By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

On Unemployment

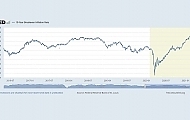

The jobs report released last Friday contained unexpectedly bad news. Normally a gain of 266,000 jobs would be a strong month, but when economists are expecting a million added jobs, the shortfall is unexpectedly large. With weekly jobless claims declining and consumer confidence high, what explains the weak job growth?

Not surprisingly, the most prominent explanations have been proffered along partisan lines. Republicans have blamed overly generous unemployment compensation, while President Biden has cited the need for further infrastructure spending and family support. In truth, there is some evidence for both positions—hours worked and wages rose, suggesting employers tried to squeeze more out of current workers during a labor shortage, while women’s employment actually fell, perhaps because of a lack of available childcare and in-person school options due to the pandemic.

Several other factors could be affecting employment numbers as well. Supply chain issues have abounded in areas such as lumber, steel, and semiconductors. Until these issues are resolved, manufacturing employment may lag even as demand for manufactured goods is strong. Seasonal adjustment issues may also be occurring—the Bureau of Labor Statistics adjusts numbers to put them in proper context (for instance, we shouldn’t take the annual pre-Christmas temporary hiring boom as a sign of an overheating labor market), but there’s no guidebook that tells us how we should expect the labor market to recover from a receding pandemic.

Finally, the labor market itself has undergone major transitions over the past year, with remote work and delivery services increasing but in-person work and hospitality/leisure sectors declining. Labor markets may simply be taking more time than expected to transition closer to a pre-pandemic economy.

In the end, many of the issues that may be affecting employment now should recede over the coming months. Expanded unemployment insurance is set to expire in September, childcare options and schools are increasingly returning to normal, and labor markets are adjusting to a world in which COVID-19 is a declining threat. At this point it probably makes sense not to overreact to a single poor jobs report, but to wait for future data before reassessing the economic recovery.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back