By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Third Quarter 2019 Key Takeaways

The third quarter of 2019 was a choppy one for financial markets as investors continued to weigh the overall health of the global economy against a host of uncertain macro factors. Uncertainties included the ongoing trade war with China, a drone attack on Saudi Arabia’s oil fields, the seemingly never‐ending Brexit negotiations, and—as September wrapped—an official presidential impeachment investigation in our nation’s capital.

On the economic front, the Federal Reserve followed its 25‐basis‐point interest rate cut in late July with another 25‐basis‐point cut in mid‐September. This was in response to the weak global economic environment and the impact of trade policy on U.S. business sentiment and capital expenditure. The European Central Bank also cut its policy rate and announced it would launch a new open‐ended asset purchase plan (i.e., quantitative easing) starting in November.

Amidst this backdrop, equity markets rose in July, fell in August, then rallied in September. Large‐ cap U.S. stocks gained 2% for the quarter and have netted over 20% year to date. Smaller‐cap U.S. stocks suffered more acutely during the market drops and ended the quarter down 2.3%. For the year to date, they are still up a healthy 14.1% through Q3 2019.

Despite a rebound in September, foreign stocks posted negative returns for the quarter. Developed international stocks fell 0.9%, European stocks fell 1.8%, and emerging‐market (EM) stocks

fell 4.1%. The U.S. dollar appreciated 2% to 4% versus other currencies during the quarter, which was an equivalent drag on foreign stock market returns for dollar‐based investors.

Bond yields around the world continued to move lower in the third quarter as deflation concerns took hold. The benchmark 10‐year Treasury yield dropped to below 1.5% in early September as trade war and recession fears crescendoed. It then sharply reversed, then dropped

back, ending the quarter at 1.68%, down from a 2% yield at the end of the second quarter.

U.S. core investment‐grade bonds were flat in July, rallied sharply in August, then dropped in September as interest rates rebounded from historic lows. For the full quarter, core bonds gained 2.4%.

Corporate bonds gained for the quarter. Floating‐rate loans returned 1.0% and high‐yield bonds gained 1.2%. Core municipal bond funds were up a little over 1%.

The economic environment continues to feel like a game of tug of war between the contractionary effects from U.S. trade policy and accommodative/expansionary global monetary policy. The divergent outcomes we see as possible from here (recession vs. cyclical rebound) explain our balanced portfolio approach and focus on diversification. Our alternatives sleeve, with only modest sensitivity to equities, should also help to limit losses from a potential downturn. Our tilt toward international and value stocks on the equity side should benefit portfolios if a cyclical rebound takes hold. Together with the broader diversification across asset classes and investment strategies, client portfolios should be fairly resilient across a range of economic and market scenarios.

Third Quarter 2019 Investment Letter

Market and Portfolio Recap

The third quarter of 2019 was yet another turbulent time for financial markets as investors continued to weigh the overall health of the global economy against a host of uncertain macro factors—the ongoing trade war with China, the seemingly never‐ending and mind‐numbing Brexit negotiations, and—in case you haven’t heard—an official presidential impeachment investigation in Washington, D.C.

On the economic front, the Federal Reserve continued to lower interest rates in response to a weakening global economy and a strengthening set of trade wars, as it enacted a 25‐basis‐point interest rate cut in late July and another 25‐basis‐point cut in mid‐September. The European Central Bank also cut its policy rate and announced it would launch a new open‐ended asset purchase plan (i.e., quantitative easing) starting in November.

Equity markets had an adventurous summer, rising in July, falling in August, then rallying in September. Larger‐cap U.S. stocks gained 2% for the quarter and have netted over 20% year to date. Smaller‐cap

U.S. stocks suffered more acutely during the market drops and ended the quarter down 2.3%. For the year to date, they are still up a healthy 14.1%.

Foreign stocks likewise rode a roller‐coaster quarter; however, their rebound in September wasn’t quite enough to see them keep pace with U.S. stocks. In the third quarter, developed international stocks fell 0.9%, European stocks fell about 1.8%, and EM stocks fell 4.1%. Returns are still robust for the year so far, with developed international and European markets posting double‐digit gains (13.2% and 13.6%, respectively) and EM stocks rising close to 8%.

Bond yields around the world continued to fall in the third quarter as deflation concerns rose. The benchmark 10‐year Treasury yield ended the quarter at 1.68%, down from a 2% yield at the end of the second quarter. Core investment‐grade bonds gained 2.4%, while floating‐rate loans returned 1.0% and high‐yield bonds gained 1.2%.

Rising interest rates brought losses to core bonds, while our flexible fixed‐income and floating‐rate loan funds had gains. September’s more optimistic news on the trade front also boosted more cyclically sensitive international and EM stock markets as well as U.S. value stocks, all of which have lagged the S&P 500 market index the past several years.

Our alternatives sleeve rose about 1% for the third quarter, during a period in which equities were relatively flat. Gains were broadly distributed among many funds. Merger arbitrage continued its path of slow and steady gains, and managed futures, whose performance has been challenging in recent years, continued its 2019 rebound. We were pleased with the overall performance of our alternatives sleeve, and continue to appreciate its diversifying power, as its low correlation with equities can help us with our defensive positioning in the potential late stages of this extended bull market.

Market and Portfolio Outlook

The financial environment continues to feel like a game of tug of war. On one side, we have a still‐solid

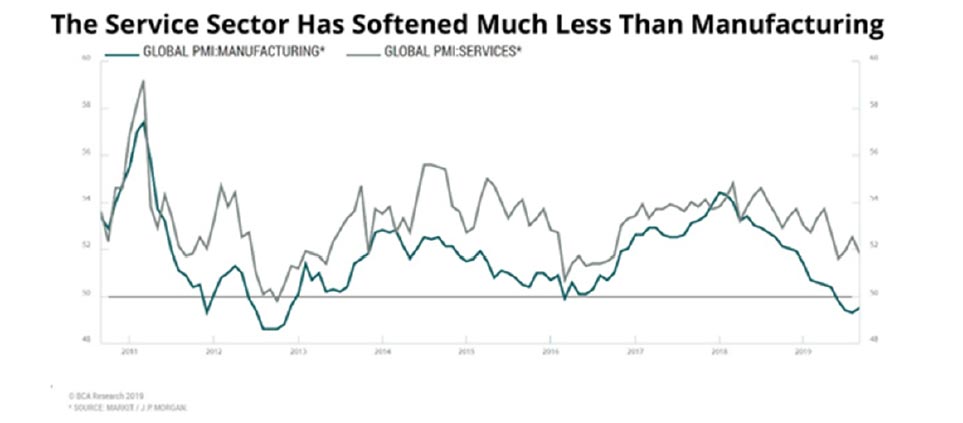

U.S. economy that has grown for a record number of consecutive years. While measures of manufacturing activity are slowing, global services activity, which represents upward of 70%‐plus of the global economy (and more than 80% of U.S. GDP) still looks solid. (See the following chart from BCA Research; note, PMIs above 50 denote expansion and PMIs below 50 denote contraction). Household balance sheets and consumer spending also remain healthy, supported by low unemployment and solid wage growth.

On the other side, global economic growth remains weak and consensus expectations are for further slowing. In particular, the longer a China‐U.S. trade agreement remains elusive, the weaker the economy will get as corporations further delay capital expenditures and hiring decisions, not to mention the direct impact already felt by the manufacturing sector.

The expansive monetary policies of central banks around the world continue to present an unknown risk factor. The total value of negative‐yielding bonds is over $14 trillion, globally. Central banks in Europe and Japan have resorted to these experimental policies because simply lowering interest rates, even to zero, has not helped them meet their growth and inflation targets. While no one really knows what the long‐term ramifications will be, we can identify some clear short‐term dangers, including investors seeking out riskier assets than they normally would, driving up the prices of these investments to unprecedented levels and exposing their portfolios to greater loss in the long run.

Much has also been made in the financial press of the “inversion” of the yield curve: an uncommon, inverse yield‐time relationship where longer‐maturity bonds carry lower interest rates than shorter‐ term bonds. A yield curve inversion is historically significant in financial markets, given an inversion has preceded the last seven recessions. One interpretation is that bond markets are telling us: “Good times are here … but bad times may be on the way.”

Looking Further Ahead

No single indicator, however reliable in the past, is sufficient to make an investment decision. We continue to diversify our bond strategies, understanding that predicting the path of interest rates is extremely difficult in the current environment. The role of fixed‐income is first and foremost to provide support to portfolios during deflationary events and bear markets in stocks; however, in this transitionary period, we are not willing to completely forego yield within fixed income.

Following a comprehensive review of our global equity assumptions, we also remain firmly convinced that foreign stocks are relatively attractive, particularly versus U.S. stocks. Despite the risks, we continue to see country‐level reforms and company‐level restructuring that we think are significant positives. If and when global growth returns to healthy levels, as it started to in 2017 before trade war tensions contributed to a growth slowdown, we think European and EM stocks are poised to do well, relative to US stocks.

The current investing environment and its range of conflicting outcomes only highlights why we believe it is important to incorporate a wide range of scenarios in our portfolio management process. The most effective way to do this is through diversification across multiple asset classes and investment strategies that have different risk exposures and different sources of return. Of course, this also means that not every position will perform well in every scenario or macroeconomic environment.

That’s the definition of portfolio diversification and the essence of risk management under uncertainty. We appreciate your trust in us and welcome any questions you may have.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment.

Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events ‐ as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back