By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Q2 2017 Market Commentary

Second Quarter 2017 Key Takeaways

The second quarter proved to be another very strong period for global stock markets. Larger‐cap U.S. stocks gained 3.1%, developed international stocks rose 6.4%, and emerging‐market stocks rose by 3.4%.

First half 2017 stock performance was even stronger. Larger‐cap U.S. stocks surged 9.3%, while international indexes were each up in the mid‐teens. International stocks continue to lead the way; our portfolios are benefiting from their overweight to foreign stocks, specifically European and emerging‐market stocks.

Core bonds also delivered solid returns, rising 1.5% for the quarter. (Higher bond prices correspond to lower bond yields.) The yield curve “flattened” considerably, with the difference between the 10‐year and 2‐year Treasury yields ending the quarter at close to a post‐2008 low.

In aggregate, the flexible bond funds we hold in place of a large portion of our portfolios’ fixed‐income allocation again outperformed the core bond index for the quarter and year to date. Floating‐rate loans delivered modest gains, but because interest rates declined during the first half of 2017, they failed to match the bond benchmark. High yield bonds and other non‐traditional approaches helped to boost returns.

Yet the calm, as manifested in low measures of volatility across global markets, was briefly interrupted during the last few days of June. Global stock and bond investors were rattled by comments from the heads of the European Central Bank and the Bank of England suggesting they are considering less accommodative policies. In response, bond yields quickly spiked higher, while currency markets saw large swings. Nevertheless, at quarter‐end, the S&P 500 remained near its highs.

Economic and corporate fundamentals largely remain solid, and investors expect the second quarter earnings season to demonstrate a continuation of the strong growth trends exhibited so far in 2017. From a big picture perspective, we think the odds favor a continuation of the ongoing mild global economic recovery we’ve witnessed so far this year. That should be broadly supportive of riskier assets, such as stocks and corporate debt. In particular, we believe there is still more room to run for foreign stocks versus the U.S. market, given their more attractive valuations and earnings growth potential, even after their strong performance in the first half of the year.

The past quarter and first half of the year were characterized by historically low stock market volatility, the strong performance of both stocks and bonds, and the reversal of market trends set in motion by last year’s U.S. presidential election. In this quarter’s commentary, we attempt to explain these phenomena, some of which may seem contradictory. We also reiterate that, given the lack of market volatility, we have not made any major changes to client portfolios. But we remain alert to and positioned to meet the high level of uncertainty in global financial markets and the geopolitical environment today.

Second Quarter 2017 Investment Commentary

As we look back over the past quarter and first half of the year, a few things stand out. Overall stock market volatility remained extremely low, despite significant domestic political uncertainty and unsettling global and geopolitical events. Both risky assets (stocks) and defensive assets (core bonds) performed well. And the period was marked by some significant market trend reversals from the previous year.

The S&P 500’s actual realized volatility recently fell to near its lowest level in the past fifty years, according to a recent Goldman Sachs report, while the S&P 500 Index continued to reach new highs. The U.S. stock market’s calm ascendance seems to fly in the face of ongoing political uncertainty and geopolitical tumult. Each day seems to bring a new headline concerning something else to worry about.

That said, maintaining a degree of equanimity is a valuable attribute of successful long‐term investors. Global risks always exist and unexpected events inevitably happen, causing markets to fall no matter their valuation. The world and financial markets have faced numerous negative shocks over the decades, but the broad economic impacts have ultimately proved transitory. Over the long term, financial assets are priced and valued based on their underlying economic fundamentals—yields, earnings, growth—not on transitory macro events or who occupies the White House. Therefore, we believe it is beneficial for investors not to react to every domestic political development or geopolitical event with the urge to sell their stocks nor get overly excited and jump into the market on some piece of news they view positively. We don’t think refraining from such short‐term trades is complacency—if the choice is supported by a sound decision‐making framework. Having a disciplined investment process and a focus on the long term are essential to best achieve your financial objectives.

It may seem somewhat surprising or contradictory that both global stocks and defensive core bonds have performed well. Treasury bond prices typically rise when people are worried about the economy or other macro risks, but that doesn’t seem to be what is driving core bond prices this year given the low volatility and strong performance of riskier assets. Rather than fears of an impending macro shock, it seems the bond market is responding largely to the recent declines in inflation and inflation expectations (inflation is the enemy of bondholders.)

The equity market, on the other hand, likes neither too little inflation nor too much. So stock investors have had plenty of reasons to propel prices higher: Inflation is lower but still in the ballpark of the Federal Reserve’s 2% target. The global economic recovery is ongoing. S&P 500 company earnings are rebounding. And global central banks, including the Fed, are not expected to aggressively tighten monetary policy any time soon.

In the short term, both markets may be “right.” But the current state is not sustainable for very long—something has to give. The Fed holds a big key as to how things might play out: will it tighten too much, too little, or manage it just right? Nobody knows, but based on history, we wouldn’t put all our chips on any single scenario. Potential changes to fiscal, tax, and regulatory policies are also big unknowns.

A final observation: several of the market trends and consensus market views we highlighted at the start of the year

have reversed (again):

- European stocks are beating U.S. stocks by a wide margin.

- The U.S. dollar is down (about 6%.)

- Treasury yields are down.

- Oil prices have plunged 20% from their recent highs.

- Growth stock indexes are crushing value indexes.

- Larger caps are beating smaller caps.

- Emerging‐market stocks are outperforming U.S. stocks.

The recent market shifts only reinforce the point we made then. We don’t think anyone can consistently and accurately time short‐term swings in markets or inflection points in market cycles. It is when “the experts” are overwhelmingly aligned on one side of a trade and the consensus is strongest that a trend will continue, that it

actually has the most potential to reverse.

Most of the market reversals we’ve seen this year are consistent with, if not driven by, an unwinding of the so‐called Trump trade. This is shorthand for the markets’ almost knee‐jerk reaction (which soon became consensus) that Trump’s election and the Republican sweep of Congress would herald a period of inflationary, pro‐growth fiscal, tax, and regulatory policies, unleashing the U.S. economy’s animal spirits. Instead, as the Trump administration has gotten bogged down in a myriad of other issues, with little progress on the economic front, confidence in that scenario has diminished.

In general, we agree with Warren Buffett who recently said, “If you mix your politics with your investment decisions, you're making a big mistake.” We made only minor changes to our portfolio positioning when Trump was elected, and we highlighted the significant uncertainty around potential Trump policies. That’s not to mention the highly uncertain timing, implementation, and magnitude of their ultimate economic and financial market impacts. Therefore, the unwinding of that narrative this year hasn’t led us to make any portfolio changes.

Portfolio Positioning & Outlook

Fixed‐Income

We think it is prudent to construct portfolios that are prepared for, and are resilient to, a range of potential outcomes. As a result, in our balanced portfolios, we maintain some exposure to core bonds, despite very low current yields, because of their risk‐mitigating properties in the event of a recession or other shock. But given core bonds’ paltry yields and unattractive longer‐term (five‐year) return prospects, we maintain meaningful exposure to other more flexible and opportunistic fixed‐income funds as well as to floating‐rate loan and high yield bond funds.These investments should also provide some protection against rising interest rates and inflation.

Our positions in flexible bond funds have performed well this year and again added value versus the core bond index. Meanwhile, our tactical position in floating‐rate loan funds generated only modest gains. These don’t benefit from falling interest rates, and returns trail the core bond index so far this year.

U.S. Stocks

Based on our analysis of valuations and longer‐term earnings fundamentals—even putting aside any near‐term political or geopolitical risks—U.S. stocks present unattractive expected returns over our five‐year tactical investment horizon, evaluated across the macroeconomic scenarios we think are most likely to play out. Valuation risk is high and offers no margin of safety in the event the optimistic scenario currently baked into valuations doesn’t play out. Therefore, we are somewhat underweight to U.S. stocks and to equity risk in general, but we don’t see any particular near‐term trigger for a sharp market decline.

Foreign Stocks

Outside of the United States, we see strong potential for both improving earnings growth and higher valuations—leading to relatively attractive longer‐term expected returns. We have a moderate overweight to both developed international and emerging‐market stocks.

We believe the outperformance of foreign stocks still has room to run given their superior valuations and earnings growth potential versus the U.S market. Even with their strong performance so far this year, our longer‐term return expectations continue to favor Europe and emerging markets compared to the United States.

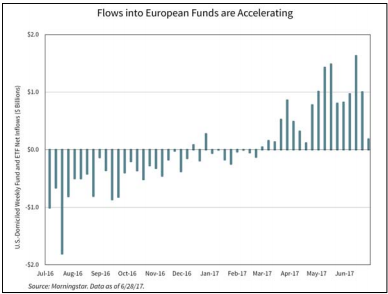

Foreign stock markets are also seeing increasingly positive investor sentiment and strong cash inflows. More than $12 billion has flooded into U.S.‐domiciled European stock funds and ETFs this year, reversing 13 consecutive months of net outflows prior to that. Year‐to‐date inflows into emerging‐market stock funds are close to $30 billion.

Momentum seems to be shifting in favor of foreign stocks. We are seeing more and more Wall Street strategists recommend an overweight to European and emerging‐market stocks: a position we have held for a while. This can feed on itself in a virtuous cycle—as more money flows into these asset classes, it can boost prices and returns, attracting yet more inflows and driving prices higher.

Alternative Strategies

Our lower‐risk liquid alternative strategies are designed to seek annualized returns of approximately 4‐6% over a full market cycle. Performance this quarter and this year has

been consistent with meeting that goal. In line with our overall wealth preservation strategy, our alternative strategies provide attractive risk‐adjusted return potential and valuable diversification to the overall portfolio. While our managed futures returns trail those of most asset classes this year, our multi‐alternative, tactical allocation and merger arbitrage funds have met or exceeded expectations.

Putting It All Together

We don’t expect a recession in the near term, but we remain alert to – and are positioned to – meet the high level of uncertainty that characterizes both global financial markets and the current geopolitical environment. We maintain exposure to assets—core bonds in particular, as well as managed futures—that should generate positive returns in the event of a recession and a bear market in stocks. In addition, our lower‐risk alternative strategies should perform pretty well in most scenarios, and we are confident they have much less downside risk than equities. While there has seemed to be little need for such strategies over the past eight years of a U.S. equity bull market, history teaches that this cycle will turn too and the portfolio benefits of these alternatives will then be apparent.

—JMS Team

Disclosure:

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events as of July 2017. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back