By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Don’t Expect Interest Rates to “Normalize” Anytime Soon

Photo by Nigel Tadyanehondo on Unsplash

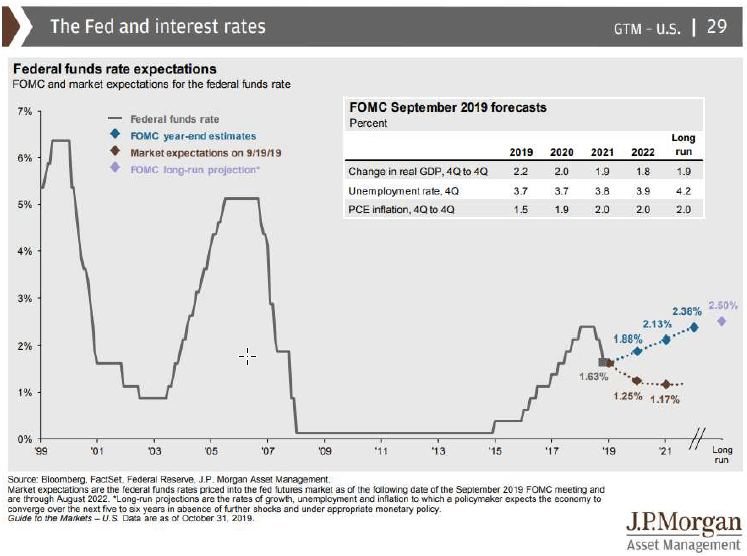

JP Morgan produces a fine market summary every quarter, and this chart on the path of interest rates caught our attention1:

Interest rates have fallen a lot in the past 20 years, and also fell a lot in the preceding 20 years. So the natural expectation for those of us who believe in relative value and the cyclical nature of markets would be for rates to rise back to a more “normal” level. And though the Fed appears to believe this too, as the FOMC year-end estimates project interest rates to rise 75bp in the next 2 years, markets aren’t buying it, as they foresee a further decline in the fed funds rate, to 1.17%.

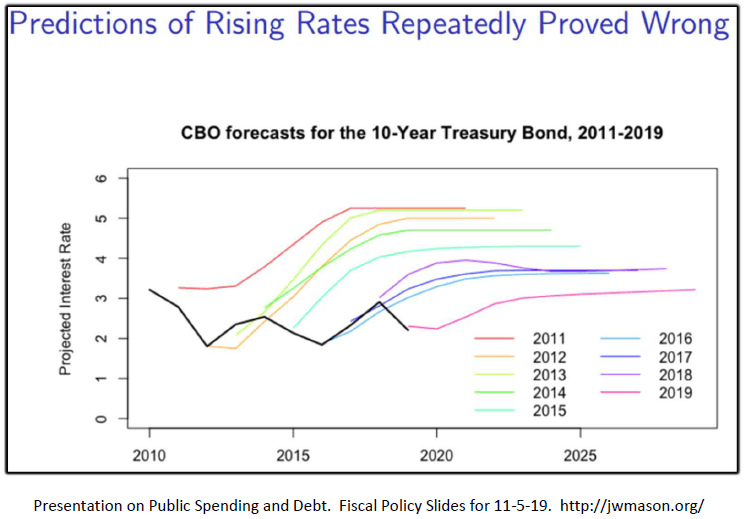

Governmental agencies projecting rate normalization isn’t a new phenomenon. The black line in the chart below indicates the actual path of interest rates over the past decade2,3. The other lines (red, green, orange, etc.) are projections of the path of the 10-year Treasury Bond, encompassing forecasts from 2010-2019. The obvious takeaway is that even though the predicted rates keep getting lower and lower, they still in nearly every case overestimate the path of interest rates.

There are various theories as to why interest rates remain persistently low—a global savings glut, a lack of good investment opportunities, demographic aging in developed nations, lower inflation expectations, quantitative easing programs by central banks, etc.—but whatever the reason, or combination of reasons, it does appear that the natural rate of interest has dropped steadily over recent decades.

Even understandable concerns about rising US budget deficits don’t appear to be coming to fruition. Japan’s experience suggests that concerns about government debt may be overblown, as government debt has grown much more sharply in Japan without spurring a spike in interest rates or a debt crisis4. In fact, some prominent economists are encouraging even more fiscal stimulus, despite the Japanese debt to GDP ratio being more than double that of the US5.

For those of us who remember the stagflation and double digit interest rates of the late 1970s and early 1980s, it’s understandable that we’re wary of the specter of inflation and harsh, corrective interest rate hikes. But as more time has passed it looks more and more like that period, and not our current one, was the aberration. While it is important to remain vigilant, the balance of current evidence suggests that low interest rates are likely to be with us for quite some time.

Sources

- https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_4Q19.pdf

- https://twitter.com/adam_tooze/status/1192411376100229121

- http://jwmason.org/wp-content/uploads/2019/11/slide-for-11-5-19.pdf

- https://www.marketwatch.com/story/heres-a-lesson-from-japan-about-the-threat-of-a-us-debt-crisis-2018-05-14

- https://www.piie.com/commentary/op-eds/rethinking-fiscal-policy-japan

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

‹ Back