By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Potential Economic Recovery in 2021

The last time the United States elected a new president during a crisis, in 2008, the recovery was a painful and protracted one. Despite what at the time was a record-setting stimulus, unemployment remained stubbornly persistent for years. Further aid became more difficult after Republicans took the House of Representatives in 2010 and cited concerns about the federal deficit.

Now, President Trump’s litigation notwithstanding, it appears likely that Joe Biden will assume the Presidency in January of next year. It is also likely that Republicans will hold the Senate, meaning that once again divided government will be in place. Given how polarized the country is, it may be challenging to reach an agreement on additional stimulus, whether during the waning days of the Trump administration or the early days of the Biden one. So is history about to repeat itself? Is the economy doomed to a sluggish recovery over the next 4 years?

Even with the prospect of political cooperation being tenuous, we believe the economy is positioned for a stronger bounceback than it was following the financial crisis of 2008.

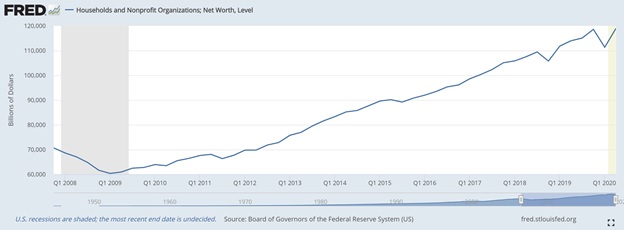

As the graph above demonstrates, household balance sheets slumped badly during the 2008 financial crisis, and didn’t recover to their pre-recession level until 2012. During the 2020 recession, household balance sheets recovered by April 1st (and have likely improved since then—the most recent update is as of April 1st).

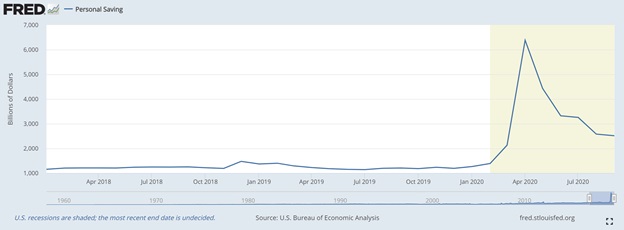

The means of this recovery? Unprecedented fiscal and monetary support that have boosted markets and personal savings:

So while economic growth looks like it’s slowing for now with the resurgence of coronavirus across the country, we are well positioned for a strong recovery with a great deal of pent-up demand. With 3 COVID-19 vaccines now appearing effective, and the Fed pledging to keep interest rates low even if inflation overshoots its 2% target, the US economy, despite a challenging winter ahead, may be poised to regain strength later in 2021.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Pfizer (PFE) is owned in some JMS client portfolios. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back