By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Let's Get Trendy!

People inherently participate in trends whether they know it or not. You’ve inevitably moved to buy the latest and greatest technology like a wearable fitness tracker or the newest fashion movement such as (at the time) bellbottom jeans or UGG boots. Perhaps your kids picked up “dabbing” from Cam Newton or followed the 2012 craze and learned the Gangnam Style dance. Trends may come and go; however, they remain around us all the time. But have you ever stopped to think; is there a way for me to make money off any given trend? Well, we have!

Managed futures is an alternative investment category whose managers utilize trend-following strategies. These trend-following strategies may also be thought of as time series momentum strategies, in that they go long on a market that has experienced a positive excess return over a previous time horizon, and short for a negative excess return. Time horizons can vary in length, from weeks to months to even a year or more. These time series momentum strategies are generally implemented across a broad class of domestic and worldwide markets, encompassing stocks, bonds, currencies, commodities and interest rates.

Why should such strategies work? How do markets exhibit trends that can be capitalized on by savvy investors? To answer this question, we first need to describe the life cycle of a typical trend. Initially, there is some catalyst—a positive earnings report, or a demand or supply shock—that causes the valuation of an investment to change. The change in the underlying value is immediate; however, market prices initially don’t fully capture that differential as they tend to underreact to investment news. The reasons for this underreaction stem from both ingrained human behavior and entrenched institutional behavior. On the individual side, behavioral economics has demonstrated that people tend to anchor their views on historical data and adjust insufficiently when new

information becomes available. Moreover, investors tend to sell winners early to realize gains (which mitigates upward price pressure), and hang on to losers to avoid accepting losses (which mitigates downward price pressure). On the institutional side, central banks reduce exchange rate and interest rate volatility, potentially slowing price adjustments. Institutional investors who frequently rebalance also slow adjustments to trends—for instance, a 60/40 (stocks/bonds) investor will sell stocks and buy bonds whenever stocks have outperformed.

Yet, even though prices tend to be slow to adjust initially, price momentum often means that over time prices will over adjust as they overshoot their fundamental valuations. Reasons for this overshooting include herding behavior, as investors flock to what’s hot; confirmation bias, as investors feel more comfortable in investing in assets that have recently made money; and fund flows, as investors pull money from underperforming managers and shower it on overperforming ones. Eventually, though, prices will ultimately settle in line with fundamental values; in the interim, however, there are financial opportunities.

So, markets have had a historical tendency to maintain price momentum, whether it be from good to great, or bad to worse. This price momentum has led to strong performance from managed futures strategies. In the 2015 book Efficiently Inefficient, author Lasse Pedersen of AQR summarized an analysis of time series momentum investing strategies with respect to 58 highly liquid futures markets from 1985 to 2012. With a 10% volatility target, each asset class—commodities, equities, fixed income, and currencies—had an annualized alpha ranging from 6.8% to 12.1%, with associated Sharpe ratios (a measure of risk-adjusted returns) ranging from 0.78 to 1.05. When a diversified time series momentum strategy across all four of these asset classes was tested, annualized alpha rose to 17.4%, with an astonishing Sharpe ratio of 1.79. With high alpha, high Sharpe ratios, moderate volatility, and low correlations with equity markets, managed futures showed it could be both a great diversifier and a powerhouse performer. (Note: these numbers are gross of performance fees and transaction costs)

Recent history, however, has been less kind. The annualized return from AQR’s managed futures fund (AQMIX) over its seven year history has been a paltry 0.98%. AQR isn’t an outlier—in fact, it has been above average relative to Morningstar’s Managed Futures category. While a tepid seven year run isn’t all that anomalous—AQR estimated that such a stretch has about a 15% probability of occurring—it does raise the question as to whether markets have fundamentally changed in a way that is detrimental for trend following. For instance, algorithmic trading may have mitigated some of the behavioral biases that had previously enabled trend following to perform so well.

We discussed this issue with AQR, and AQR has done extensive research on this subject. They found that very short-term signals have shown a decline in efficacy, but that trends on all other signal lengths have not fundamentally changed. We’ll continue to monitor managed futures carefully, but at this time we would perceive seven tepid years as being more than counterbalanced by the previous 28 outstanding ones.

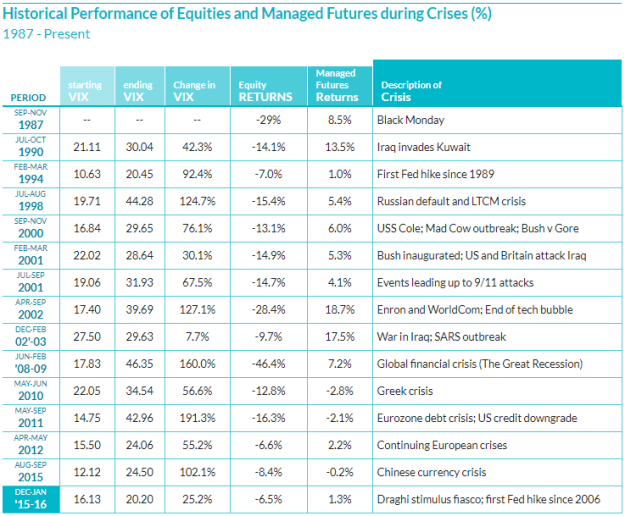

With respect to your portfolio, managed futures offers three significant benefits. First, managed futures is an excellent diversifier—it has very low long-run correlation with stocks, bonds, commodities, or currencies. Second, managed futures has historically provided excellent protection against equity drawdowns, as shown in the table above.

In fact, managed futures is known for exhibiting a “smile curve” return pattern, in which returns have generally been at their best either when domestic equities were performing very well, or performing very poorly. As the table above shows, an equity downturn does not guarantee managed futures will boost your portfolio—in fact, at this time a sudden sharp downturn (as in 1987’s Black Monday) will likely cause an initial drop in the equities aspect of a managed futures position. As well it should—the basic math of an uncorrelated investment means that when markets move in one direction, the uncorrelated investment could move in any direction, as in the long run it has very low beta--it is not tied down to the performance of underlying asset classes. In short, the low beta of managed futures (relative to stocks) means significant downside protection in the event of an equities correction, and if the smile curve proves to be robust, then trend following would be even more valuable, as it would represent a critical hedge, especially against deep and sustained drawdowns.

Third, recent history notwithstanding, managed futures has historically provided excellent returns, and, since it is now available as a liquid mutual fund, it provides hedge fund strategies at a cost much lower than the traditional 2 and 20 hedge fund model (2% management fee plus 20% of profits).

Trend following, while intuitive in principle, certainly marches to the beat of its own drum. Most investment philosophies rely on a set of concrete expectations of the future. For instance, you may avoid bonds because you expect the Fed to raise interest rates, or you may invest in Tesla because you expect consumer and government support of electric vehicles to rise. What's remarkable about managed futures is how agnostic it is—you may still invest in Tesla, but it's not out of a personal belief in the stock—it's because your model indicates that its current momentum is likely to be sustained for awhile. And though it's true that trends can come and go, we believe that managed futures is here to stay, because ultimately, a diversified portfolio is an essential protection from a bear market, and maintaining an uncorrelated investment such as managed futures may prove to be a trend worth following.

— JMS Team

Sources:

1. https://equinoxfunds.com/insights/crisis-alpha

Disclosure:

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

‹ Back