By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Q4 2016 Market Commentary

2016 Year-End Key Takeaways

Global stocks performed well both in absolute terms and relative to core bonds this year, with U.S. stocks again taking the lead. Large‐cap stocks gained over 10% and small-cap stocks surged more than 20%.This marked the eighth straight year the lar ge‐cap S&P 500 Index had a positive return. While streaks of this length have occurred twice before, the market has never had a nine‐yea r winning streak.

Emerging‐market stocks w ere also strong performers, gaining over 12% for t he year. Dev eloped international stocks were the big laggards. They returned just 2. 7% in U.S.‐dollar terms. European stocks did worse, falling 0 .4% in dollar terms, although they gained 7.2% in local-currency terms. For the third straight year, dollar appreciation was a drag on European stock returns. The major currency decliner was the British pound. It plunged 16% versus the U.S. dollar, triggered by June’s Brexit vote. The euro fell 3% on the year. Overall, the U.S. dollar index rose around 4% against a basket of developed‐market currencies.

For the year, core bonds produced a 2.5% gain, slightly above our longer‐term (five‐year ) expected return outlook for them. Investment‐grade municipal bond returns were slightly negative on the year. Though core bond prices got off to a strong start with the 10‐yea r Treasury yield dropping to an all‐time low of 1.37 % in early July, yields then reversed course, rising to 2.5% by year‐end . In the fourth quarter, t e core bond index fell 3.2%—its worst quarterly performance in 35 years—due to rising interest rates.

While 2016 wound up being a poor year for Treasurys and core bonds, it was a good year for riskier fixed‐ income sectors. Fixed‐income sectors with more credit risk (and less interest rate risk), such as high‐yield bonds and floating‐rate loans, performed very strongly, gaining 17.5% and 10 .2%, respectively.

Alternative strategies turned in a mixed but overall disappointing performance. Though skillful as usual with respect to risk management, several funds with strong long‐term track records struggled to post positive returns in the largely low volatility, rudderless pre‐election period. Moreover, while managed futures performed beautifully after the Brexit shock, it floundered in the remainder of a year during which clear trends often fluctuated or failed to materialize .

In our year‐end investment commentary, we look back at 2016 as well as ahead to 2017. Several trend reversals occurred in 2016 that leave us hopeful the portfolios we manage will benefit in the coming years.

Our analysis leads us to st y the course, maintaining a focus on our investment discipline, as opposed to trying to forecast economic or political outcomes, which we believe are inherently unpredictable. This was evident in both the Brexit vote in June and the U.S . presidential election in November as both produced outcome that were not anticipated.

2016 Year-End Investment Commentary

Portfolio Positioning

As we look back at 2016 and ahead to 2017 and beyond, we’ll leave the political discourse and analysis to others and focus our comments on the financial markets. In this commentary, we recap portfolio performance, before speaking to client concerns regarding our investments in foreign stocks.

Fixed‐Income: In our balanced portfolios, roughly 75% of our fixed‐income exposure is in non‐core bond funds, including actively managed unconstrained/absolute‐return‐oriented, flexible multisector, and floating‐rate loan funds. These positions benefited greatly from rising interest rates and added significant value compared to core bonds. Gains in these segments were in the 8% to 11% range versus 2.5% for the core bond index. Looking ahead to 2017, floating‐rate loan funds should again meaningfully outperform core bonds, although 2016’s double‐digit returns will most likely not repeat themselves.

Larger‐Cap U.S. Stocks: Our underweight to U.S. stocks in favor of non‐U.S. stocks and alternative strategies was again a headwind to performance this year (we provide more details on this in the following sections).

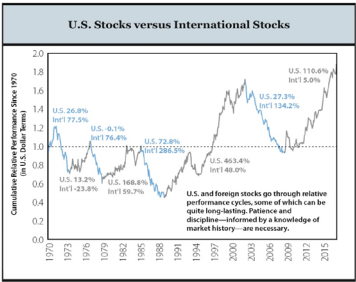

Developed International Stocks: Given our modest tactical overweight to this asset class, we were hurt by U.S. stocks’ continued outperformance versus other regions. This marked the fourth straight calendar year and the sixth in the past seven that the S&P 500 beat the global ex‐U.S. index. Since 2008, this is one of the longest stretches of U.S. outperformance on record. U.S. stocks also meaningfully outperformed European stocks.

Emerging‐Market Stocks: We were pleased to see emerging‐market stocks rebound in 2016. Through the end of October, emerging‐market stocks were up 18% on the year (versus larger‐cap U.S. stocks’ 6% rise), though they did give back some gains following the presidential election and ended the year up over 12%.

Alternative Strategies: We began investing in alternatives late in 2015 as part of a broad wealth preservation strategy. With domestic equities in the midst of a near‐record bull run and bond yields low, alternative investments offer portfolio diversification, risk management, and downside protection. And indeed, as is their wont, alternatives once again provided a protection against a potential downturn. However, alternatives also carry the promise of moderate growth, and unfortunately several of our alternative investments did not meet those expectations. Several funds struggled mightily in the meandering markets of summer before recovering significantly in the last quarter of 2016.

In addition, despite some short periods of very strong performance, when equity markets dropped sharply early in the year and again right after Brexit, managed futures had a very tough year. We certainly aren’t happy about their performance. Unfortunately, it is entirely consistent with our shorter‐term return expectations for these strategies (i.e., returns can range widely from very negative to very positive in any given year, particularly in a year with so many sharp market reversals). That said, our view of the long‐term strategic benefits from investing in managed futures strategies as part of a diversified portfolio has not changed.

Moreover, to pull back further, our view of the long‐term strategic benefits from investing in alternatives as part of a diversified portfolio has not changed. In a year of double‐digit returns for US stocks, alternatives performance paled by comparison. But while we continue to hope for the best from domestic bonds and equities, we will certainly continue to be prepared for alternative states of the world.

Why Do We Still Own Foreign Stocks?

Since the end of 2009, the S&P 500 has roared higher. In contrast, developed international stocks have only provided about ¼ of what U.S. stocks delivered and emerging‐market stocks are nearly flat in dollar terms. Because of their globally diversified long‐term equity allocation, our portfolios have lagged compared to a purely U.S. stock portfolio. While foreign stocks’ underperformance is trying, we continue to believe, supported by our analysis, in maintaining strategic allocations to foreign stocks particularly after this prolonged period of underperformance.

Our analysis implies that from current price levels, both European and emerging‐market stocks are likely to generate higher returns than U.S. stocks over our tactical time horizon of five years. In our base case scenario, we estimate low double‐digit potential returns from European and emerging‐market stocks, driven largely by improving earnings growth from still very depressed levels. This compares to our base case of low‐single‐digit expected returns for the S&P 500

Our analysis indicates we are being reasonably compensated for equity risk in developed international and emerging markets, but U.S. stocks appear somewhat overvalued with a lot of optimism baked into current prices. This dynamic accelerated post‐election and makes them particularly vulnerable to a negative surprise. We expect the market price‐to‐ earnings multiple to decline in our base case, consistent with U.S. market history, dragging down expected returns. History and investment logic also tell us that high starting‐ point valuations are a strong predictor of low future returns over a five‐to‐10‐plus‐year horizon. It is this horizon upon which we base tactical decisions. So on a relative and absolute basis, we are moderately overweight to non‐U.S. stocks and underweight to U.S. stocks.

Though there are risks to our developed international and emerging‐market equity positions, current valuations suggest these are pretty well—though not fully—discounted. News flow regarding political uncertainties from rising nationalism in Europe and related economic/breakup risks facing the eurozone, or the negative ramifications for emerging markets of China’s huge public debt build‐up (to name a few big ones), has contributed to their poor stock market performance in recent years. With investors discounting lots of risks and bad news, the news must only be “less bad” for sentiment and stock prices to improve. That typically happens when the market least expects it.

We believe the key earnings growth and valuation assumptions that underlie our base case five‐year scenarios for these markets are reasonably conservative. These markets still face potential shorter‐term cyclical downside risk. We do consider more bearish scenarios and outcomes in our analysis, which is why we don’t have larger tactical positions to these markets. However, we believe the overall risk/reward, the combination of the likelihood of certain scenarios playing out and the magnitude of gains or losses across those scenarios, continues to support our allocation.

Unless or until our analysis suggests making an allocation change, we will remain patient and confident we will be rewarded, as has been the case historically for long‐term value‐driven strategies. As Warren Buffett wonderfully and concisely put it, “A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful.” Much easier said than done.

.png)

Looking Ahead to 2017

Expert predictions of the future are usually no better than guesses. When it comes to economies and financial markets, there are way too many complex, adaptive, and interactive variables—most of which are consistently unpredictable—to confidently forecast outcomes, at least over the shorter term.

Even if one could know in advance the outcome of many of the important individual variables (such as election results, central bank policy decisions, and currency movements), one would still be likely to make many inaccurate market forecasts. For example, how many experts would have predicted gold would drop and stock markets would rally in the days and weeks after an unexpected Donald Trump election victory?

We don’t bother guessing what financial markets will do next year. An important part of our portfolio risk management process does analyze the impact of 6‐month stress‐test scenarios. But those are neither forecasts nor predictions. If we had to make a forecast for next year, or any year, it would be this: Expect the unexpected. Prepare to be surprised. Stock markets will be volatile; they will go up and down ‐ probably a lot.

—JMS Team

Disclosure:

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events as of December 2016. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back