By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Checking in on Inflation

More on Energy’s Future

This spring we discussed JP Morgan’s annual energy report, which sounded a note of skepticism regarding how quickly we can expect to transition away from fossil fuels into cleaner sources of energy. Bloomberg’s New Energy Outlook takes a different tack, at https://about.bnef.com/new-energy-outlook/, as it assesses the changes required for the world to meet the Paris agreement and attain net zero emissions by 2050.

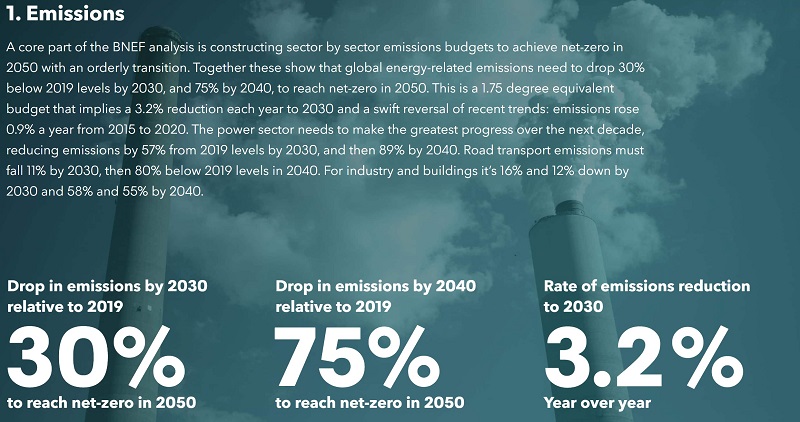

The degree of change required in the next 30 years would be massive:

Source: Bloomberg

Source: Bloomberg

As noted, emissions rose 0.9% per year from 2015 to 2020, so reducing emissions by 3.2% per year until 2030 would be challenging, to say the least. Most of these initial emissions reductions would need to come from the power sector, as addressing transport, industry, and buildings emissions is presumably a more difficult task given the tools and technologies at hand.

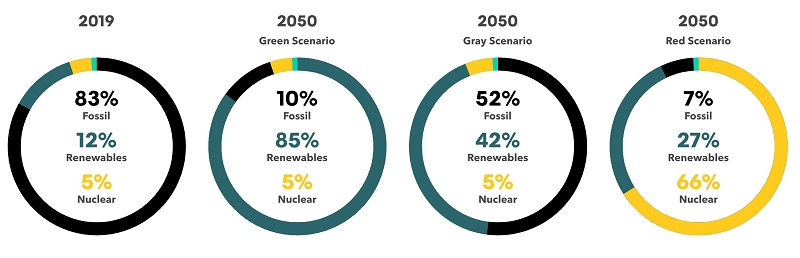

The New Energy Outlook describes 3 scenarios under which net zero emissions can be achieved by 2050:

Source: Bloomberg

Source: Bloomberg

All 3 scenarios are sizable transitions from fossil fuels. The middle scenario assumes widespread implementation of carbon capture and storage technologies, and even in that case, fossil fuels shrink from 83% to 52% of primary energy. The green and red scenarios would require fossil fuel use to shrink down to no more than 10% of primary energy within the next 30 years. The red scenario accomplishes that goal through a vast expansion of nuclear power, and the green scenario through wind and solar comprising 70% of primary energy (split 62%-38% for wind and solar).

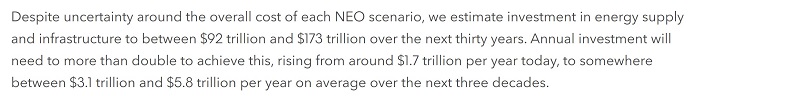

Needless to say, net zero emissions by 2050 would require a substantial increase in energy supply and infrastructure investment:

Source: Bloomberg

Source: Bloomberg

Doubling or tripling energy supply and infrastructure outlays, with a shift to funding renewables, would be a highly ambitious project. JPMorgan’s report argues that changes in methods of energy production accrue slowly, and if that report is correct, it is difficult to see how we could approach the ambitious targets outlined by Bloomberg. However, we are likely to get a real world test of energy infrastructure this fall. Democrats are seeking to pass a reconciliation bill with significant infrastructure investment; if such a bill passes, it may include funding for some combination of wind, solar, heat pumps, electric vehicle credits, and carbon capture and storage technologies. The level of funding for clean energy projects may provide a clue as to whether the US and the world can plausibly transcend the traditional limitations on energy transformation cited in the JPMorgan report.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back