By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Second Quarter 2020 Key Takeaways

If the first quarter of 2020 was all about financial shock, the second quarter was all about financial recovery. Not a recovery from COVID‐19 in terms of public health, certainly—the June and July surge in caseloads means that despite optimism in vaccine availability in 2021, we still have several more difficult months ahead of us to limit the spread and scale of the epidemic. But financial markets are forward looking, and with critical monetary and fiscal support, they have largely shaken off the downturn.

During the second quarter the S&P 500 gained over 20%, and as of June 30th, this surge had the S&P 500 down just over 3% for the year. As one would expect, the rising stock tide lifted many boats, with small caps gaining 23%, large caps gaining 20%, international stocks rising 15%, and emerging markets advancing over 18% for the quarter.

Fixed income markets also had a strong quarter, with core US bonds up nearly 3%, and the global agg posting gains of over 3% as well. After a volatile first quarter, yields were extremely stable in the second quarter, with the 10‐year yield holding between 0.60% and 0.80% for virtually the entire period, and closing at 0.66% as of June 30th. The 10‐year yield was 0.70% at the end of the first quarter, down from 1.92% at the close of 2019. In the credit markets, after dropping over 12% in the first quarter, high‐yield bonds made up a significant percentage of its losses, rising over 8% in the second quarter. Floating rate loans recovered strongly as well, gaining 6.6% in Q2 2020.

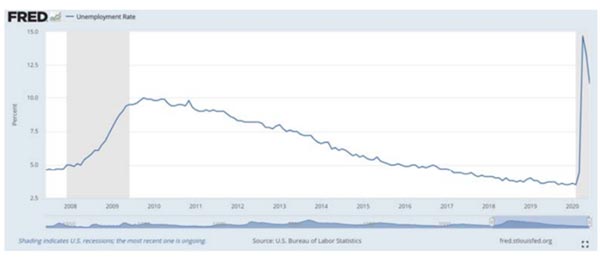

On the macroeconomic front, the near‐term economic damage from the coronavirus pandemic has been severe. The commerce department estimates that US GDP contracted 5.0% in the first quarter of 2020, and economists expect a further decline in the second quarter before a possible rebound in the second half of the year. Global growth is expected to be negative for 2020 as well. On the labor front, US unemployment skyrocketed in April to 14.7%, but shrunk quickly to 11.1% by June as firms recalled workers previously furloughed due to a combination of lockdowns and low demand stemming from coronavirus fears.

The shape of the recovery will depend on our ability to beat COVID‐19. On the plus side, vaccine and therapeutics testing continues apace, and fiscal support from the government combined with monetary intervention from the Fed has blunted the financial impact of coronavirus on millions of Americans. On the negative side of the ledger, expanded unemployment expires at the end of the month, coronavirus caseloads have mushroomed, and recent economic indicators suggest that the recovery is slowing, at least for now.

Remember, though, that markets are very much forward looking, and their resurgence in the second quarter suggests the view that the COVID‐19 nightmare, however overwhelming it can be at times, will come to an end. But getting through the next few months may be a very bumpy ride—we’re facing the ups and (currently) downs of coronavirus news, an escalation in US‐China tensions, and uncertainty with respect to the US Presidential election and its impact.

Second Quarter 2020 Investment Letter

After a 30% decline in a record 30 days in the first quarter, US stocks climbed over 40% since bottoming out on March 23rd. During the past quarter you had the seeming paradox of horrific macroeconomic numbers with a sizzling market. Upon reflection, it’s not really a paradox at all—the market’s rise has been supported by massive fiscal and monetary stimulus from governments and central banks, and has also arisen simply from the forward looking nature of markets, which is envisioning the light at the end of the coronavirus tunnel. There is also the likely prospect of a second fiscal stimulus later this summer, though its size and scope is unclear as of this writing.

Going forward, there is legitimate concern whether the market has come a little too far, a little too fast, and from a public health standpoint, we are expecting a difficult few months ahead. We anticipate the possibility of the economic recovery, along with markets, being fairly choppy for the remainder of 2020. As we’ve said before, it’s important to be prepared for various states of the world, and that is best done with a well balanced, well diversified portfolio.

Second Quarter 2020 Market Update

As we noted above, markets erased most of their massive first quarter losses with astounding second quarter gains. The S&P 500 rose over 20%, and many broader categories—small caps, large caps, developed international, and emerging markets—climbed a similar percentage. If we look under the hood, however, there are major return differences among styles and sectors. For instance, large growth has a nearly 10% positive return this year, whereas small value has declined over 23% as of June 30th. By sector, energy is down over 35% YTD, and financials over 23%, whereas consumer discretionary has returned over 7% and technology 15%. Both the global and US aggregate bond posted approximately 3% returns in Q2 2020, continuing a good year for the asset class. The 10‐year rate has held steady for the quarter, settling at 0.66% at the close of June. Volatility, as measured by the VIX, fell about 50% in Q2, though it still remains well above pre‐COVID levels.

Update on the Macro Outlook

This news will surprise no one, but we are currently in a recession—the National Bureau of Economic Research cites February as the final peak of the record 128 month expansion before the downturn. As noted above, GDP declined by an estimated 5% in Q1 2020, and as of July 9th the Atlanta Fed projects an additional 9% decline in Q2 (35.5% annualized). The Fed’s monetary support, combined with the March stimulus bill, has alleviated much of the recessionary pain; in fact, with household savings climbing (with so much of the economy shuttered, there’s less consumer spending), there has been the potential for a V shaped recovery fueled by pent‐up demand. Unfortunately, our current inability to contain the coronavirus likely means that the recovery will be characterized by stops and starts. And we still have a long way to go—while the recent consecutive strong job reports were welcome news, unemployment still remains above the peak reached during the 20082009 financial crisis. We observed in our last newsletter that the depth and duration of the recession—and the strength and timing of the ensuing recovery—depend on two key variables:

This news will surprise no one, but we are currently in a recession—the National Bureau of Economic Research cites February as the final peak of the record 128 month expansion before the downturn. As noted above, GDP declined by an estimated 5% in Q1 2020, and as of July 9th the Atlanta Fed projects an additional 9% decline in Q2 (35.5% annualized). The Fed’s monetary support, combined with the March stimulus bill, has alleviated much of the recessionary pain; in fact, with household savings climbing (with so much of the economy shuttered, there’s less consumer spending), there has been the potential for a V shaped recovery fueled by pent‐up demand. Unfortunately, our current inability to contain the coronavirus likely means that the recovery will be characterized by stops and starts. And we still have a long way to go—while the recent consecutive strong job reports were welcome news, unemployment still remains above the peak reached during the 20082009 financial crisis. We observed in our last newsletter that the depth and duration of the recession—and the strength and timing of the ensuing recovery—depend on two key variables:

1) The effectiveness of our medical response and social policy efforts in flattening the curve

2) And the speed and effectiveness of our fiscal, monetary, and regulatory policy response

While we were able to flatten the curve, we were unable to crush the virus, as some countries have done. Therapeutics and vaccine trials show significant promise, helping ease market fears of a more severe downturn. The Fed and other central banks continue to indicate they will be all‐in on providing monetary support through the coronavirus, and it is likely that the House and Senate will come to an agreement on additional aid for workers and businesses bearing the brunt of COVID‐19. The long‐term prognosis for defeating coronavirus is promising, probably even moreso than 3 months ago, but the short‐term challenges for the United States remains high, as curve bending efforts are renewed. On top of the pandemic we still have many preexisting sources of uncertainty, including souring US‐China relations and the November election. The country and the world have a lot on their plate right now.

Portfolio Positioning

The first half of 2020 has demonstrated the value of a diversified and flexible portfolio. While market shocks are inevitable, diversification across asset classes and across the globe means that your portfolio is not dependent on any one scenario, and that you have a better chance of resilience in the face of a bear market, and the nimbleness to catch the wave of the recovery. When the downturn hit in March, we had significant ballast in the form of bonds and liquid alternatives that were able to mitigate portfolio losses. We then exited our alternative positions in order to take advantage of depressed stock market valuations and widening bond spreads, hoping to reap greater gains from the potential market bounceback.

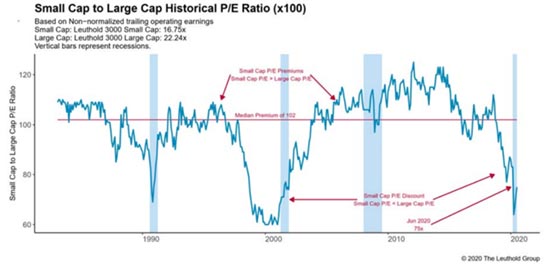

And fortunately, we have witnessed a swift recovery in stocks. U.S. large cap stocks have recovered the majority of their losses for 2020—primarily on the back of technology stocks. But while the overall return for large U.S. stocks looks much better than just one quarter ago, there are still numerous stocks down significantly. Stocks that tilt toward value, instead of growth, remain depressed. Energy and financial stocks have taken the hardest hits through one‐half of the year. The valuation gap has only widened between growth and value. The question is, will we see a shift toward these depressed areas at some point? We are not making large bets on either outcome at this point. In most portfolio strategies, we locked in gains from the large cap growth segment (where we added exposure in March) and moved a portion of the proceeds to small cap value stocks. This trade added exposure to one of the cheapest segments of the stock market—as can be seen in the graph below, small caps now trade at a discount not seen since the tech bubble of the early part of the century.

Diversifying positions within equities have not fared as well in 2020. Although all major categories pushed significantly higher in the second quarter, most trail large cap stocks by a decent amount. Lower capitalization stocks remain down at the halfway point of the year, with mid cap stocks losing over 11% and small cap stocks sliding over 15%. Foreign stocks have fared a bit better and closed the gap with large cap stocks to end the quarter. For 2020, as of June 30th, international stocks are down 11% and emerging market stocks are down nearly 10%. Investors have focused on the relative safety of large U.S companies thus far in 2020. However, portfolios with diversified positions in lower capitalization stocks and foreign stocks now have a more attractive profile in terms of valuation as these areas all offer better opportunities for returns if we witness any mean reversion for valuations going forward.

In fixed income, yield has become difficult to find. Between rate cuts by the Federal Reserve and downward pressure on yields for longer dated bonds during the COVID‐19 selloff, many higher quality bonds offer paltry yields. There are more attractive opportunities for both yield and price appreciation within credit markets. Areas such as high‐yield, floating‐rate and some multi‐sector approaches that target segments such as non‐agency mortgages and asset‐backed securities can boost yield within bond portfolios. However, yields in these areas are also somewhat depressed, as the Federal Reserve has stepped into many credit markets as support and narrowed spreads for many bond credit categories. Emerging market bonds also offer superior yields to core fixed income, and in addition to yield, price appreciation may be possible if we see a weakening US dollar.

A diversified approach, employing several of these bond market segments, can augment the total yield of portfolios. Risks remain and portfolios should continue to keep allocations to short‐term and/or core fixed income as a ballast against another market shock. Holding higher than normal levels of cash can also provide safety and the ability to be proactive if the markets move significantly lower again.

Closing Thoughts

We anticipate continued volatility in 2020 as the markets navigate the continued fight against COVID‐19 and the upcoming U.S. election. While upside remains in stocks given the unprecedented stimulus from the government and low bond market yields, we believe a moderate approach makes the most sense until we get more clarity on several fronts. Valuations appear stretched for many stock market winners this year, while the harder hit stocks have clear hurdles given the current economic reality. Positions in areas such as small cap value, developed international, and emerging market stocks all appear attractive in terms of potential to add value over U.S large caps in the coming years. However, if we witness another leg down in stocks this year, these areas will likely see declines greater than those of core U.S. stocks. With the Federal Reserve supporting bonds on many fronts, we believe diversifying across numerous, higher‐yielding bond categories will improve returns over core bonds moving forward. Categories like high‐yield bonds also look attractive for investors looking to de‐risk portfolios by selling stocks but not wanting to hold cash and accept no return moving forward.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment.Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back