By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

A Soft Close

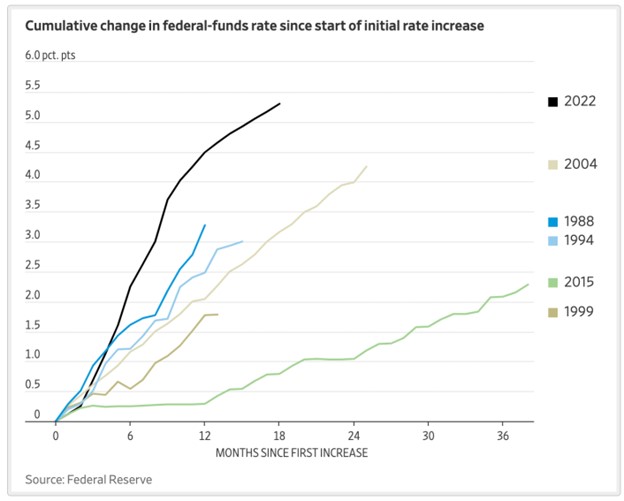

The last two years have brought the challenge of rapidly rising interest rates. Mortgage rates have skyrocketed, and the bond market, which cratered in 2022, remains a long way from recovering its losses. Markets and the Fed expect multiple rate cuts in 2024, which would partially reverse the record-setting pace of rate hikes we’ve witnessed:

The spike in interest rates has been subsequently accompanied by a fall in inflation. While many measures of inflation remain elevated, we are starting to see some numbers hitting the Fed’s 2% inflation target, with the core personal consumption expenditures price index showing just a 1.9% increase over the past 6 months.

As Jordan Weissmann notes, even if the US does manage a soft landing, achieving the 2% inflation target without provoking a recession, debate and analysis will continue as to why. Are the Fed’s rate hikes and hawkish stance primarily responsible, or would inflation have come down naturally, as pandemic-induced supply chain snarls untangled over time? If the Fed’s action were overkill, there would likely be greater scope to reduce rates quickly in the coming years than if the Fed’s rate increases were essential.

In any event, the US economy has so far defied the predictions of economists, 85% of whom forecasted a 2023 recession in a poll taken last year. Markets have probably priced in the improving economic news, as the S&P 500 is up nearly 25% for the year. We hope that the economic soft landing comes to fruition, and that benign conditions prevail, as we wish you and yours a happy, healthy, and prosperous 2024.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back