By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Second Quarter 2018 Key Takeaways

US stocks rose to the top of asset class performance charts with solid returns in the second quarter. Larger-cap US stocks gained 3.4%, but were outdone by smaller-cap stocks, which jumped 7.9%. The smaller-cap outperformance was driven by the market narrative du jour that smaller companies are more domestically focused and therefore not as exposed to a strengthening US dollar or potential trade wars, both of which are assumed to be detrimental to larger-cap (multinational) company profits.

Developed international stocks fell 1.8% for the period, as the US dollar rebounded. Dollar appreciation can be a meaningful headwind to returns for dollar-based investors in foreign securities.

Emerging-market (EM) stocks fared the worst, dropping 9.6% in dollar terms. In addition to the currency effects, EM stocks were negatively impacted by trade tensions between the United States and nearly all its major trading partners. As we discuss this quarter, we remain confident in our modest overweight to EM stocks in our tactical portfolios.

Moving on to the bond markets, in May, the benchmark 10-year Treasury yield pierced the 3% level, hitting a seven-year high before falling back, ending the quarter higher by 11 basis points at 2.85%. The core bond index had a slightly negative return (bond yields move inversely to bond prices). Once again, floating-rate loan funds outperformed core bonds and generated positive returns, as they have every month this year. For the year, the core bond index is down 1.62% and floating-rate loans are up roughly 2%.

With the US economy growing above trend and the labor market tight, the Fed continued its gradual path of tightening monetary policy. It raised interest rates again in June, but also forecasted a slightly accelerated path of hikes over the next two years. Whether the economy can withstand that degree of tightening remains to be seen. The impact of the Fed’s tightening on the short-end of the yield curve has resulted in extremely tight spreads between 10 year and 2 year treasury bonds; this spread was 0.54% at the beginning of 2018 and closed the second quarter at 0.33%. The potential for an inverted yield curve has increased as spreads have compressed which historically been a leading indicator of a potential recession.

Beyond the strength of the US economy, the global economy remains in pretty good shape, with real GDP growth expected to be above trend again this year. However, last year’s highly synchronized growth has decelerated and may have peaked for this cycle.

Recent US dollar strength may continue for a while as currency momentum can take on a life of its own. But there are fundamental reasons to expect the dollar may weaken looking a bit further out: the prospect of a ballooning US federal budget deficit in the coming years, a large US trade deficit, the eventual convergence of central bank monetary policies, and the fact that the Trump administration seems to prefer a weaker dollar.

Regardless, from a portfolio management perspective, we remain tactically indifferent on the dollar—we don’t have a high-conviction view relative to the currency markets that we would want to reflect in our portfolios. Instead, we maintain our strategic (long-term) diversified approach of having both dollar and non-dollar exposure—with the latter coming primarily from our foreign stock funds.

Second Quarter 2018 Investment Commentary

Market Recap

As we pause to reflect at the midpoint of the year, it seems so far 2018 has served as yet another reminder to investors that over the short term, markets are driven by innumerable and often random factors that are impossible to consistently predict. In the first quarter, US stocks experienced their first major losses since 2016 and a return to more “normal” market volatility. Many market prognosticators speculated that this could indeed be the end of the nearly decade-long US bull market.

Fast-forward through three more eventful months and this time around US stocks have been the net beneficiaries, gaining 3.4% on the back of a surging dollar while the rest of the world has slowed. The dollar’s 5% appreciation translated into a meaningful return headwind for dollar-based investors in foreign securities as foreign currencies depreciated against the dollar. Developed international stocks fell 1.8% for the quarter and EM stocks fared the worst, dropping 9.6% in dollar terms.

In bond markets, the benchmark 10-year Treasury yield pierced the 3% level in May, hitting a seven-year high. Yields then fell back, ending the quarter at 2.85%, an 11-basis-point increase from the prior quarter-end. As such, the core investment-grade bond index had a slight loss for the quarter and remains in negative territory for the year to date.

Portfolio Attribution

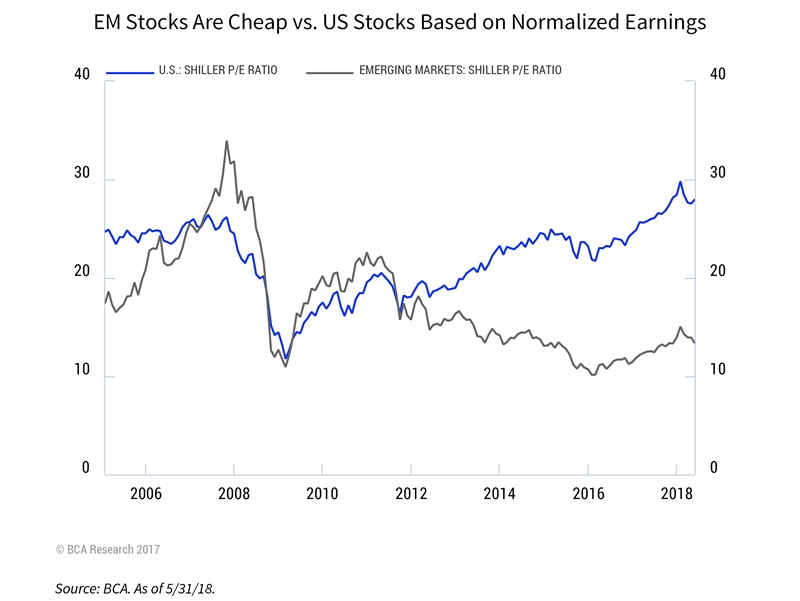

It was a somewhat difficult quarter for our equity holdings given the jittery investment climate outside the United States, particularly in the emerging markets. Over the past few years we have been slowly adding to both developed international and EM equities given their attractive valuations relative to domestic stocks. Following China devaluing its currency in the summer of 2015, the global economy began firing on all cylinders for the first time since the financial crisis and our thesis began to play out, with EM stocks gaining 11% in 2016 and 37% last year. EM stocks then bolted out of the gates in 2018, with an additional 11% return through late January. Since then, however, these holdings have declined sharply, and returns are now in negative territory for the year. Developed international equities, while not being hit as hard as EM stocks in recent months, have still underperformed US stocks by approximately 5.5% year-to-date.

The selloff in EM stocks appears to have been driven by a combination of investor concerns about

- a potential trade war with China (and possibly other global trade partners such as the European Union, Mexico, and Canada);

- how EM economies will manage a deceleration in global growth outside the United States; and

- a stronger US dollar coinciding with rising US interest rates and tightening Fed monetary policy.

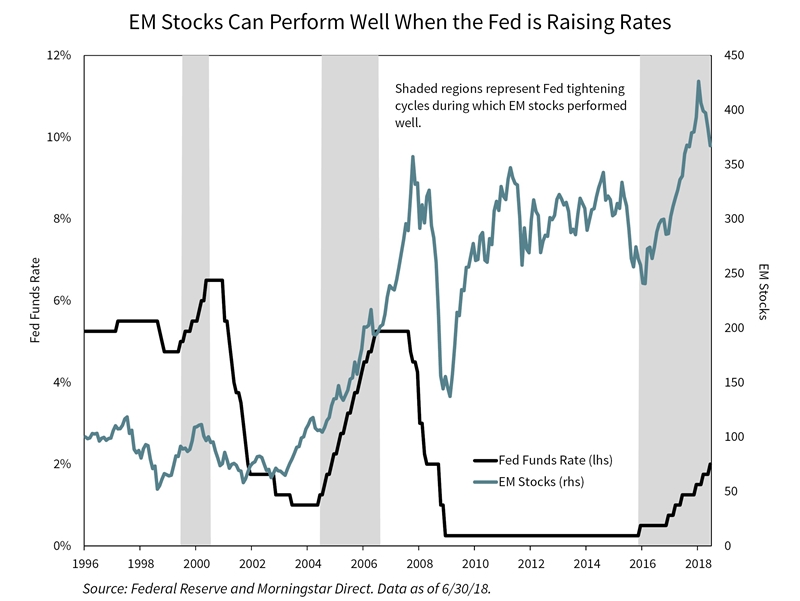

These macro developments, in particular the risk of a US trade war with China and the rest of the world, are indeed risks to EM stocks, at least in the shorter term. However, these are not new risks, nor do we believe they overwhelm the attractive fundamentals, valuations, and potential longer-term returns of EM stocks. Based on our analysis, we find that emerging markets are fundamentally better placed today than in past cycles. The sector composition of EM indexes has changed meaningfully over the past decade, from traditional heavy-cyclical industries like materials and energy to more growth-oriented technology and consumer-driven sectors that are less sensitive to shifts in global growth. Evidence also suggests EM stocks do fine when interest rates in the United States are rising as long as global growth is solid (real GDP growth is expected to be above trend again this year). As to the underlying fiscal health of EM economies, emerging markets, in aggregate, have much better debt coverage than in the late 1990s/Asian crisis era. Additionally, most EM countries now have floating rather than dollar-pegged currencies, which should help release pressure in these economies and reduce the likelihood of a currency devaluation–driven crisis.

On the fixed-income side, our portfolios were helped once again by our large allocation to actively managed flexible bond funds and floating-rate loan funds. In aggregate, these funds outperformed the core investment-grade bond index, as has been the case over the past several years. Thus far in 2018 success in the bond market has been primarily about losing less money as interest rates rise.

The performance of our liquid alternative investments was sub par in the second quarter. Despite the disruption of the US-China trade spat, our lower-risk arbitrage strategies produced modest gains, outperforming core bonds and foreign stocks but trailing US stocks. Convertibles and real estate also rose in the quarter. However, our multialternative and long-short equity funds, previously among our best performers, were down more than we expected for the quarter. In addition, our position in a set of trend-following managed futures funds was negative for the quarter.

Holding uncorrelated positions has clear diversification benefits and improves the overall risk/return profile of a portfolio. However, even uncorrelated assets can sometimes randomly move in tandem, and this quarter we have experienced that to the downside. We do not expect such an anomaly to continue. Moreover, in the long run we believe that the benefits from managed futures should be most evident during the next bear market, whenever that may be. We are not in the business of timing a bear market, but given the age of the current bull market it is more likely than not that we shall see one within the next five years. Should there be a bear market and managed futures do not perform as we expect, we would likely declare the thesis “broken” and exit our positions. In the meantime, while acknowledging the frustrating recent performance, we continue to believe our patience and long-term discipline will be rewarded with this allocation.

Market and Portfolio Outlook

It is understandable that fears of a global trade war are rattling financial markets. Any resolution of the current trade tensions is a meaningful uncertainty—our relationship with China being most tenuous—with the potential to seriously disrupt the global economy at least over the shorter to medium term. (The potential for a positive surprise seems more limited, but also exists.) President Trump’s unconventional negotiating approach adds an additional wildcard dimension.The process is likely prone to several more twists and turns before things become any clearer.

Our view on the matter, however, remains broadly the same. It is in the best interest of both the United States and China to negotiate a resolution and prevent trade skirmishes from becoming an all-out trade war. However, the potential for a severely negative shorter-term shock to the global economy and risk assets (not

just emerging markets) can’t be dismissed. Even absent an actual trade war, the negative impact on business and consumer confidence from the uncertainty and fear of a trade war is a risk to the remaining longevity and strength of the current economic cycle.

The recent dollar-strength trend may also continue for a while. But there are reasons to expect the dollar may weaken looking further out: the prospect of a ballooning US federal budget deficit in the coming years, a large trade deficit, and the eventual convergence of central bank monetary policies—as other central banks start to raise interest rates, thereby shrinking the yield gap versus the United States.

We remain confident in the positioning of our globally diversified portfolios, which we believe are structured to perform well over the long-term while providing resiliency across a range of potential short-term scenarios. Should the current trade tensions resolve, and the global economic recovery continue, we expect to generate good overall returns, with outperformance from our developed international and EM stock positions, active equity managers, and flexible bond funds.

Alternatively, should a bear market strike, our portfolios have “dry powder” in the form of lower-risk fixed-income and alternative investments that should hold up much better than equities. We’d expect to put this capital to work more aggressively following a market downturn by, for example, reallocating to US equities at lower prices and higher expected returns sufficient to compensate us for their risks.

Thank you for your continued confidence and trust.

—JMS Team

Disclosure:

An SEC-registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy.Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment.

Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back