By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Inflation vs Wages

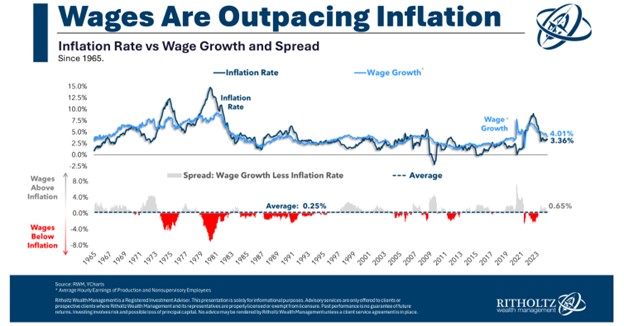

Ben Carlson reviews the history of inflation and wages. Not surprisingly, these markers tend to move hand in hand, though it’s hard to tell to what extent inflation drives wage increases, or wage increases drive inflation, or both. Carlson provides a graph relating year-over-year wage growth to twelve-month inflation:

Not surprisingly, wage growth typically outpaces inflation, with notable exceptions. The high-inflation 1970s saw inflation running well ahead of wage growth, and even through the mid 1990s the inflation rate typically remained higher than wage growth.

The inflation spike from 2021-2022 doesn’t stand out that much in terms of impact on real (inflation-adjusted) wages. Wage growth definitely fell behind the inflation rate, but the gap is closer to the shortfall in the late 1980s or early 1990s, or the early 2010s, than it is to the 1970s. Moreover, as Carlson notes, wages have run ahead of inflation for the last fourteen months, so it appears wages have, on average, more than caught up with inflation.

Why then have economic sentiment numbers been so poor? Carlson plausibly suggests a psychological explanation—that inflation triggers loss aversion, with the pain of higher food prices, gas prices, and mortgage rates having a more powerful impact than whatever relief is provided in the form of higher wages. Or, as Carlson describes it, that “people see higher wages as something they earned while higher prices are a form of theft.” Even if inflation nears the Fed’s 2% target in the coming months, it will take time for people to become accustomed to higher price levels. And even further down the road, we may in a few decades look back nostalgically and lament how cheap everything was in 2024.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back