By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Private Equity Investing Considerations

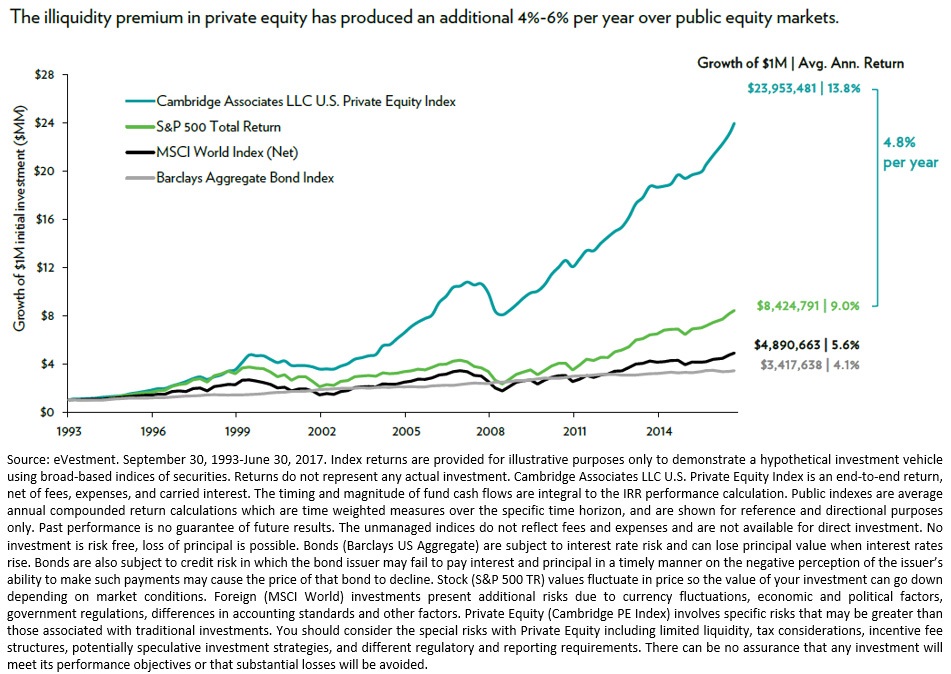

Investor demand for private investments continues to grow. According to Preqin, a global leader in alternative assets data, 921 private equity funds that closed during 2017 raised a total of $453 billion, the largest amount ever raised in a given year. Additionally, 95% of investors felt that their private equity investments met or exceeded their expectations in 2017, and 53% of investors plan to increase their allocation to private equity over the longer term, a record proportion1. It’s no wonder why when you look at the performance of the asset class over the prior 20+ years.

In the past, we have had several concerns that made us hesitant to give private equity our full endorsement. A prohibitive challenge was there was no simple way to access private equity—the minimum starting investment was $1 million dollars or more, and diversification meant an investor’s net worth should be in the tens of millions. Beyond funding, there were several other challenges which would have given us pause even if access had been easier:

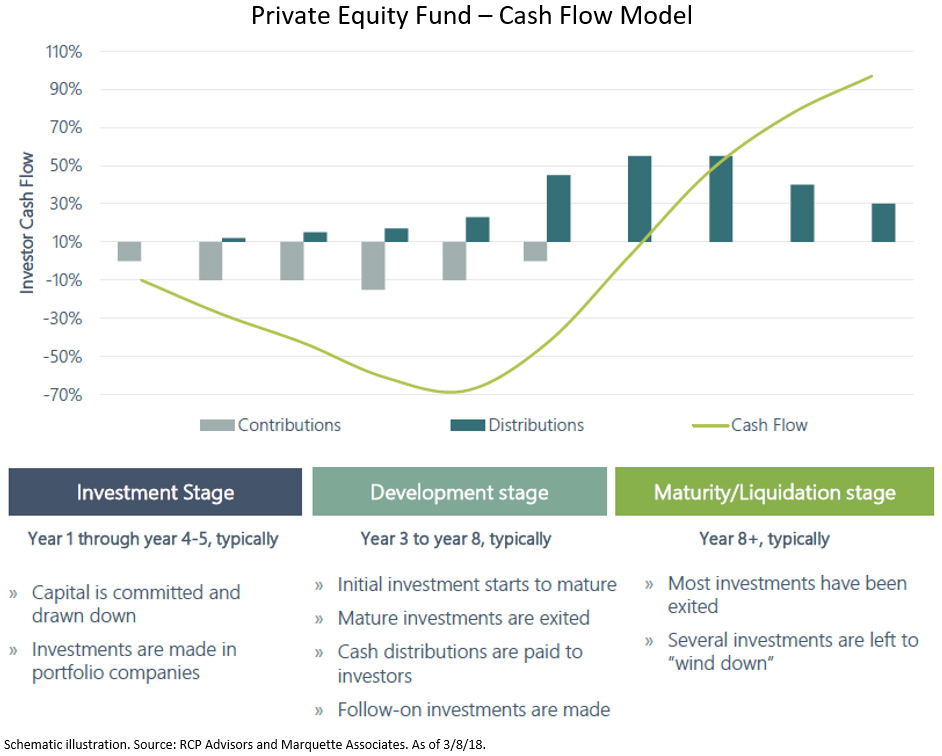

- Private equity funds typically don’t take your entire commitment at once right at the beginning of the fund, but instead they issue capital calls periodically as they find investments to make. This usually occurs over a period of several years, and it means that although you committed a million dollars, for example, you may only invest $200,000 in the first year of the fund’s life and have that additional $800,000 still looming as a commitment that you have to be able to contribute, likely in several different chunks on relatively short notice (typically a month or so). This means you can’t invest that committed amount in other illiquid assets. Depending on your risk tolerance and other sources of liquidity, you may prefer to hold that in very conservative assets like cash or short-duration high-quality bonds, so that your $800,000 that’s ticketed for private equity doesn’t turn into $600,000 while you’re waiting.

- Incidentally, this also reduces the total return of that $1 million investment since you’re likely being more conservative with a portion of it than you would otherwise be. That opportunity cost doesn’t show up in the stated returns of private equity funds. The returns (internal rate of return or IRR) they report are on contributed capital, so while they’re mathematically correct, they leave out the fact that you may have had to hold cash or other low-returning assets while waiting to get fully invested. (It could work the other way of course, with cash outperforming whatever else you might have done with the money, but over time, markets tend to go up, so on average, it will be a long-term drag relative to being fully invested.) That’s why it’s important to look at the multiple of capital return in addition to the IRR. A 30% IRR sounds great, but if it results in a 1.2x multiple of capital on money that you set aside for an illiquid, higher-returning investment, it’s not as great.

- You need to be able to identify and access above-average private equity managers. This can be challenging even for relatively large institutions, to say nothing of the challenges for high-net-worth individual clients. The return dispersion between the best and worst private equity and venture capital mangers over long periods is massive relative to the differences between public equity managers (which can still be significant). The best, most sought after managers are typically capacity-limited, and they usually give some preference to investors in their previous fund(s). Even if these funds have capacity, individual investors are unlikely to gain meaningful access to the senior managers, assuming they can even meet the minimum investment size, which makes due diligence very difficult. This doesn’t even take into account the challenge of tracking and researching new private equity managers who might be leaving larger shops to start their own smaller firms. Selectivity and access to top-tier managers is more important than ever due to the increase in capital targeting private equity and the significantly higher valuations being paid for target companies over the last several years compared to both the early years of the industry and in the wake of the financial crisis.

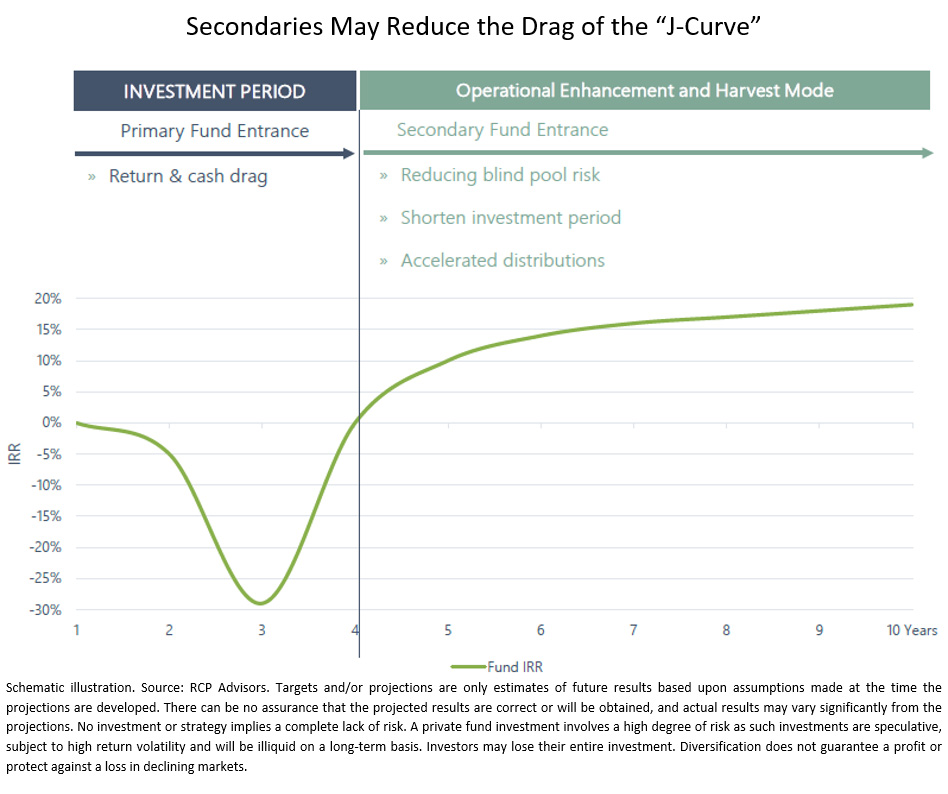

- Investments in private equity typically start with a good deal of pain before the returns are seen. During the first year a client may commit $1 million, have $200,000 called, pay 2% in management fees (on all of the $1 million), but not yet see any returns come in. The net return at the end of year one: -10%, as $20,000 in fees has been paid while only $200,000 has been invested. To be sure, in the long run private equity historically has done well for clients, but this J-curve effect—seeing your investment dip for awhile before returns take off—can be an unpleasant experience for clients.

The next chart offers another illustration of the J-curve. Note that steady capital calls and meager distributions mean that cash flow could be negative for about 4-6 years in a typical private equity investment.

Private equity has traditionally had lengthy lock-up periods—commonly 8-12 years but potentially even much longer—and illiquidity of this duration can certainly be worrisome, as life changes can create unexpected needs for capital. We acknowledge that by its nature, private equity is illiquid, and investors have historically been compensated for this illiquidity with higher returns; ideally, however, the length and degree of lock-ups would be somewhat lessened.

Private equity has usually meant high fees—typically 2% management fee, plus 20% of profits. High fees exacerbate the J-curve, and makes manager selection that much more critical. As with illiquidity, significant fees are likely endemic to private equity—skilled management will always be well compensated—but lower fees are certainly better for your portfolio than higher ones.

With all that said, we understand that there are many potential benefits from investing in private equity. Investors have access to a much wider scope of investment opportunities by including private companies. According to a 2017 study from Credit Suisse, the number of publicly listed U.S. companies dropped by almost 50% from 1996 to 2016! There are obviously a number of reasons for these that we won’t get into here, but if you believe that skilled managers can add value, you would rather have access to a greater opportunity set from which they can select. Anecdotally, many commentators have observed that in recent years the majority of game-changing innovation and growth has come from private-market companies, while larger, more established public companies have been content (in many cases reasonably so) to buy back stock and cut costs.

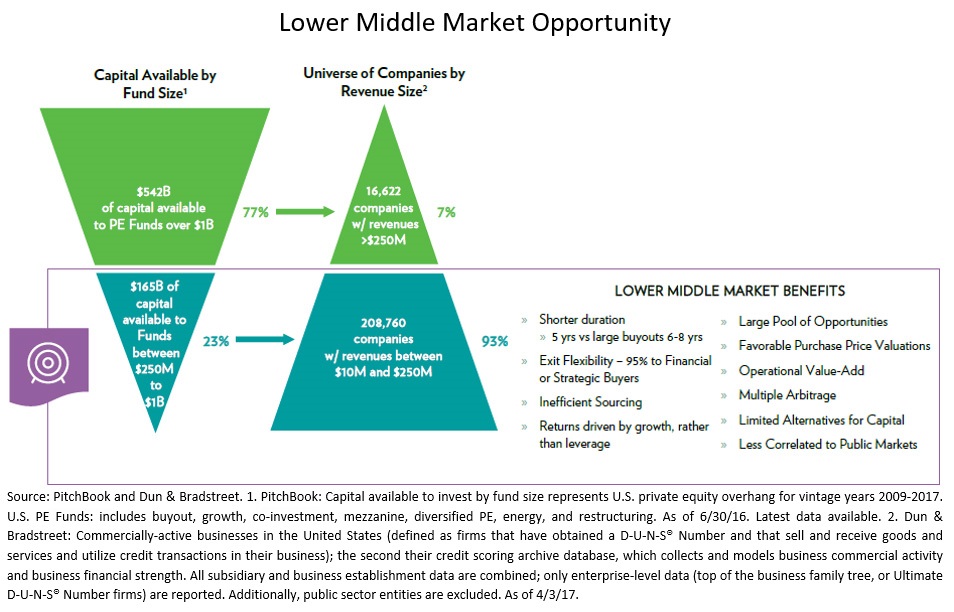

Public markets are becoming increasingly efficient. We still think there’s room for active management, and we may be on the verge of or at the beginning of a significant cyclical reversal in the outperformance of passive versus active managers, but the long-term trend is that public markets are getting more efficient. Private markets are also becoming more efficient with the dramatic increase in private equity activity over the last 30 years, but they are still less efficient than public markets, which should allow skilled managers to add value. (Generic, large company buyouts that depend primarily on financial engineering are much, much more competitive than they were at the dawn of the industry, for example, but the middle market of smaller companies is vast and still quite inefficient.)

There are more ways private equity managers can add value. There is obviously leverage and other financial engineering, but as already mentioned, that strategy is largely over as a way for managers to truly differentiate themselves. It can certainly be a useful tool, but leverage alone is rarely enough to sustain strong and differentiated performance. However, private equity managers can also add value through unique sourcing channels, specific niche industry knowledge and contacts, direct operating experience, the ability to consolidate fragmented markets, and greater resources to assist management teams with a host of issues. As a side note, a beneficial effect of the structure of private equity, namely the illiquidity, helps insulate investors from their natural instincts to buy high in periods of exuberance and sell low during periods of fear or frustration.

The challenge for us has been to find an investment vehicle that possessed the benefits of private equity but also mitigated some of its potential flaws. We have surveyed several investment options in private equity and have compiled a list of what we would be seeking in such a fund:

- We would like to see diversification within a private equity fund—ideally gaining exposure to multiple vintage years, managers, stages, strategies, and subclass.

- We would like to see fund flexibility. We would prefer minimum investment amounts in the ballpark of $250,000 rather than $1,000,000. We would rather have a shorter initial lock-up period than a longer one.

- We want to see strong returns, both in absolute value and relative to other firms within the industry.

- We would prefer lower fees to higher fees. Given that highly skilled management generally requires high compensation, we would expect significant expenses under any circumstance. But just as hedge fund fees have declined from their traditional 2% plus 20% of profits, we would like to see private equity fees well under the 2 and 20 marks.

- We want as much transparency as we can find. Gross returns are not nearly as informative as net returns. Capital calls and associated bridge financing can also be used to game a fund’s IRR by lowering the amount of time an investor’s money is used, thereby artificially inflating its return2.

- We would prefer a fund that allows investors to buy into secondary investments quickly. This means that your investment dollars would be put to work more quickly, so that you would be less likely to be subject to capital calls, or stuck with keeping much of your committed capital on the sidelines until it’s needed. Having access to secondary investments also means having access to more mature investments, which should help smooth out the J-curve, as illustrated below.

- 7.We would prefer a company that explores the “dusty corners” of the market. If we are paying for expertise, we don’t want to be caught up in a situation with too many private equity managers chasing too few megadeals, as the chart below illustrates—with 77% of private equity capital invested in only 7% of the universe of companies. Just as traditional active management tends to do its better work in small caps, international stocks, and emerging markets, we believe that private equity has greater potential excavating the mid-size company deals instead of those of the behemoths.

At JMS Capital Group Wealth Services, we strive to employ a more diverse set of asset classes than a traditional advisory firm. Beyond public stocks and bonds, we have also owned direct real estate and liquid alternatives in our effort to augment income, further diversify portfolios and improve risk-adjusted returns. The one asset class that has eluded our portfolios for the reasons mentioned previously has been private equity, until now.

We have researched multiple offerings that provide access to private equity. Each of them satisfies some of the conditions we outlined above, but only one of them checks all of the boxes on our list. If you are intrigued by private equity—and if you’ve read this far, we hope you would be—please contact us and we can outline the investment possibilities for you.

— JMS Team

1Source: 2018 Preqin Global Private Equity & Venture Capital Report: Sample Pages

2Source: https://www.wsj.com/articles/private-equitys-trick-to-make-returns-look-bigger-1520600579

Disclosure:

An SEC-registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting and legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back