By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

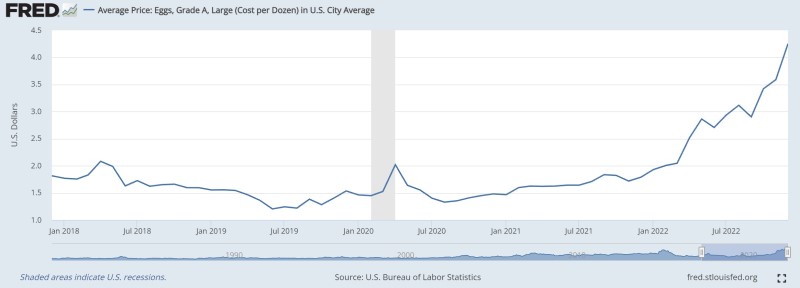

Eggflation

Egg prices have risen dramatically over the past year:

Jeanna Smialek and Ana Swanson provide a terrific overview of the moving parts that have come together to both raise the price of eggs and raise the demand for and price of chicks. The pandemic shifted consumption from services to goods, as more people stayed at home. Stimulus checks meant more people had more money to spend. Russia’s invasion of Ukraine raised energy prices and reduced grain production, resulting in higher costs for fuel, fertilizer, and feed. Finally, bird flu has resulted in the deaths of over 52 million animals, leading to a reduced egg supply.

Smialek and Swanson note that as egg prices rose, interest in raising egg-laying chicks surged. But as demand for chicks rose, prices rose as well. The supply of chicks can increase over time, but is also constrained by the tight labor market, so in order to induce more people to work at hatcheries, employers are offering higher wages. The authors also cite a hatchery owner who is offering higher wages in part to offset higher inflation, and observe that such behavior, if exhibited economy-wide, could entrench higher inflation by embedding it into wage negotiations.

If an egg supply shock is an isolated development, it’s unlikely to capture the Fed’s attention. However, if egg price inflation and production problems are representative of an economy that has experienced widespread disruption due to a series of shocks, starting with a global pandemic, then the Fed may no longer be able to downplay such shocks as transitory, instead using its primary tool—raising the federal funds rate—to cool consumer demand. If inflation expectations remain low, supply issues resolve over time (which should also help reduce inflation), and additional economic shocks are of modest impact, we may yet continue to reduce inflation without triggering a recession.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back