with June as a likely date for a 25 point cut.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back