By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Inflation and Interest Rates

After the yield curve flattened in 2020, with the US 10 year rate falling to under 0.6% and the 30 year rate briefly slipping to under 1%, we’ve started to see significant renormalization in 2021. With the combination of effective COVID vaccines, dovish global monetary policy, and expansionary fiscal policy (especially in the US), we have seen the 10 year rate rise to 1.4% and the 30 year rate to over 2%.

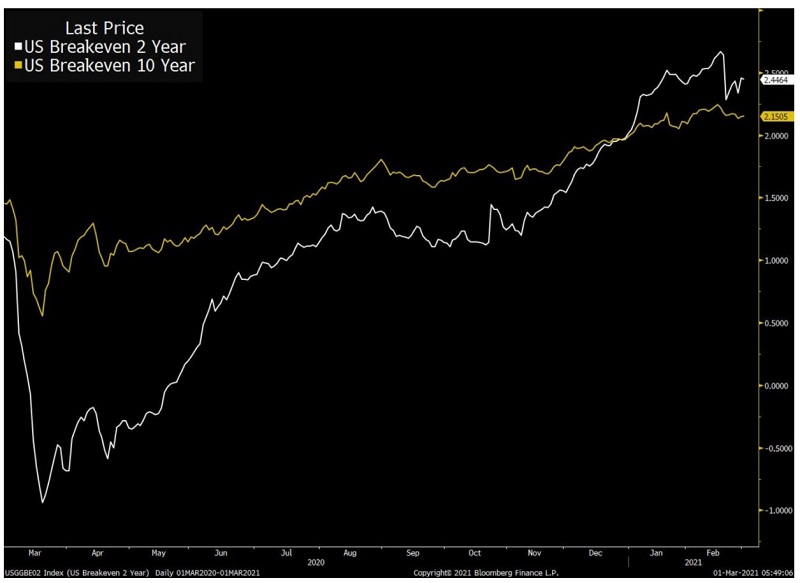

Does the combination of stimulative monetary and fiscal policy mean that inflation is likely to increase? Markets appear to think so:

Considering the Fed has a 2% inflation target, which it has fallen short of for years, and that the Fed has given guidance that it will tolerate inflation above 2% while employment recovers, it is hardly surprising that markets are taking Fed Chair Jerome Powell at his word. But even running the economy hot currently has markets anticipating a temporary spike that’s still under 2.5%, before settling over the next decade at 2.15%.

Former Fed Vice Chairman Bill Dudley expresses a similar view at https://www.bloomberg.com/opinion/articles/2021-02-23/four-reasons-not-to-worry-about-u-s-inflation?srnd=premium&sref=qzusa8bC , writing that even though in his view an inflation surprise is plausible, inflation is not likely to run rampant.

Dudley’s argument echoes the breakeven chart in that Dudley believes an inflation spike would be largely temporary in nature, as pent-up pandemic demand leads to a rise in prices over the next year or two. Moreover, the economy has enough employment slack to soak up significant stimulus, and much of the fiscal package Congress is likely to pass is temporary in nature.

According to Dudley, inflation expectations are sufficiently low and well-anchored to prevent a rapid rise in inflation. Moreover, if there is unexpected acceleration in inflation, or when the Fed believes the economy has achieved full employment, the Fed always has the option of raising short-term interest rates to limit inflation growth. If and when tightening occurs, markets will then face additional challenges from a rising rate environment, though the Fed will at least have more ammunition to fight any future recessions. So, while the recent jump in interest rates has applied pressure to both longer dated bonds and risk assets, inflation expectations appear manageable for now.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back