By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Q4 2017 Market Commentary

Year-End 2017 Key Takeaways

The fourth quarter capped yet another stellar year for U.S. stocks. Larger-cap U.S. stocks gained 6.6% for the quarter and ended the year with a 21.7% total return. This was the ninth consecutive year of positive returns for the index—tying the historic 1990s bull market and capping an impressive run from the depths of the 2008 financial crisis.The broad driver of the market’s rise for the year was rebounding corporate earnings growth, which was supported by solid economic data, synchronized global growth, still-quiescent inflation, and accommodative monetary policy. U.S. stocks got an additional catalyst in the fourth quarter with the passage of the Republican tax plan, presumably reflecting investors’ optimism about its potential to further boost corporate after-tax profits, at least over the shorter term.

By year-end, the S&P 500 Index had rallied for more than 400 days without registering as little as a 3% decline. This is the longest such streak in 90 years of market history, according to Ned Davis Research.

Foreign stock returns were even stronger, with developed international markets gaining 26.4% and emerging markets up 31.5% for the year. In the fourth quarter, however, these markets couldn’t match the S&P 500, gaining 4%–6%. Our portfolios benefited from meaningful exposure to emerging-market and developed international stocks.

Moving on to bonds, the core bond index fund gained 3.5% in 2017. This return was close to the index’s yield at the start of the year, as intermediate-term interest rates changed little during the year. Although the Federal Reserve raised short-term rates three times, yields at the long end of the Treasury curve declined and the yield curve flattened. Corporate bonds across all credit qualities and maturities had positive returns. High-yield bonds gained 7.5% and floating-rate loans rose 4.1% for the year. Investment-grade municipal bonds rebounded from a flat 2016, returning 4.5%. Our long-held tactical positions in several flexible and absolute-return-oriented bond funds added value, outperforming core bonds by several percentage points.

Our investments in liquid alternative strategies fulfilled their portfolio diversification roles while generating midsingle-digit

returns as a group. Most managed futures funds experienced a difficult first half of the year, but the second half was significantly better. Net long exposure in equities globally has been a positive contributor, with mixed performance from other asset classes. Lower-risk arbitrage strategies generated absolute returns in the 4%–6% range. These funds beat core bonds but, not surprisingly, trailed the 20%-plus stock market returns.

The year 2017 was a very good one for most financial markets. While the macro outlook remains positive, unprecedented central bank policy shifts could trigger increased volatility, a stock market correction, or even a recession sometime in this business cycle. During this uncertain time, it is all the more important to stay disciplined and patient. We remain confident in our diversified portfolio positioning looking ahead over our long-term investment horizon.

Year-End 2017 Investment Commentary

Looking Back: Key Drivers of Our 2017 Portfolio Performance

Our globally diversified portfolios generated strong returns for the year, consistent with the positive overall return environment for most financial markets and asset classes. Our meaningful exposure to developed international and emerging-market stocks was a significant contributor, as foreign stocks outpaced U.S. stocks in 2017.

Stocks were not the only contributors to our portfolio returns. Our tactical positioning toward flexible, absolute-returnoriented fixed-income funds resulted in several percentage points of outperformance versus the core bond index’s 3.5% gain.

Looking Ahead: Updates on Our Asset Class Views

U.S. Stocks: As noted above, U.S. stocks were up 22% for the year, driven in part by expectations of a historic corporate tax cut, which the Republican-led Congress duly delivered. We suspect much of the benefit of tax decreases might be priced in based on consensus earnings estimates for the S&P 500, but acknowledge that momentum is on the side of U.S. equities.

Foreign Stocks: Political uncertainties notwithstanding, Europe continues its economic recovery within what appears to be a benign fiscal and monetary environment. Europe is matching the United States in terms of economic growth and, according to Capital Economics, is on track to generate its strongest growth since 2007. Earnings have rebounded strongly, with Ned Davis Research analysis showing continental Europe and U.K. local-currency earnings growing over 25% and 35%, respectively, over the past 12 months. (The United States has seen earnings growth of 14% over the same

period, according to NDR.) While earnings were up strongly, investor sentiment was relatively depressed (especially during the fourth quarter), leading valuation multiples to compress. Like European stocks, emerging-market stocks posted strong earnings growth of nearly 20%. Despite the recent run-up, we still expect emerging-market stocks to generate mid- to upper-single-digit annualized returns over the next five years. While not attractive in absolute terms (given equities’ downside risk), these returns are superior to what we expect from U.S. stocks.

Fixed-Income: Our return expectations for core bonds remain muted looking out over the next five years, in the range of 2.5% to 3.5%. Today, we’re faced with taking on elevated levels of interest rate risk for low yield. The yield per unit of duration is near its all-time low. For context, a 50-basis-point yield increase in the Bloomberg Barclays U.S. Aggregate Bond Index would wipe out more than a year of income. This explains our meaningful positioning away from core bonds in favor of flexible credit strategies, which we believe will outperform core bonds in a period of flat or rising rates. That

said, we still maintain core bond exposure in our balanced portfolios to serve as ballast in the event of a risk-off environment and a sell-off in stocks.

As noted above, high-yield bonds and floating-rate loans had solid absolute returns in 2017. We are somewhat cautious when looking at both for 2018. We acknowledge that low global rates, accommodative monetary policies, and healthy overall fundamentals could keep bond spreads historically narrow, at least in the near term. We think that higher interest rates in general, but particularly short-term rates, will result in a headwind for high-yield bonds. One factor that caused loans to lag high-yield bonds in 2017 was the meaningful amount of loans being called by issuers to reprice/refinance them at a lower cost. We expect this repricing trend to abate and loan coupons to increase, narrowing the gap relative to bonds.

Alternative Strategies: It was an interesting year for trend-following managed futures funds. Most funds experienced a difficult first half of the year, culminating in a very negative June. After the European Central Bank and other central banks came out with hawkish statements in late June, yields spiked globally and long trends in bonds got crushed. That changed year-to-date performance from basically flat to significantly negative. The second half of the year was much better. Net long exposure in equities globally has been a positive contributor throughout the year, with mixed

performance from other asset classes.

There are no “fundamentals” to guide expected returns in trend following over a given period. The one prediction we can again confidently make, however, is that the greatest diversification benefits from a managed futures allocation are highly likely to emerge during an extended equity bear market. We don’t think we (or anyone else) can consistently predict the timing of bear markets, so maintaining a strategic allocation to diversifying alternative strategies that have long-term positive expected returns makes sense, even more so given the elevated valuations in almost all traditional

asset classes and U.S. stocks in particular.

Arbitrage strategies generally experienced positive conditions last year. The merger-arbitrage universe experienced relatively few deal failures. Deal spreads have been fairly range bound most of the year, but they widened in the third quarter on fears of protectionism hampering cross-border transactions. Announced deal activity is below its peak level of two years ago but remains above the long-term average. With borrowing costs still low, but short rates significantly above zero, conditions are supportive for reasonable expected returns moving forward.

Looking Ahead: A Quick Word on the Macro Outlook

In terms of the near-term macro outlook, the consensus view is that there is little risk of a U.S. or global economic recession in 2018. The market expects the in-sync global growth that we saw in 2017 to continue. Most investors and strategists seem to share this view. However, when an outlook becomes the strong consensus view, one should assume it is already discounted to a meaningful degree in current market prices. This is where our investment discipline comes in, because we think we have an edge in assessing fundamentals, valuations, expected returns, and risks across different asset classes and over longer-term periods.

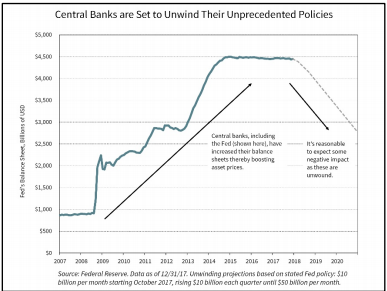

We fully expect to get the opportunity to add back to our U.S. stock exposure at prices that imply (much) better expected returns across our scenarios. One obvious trigger for that would be a meaningful drop in the market. We believe a bear market is likely sometime in the next five years (our tactical time horizon). Again, we can’t confidently predict exactly when, but one reasonable scenario would be triggered by ongoing monetary policy tightening, which is already underway in the United States, to be followed by other central banks. Given the boost to asset prices from unprecedented monetary stimulus, it is reasonable to expect some negative impact as central banks stop and then reverse course. On the other hand, should U.S. stocks continue their very strong upward trajectory, we will consider further reducing our exposure to them. There are a lot of variables involved, but all else equal, one key trigger for U.S. stocks would be if even under our optimistic/bullish scenario, we are seeing low-single-digit five-year expected annualized returns, down from 7% - 8% currently.

Putting it All Together: Our Portfolio Positioning

Currently, our base case scenario implies low expected returns for U.S. stocks. As such, we remain somewhat underweight in U.S. stocks and tilted toward developed international and emerging-market stocks, where our return expectations are materially higher. We were heartened to see our investment thesis of a European earnings rebound coming through strongly last year. However, we don’t believe our portfolios have been fully rewarded for this yet given European stocks lagged the U.S. market in local-currency terms, so we’re maintaining our tactical overweight to foreign

stocks. We also remain comfortable overweighting emerging-market stocks slightly relative to U.S. stocks, although valuations are a bit less compelling than they were a year ago.

Our fixed-income positioning also remains unchanged. In light of the particularly low expected returns for core bonds, along with the risk of rising interest rates (which correspond to lower core bond prices), we have meaningful exposure to flexible, actively managed bond funds. While our base case five-year expected returns for these funds are several percentage points above that of core bonds, they do carry more credit risk than core bonds. We factor this into our overall portfolio risk exposure, and it’s why we still maintain a meaningful allocation to core. Despite their poor longer-term

return outlook, we expect core bonds to perform well in a traditional bear market/recession and therefore, will remain an important part of portfolios.

Lastly, most of our portfolios have allocations to alternative investment strategies. These strategies are “alternative” in that they have some different drivers of return and risk than traditional stock and bond investments. We believe they have superior risk-adjusted return potential relative to the mix of stocks and bonds from which they are funded. While the “insurance” value of these investments hasn’t been realized during the strong equity market run-up, we remain confident their relatively low correlation (or no correlation) to other investments in our portfolios is a valuable longterm benefit

Concluding Comments

The year 2017 was a very good one for most financial markets and particularly global stocks. Yet we know the path to long-term investment success is simple to describe but not easy to achieve. Acknowledging this, we focus on the more realistic goal of having a high batting average - maintained by following our investment discipline and only taking on risk when we believe it raises the client’s portfolio return potential without materially impacting the potential downside.

Thank you for your continued confidence and trust. We wish you and yours a very happy, healthy, peaceful, and prosperous New Year.

—JMS Team

Disclosure:

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment.Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back