By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

A Few Perspectives on Debt

The Biden Administration has proposed an additional $1.9 trillion in spending on a COVID relief package, and unsurprisingly, many Republicans are balking at the price tag.

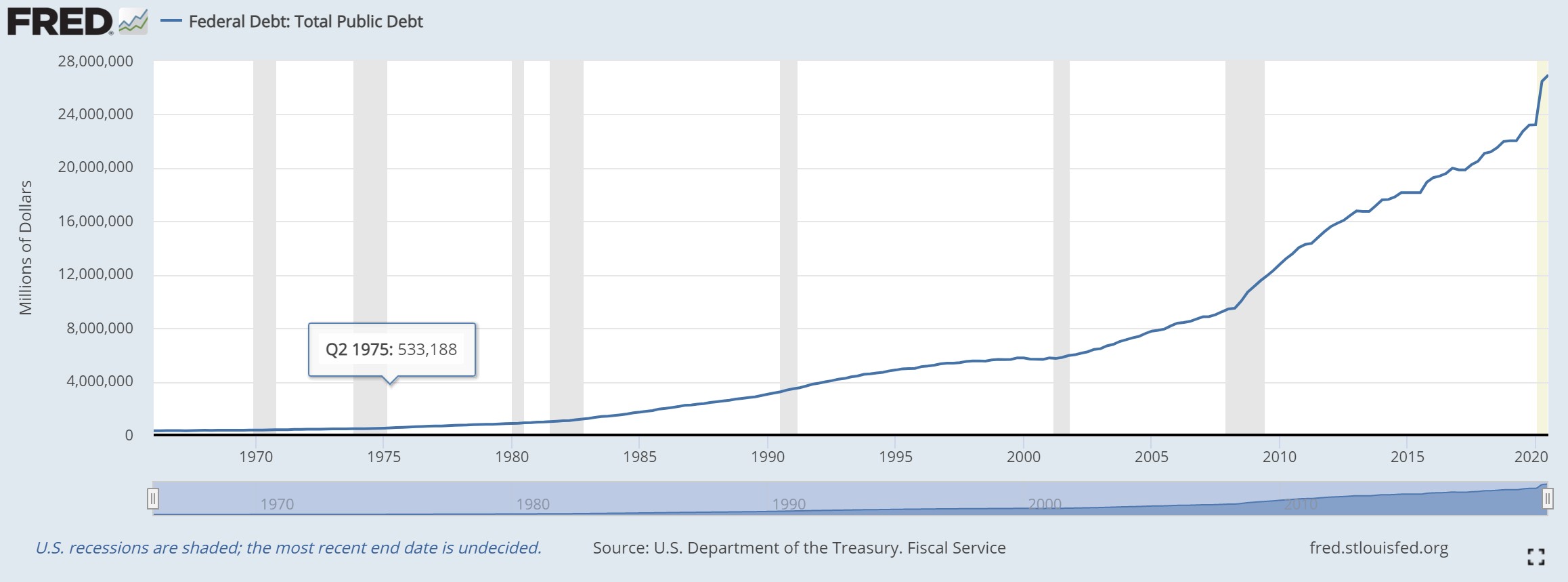

The graph above shows why. Total Public Debt has risen steadily over time, then grew more sharply after the 2008 financial crisis, slowed a little bit during the late Obama years, sped up a bit after the Trump tax cuts, then spiked again with 2020 Covid relief. But while $27 trillion dollars is a scary number, it lacks perspective; it would be helpful to understand the size of the debt relative to the size of the economy.

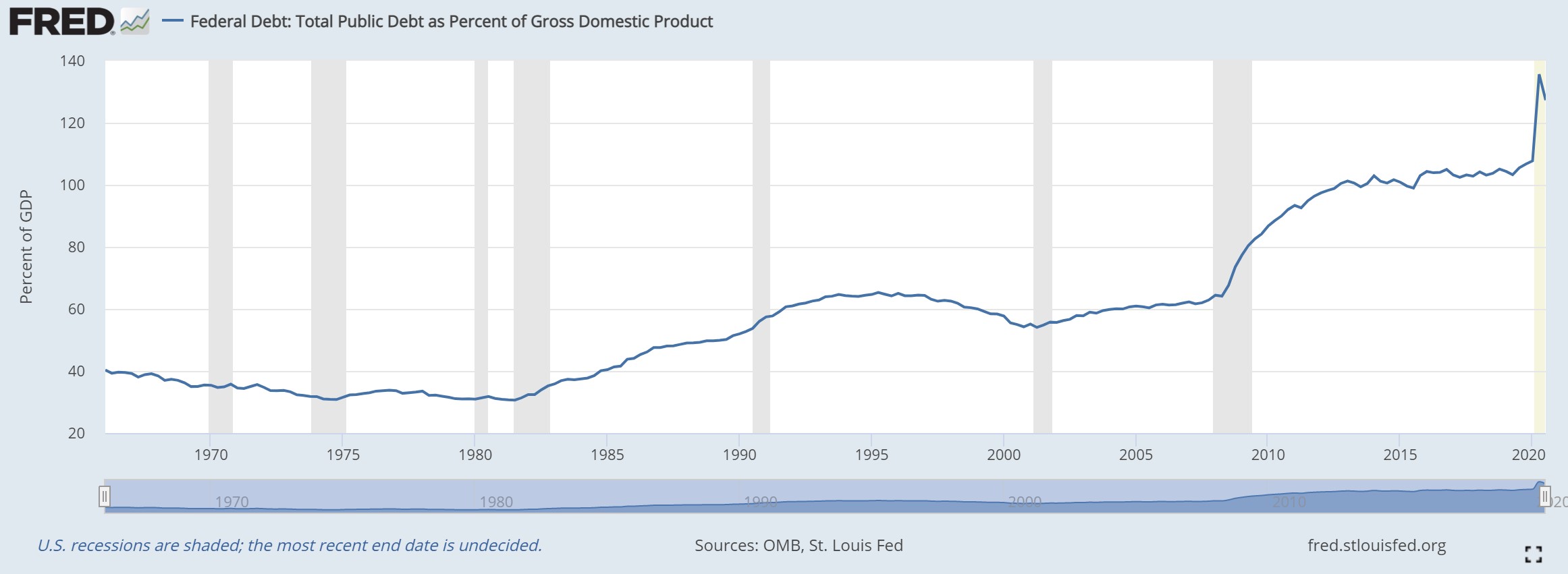

From this picture, we can see Debt per GDP rose during the Reagan years, stayed roughly steady after the Clinton and Bush years, then rose sharply again with the financial crisis, flattened out for the next several years, and surged again with coronavirus relief. Considering the Debt/GDP ratio rose from about 30% of GDP during the early 1980s to 100% of GDP pre-COVD, while inflation fell steadily over those years, the economy may be more tolerant of debt than many fear.

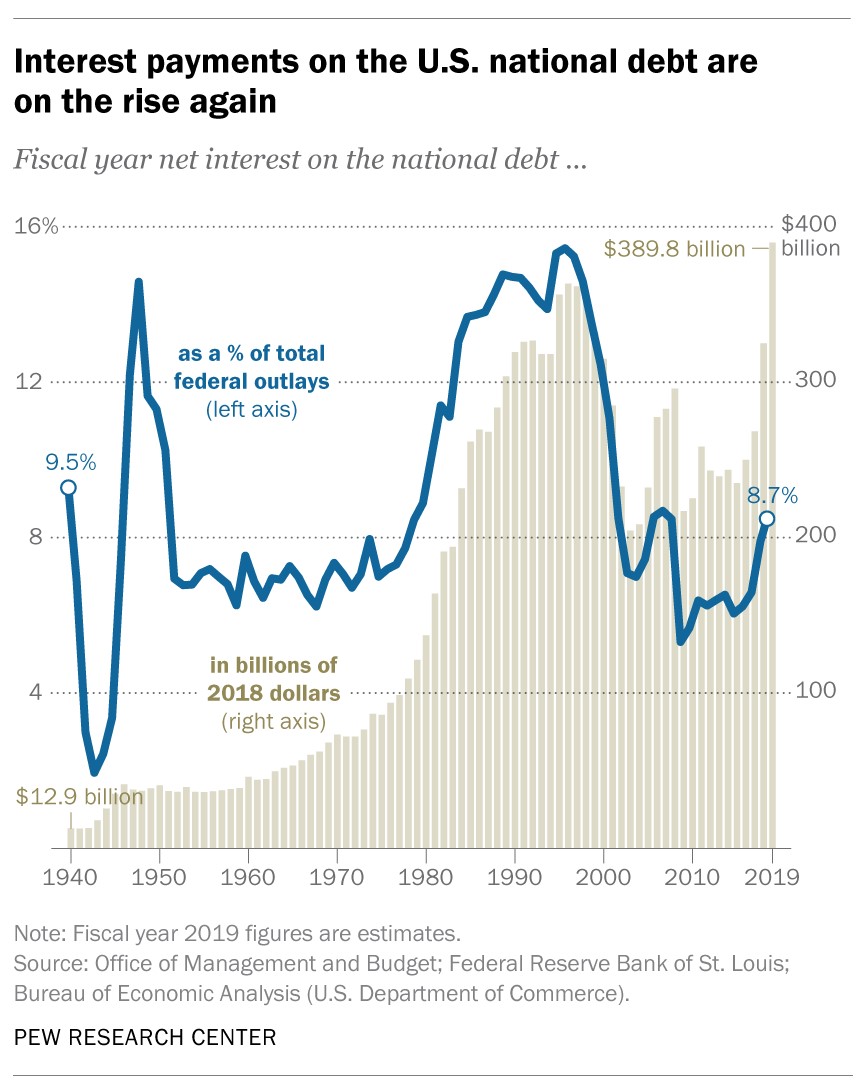

For a perspective why, we add a third graph, from Pew Research at https://www.pewresearch.org/fact-tank/2019/07/24/facts-about-the-national-debt/

Because interest rates have plummeted over the last 40 years, US debt was able to grow dramatically without increasing the relative share of interest payments. The above graph ends at 2019, and interest payments have risen since then, but we have a lot of room to run to get to Reagan-level interest costs.

Of course, we’re assuming interest rates remain low. Market expectations are for continued low interest rates, but if rates do rise, the debt will become an increasing problem. So why take the risk? What’s the economic benefit of increased spending? One answer comes in one last chart:

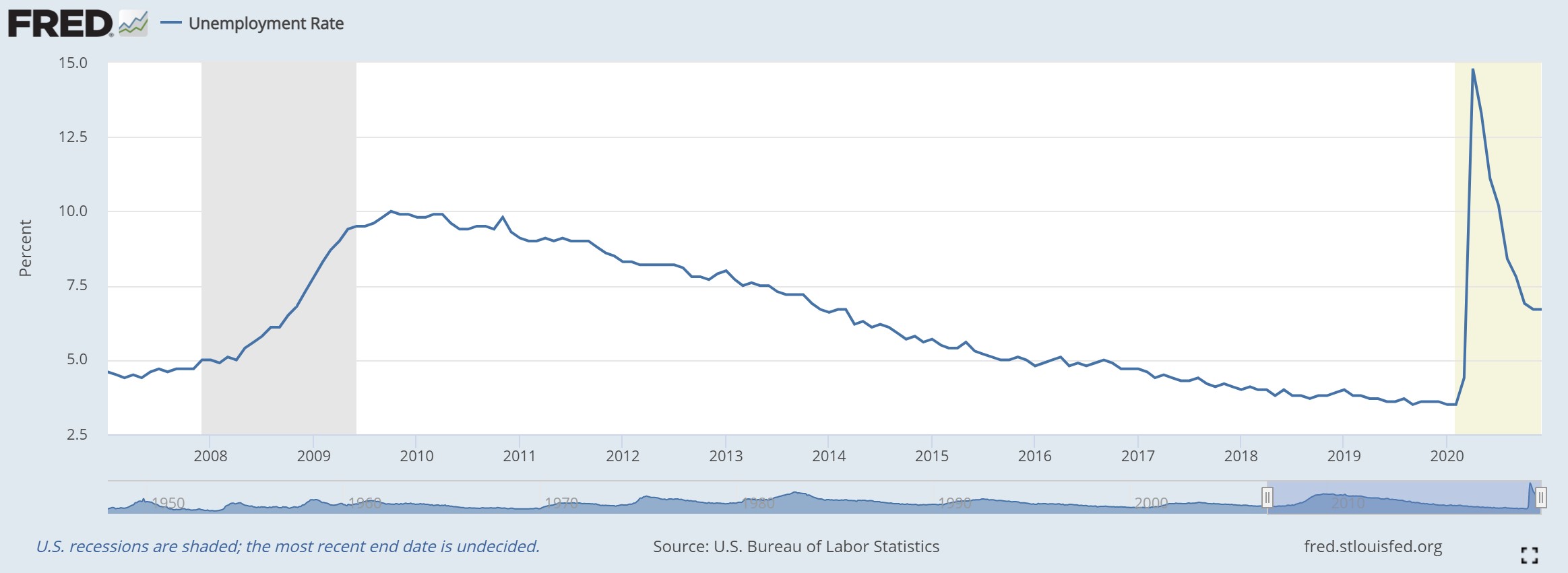

The US entered the financial crisis in 2008 with 5% unemployment. After the recession unemployment peaked at about 10% in 2009, then took 7 years to fall back to its pre-recession levels. Moreover, President Trump did his own experiment in deficit spending with his tax cut package. The deficit rose, but interest rates remained low, inflation remained low, unemployment fell to 3.5%, and wages increased in a tight labor market. The US economy showed the ability to be run “hot” without negative repercussions.

With unemployment at 6.7%, President Biden and Treasury Secretary nominee Janet Yellen would like to get the economy back to where it was pre-COVID. As Yellen stated in her opening statement (found at https://www.finance.senate.gov/imo/media/doc/JLY%20opening%20testimony%20%20(1).pdf) to the Senate Finance Committee: “Neither the President-elect, nor I, propose this relief package without an appreciation for the country’s debt burden. But right now, with interest rates at historic lows, the smartest thing we can do is act big. In the long run, I believe the benefits will far outweigh the costs, especially if we care about helping people who have been struggling for a very long time.”

President Biden’s COVID relief package comes with the likely economic benefit of helping those in need, but the uncertain costs of worsening the US debt situation. If Biden is able to shepherd this aid through Congress, we hope that his and Yellen’s judgment is correct that this additional spending will be a net plus for the US economy in the long run.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back