By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

First Quarter 2020 Key Takeaways

The first quarter of 2020 has been an unprecedented period in U.S. financial market history across numerous dimensions. We just witnessed the fastest 30% decline from a recent high on record for the S&P 500 (in only 30 days). We have experienced historic volatility. And U.S. Treasury yields recently dropped to all-time lows.

As of March 31st, the S&P 500 was down almost 20%, even with a rebound at the end of March. Small-cap U.S. stocks have done even worse, falling 32%. Developed international stocks have declined 23%, and emerging-market stocks have dropped 24%. Much of the differential between U.S. and foreign stock market returns has been due to the appreciation of the U.S. dollar, which has risen roughly 2% year to date.

In the fixed-income markets, core bonds gained 3%, once again playing their key role as portfolio ballast against sharp, shorter-term stock market declines. Intermediate treasuries also had a positive return, at 1.5%. Yields have been extremely volatile as well—shooting up on some days when stocks were also sharply selling off. The 10-year yield was at 0.70% at the end of the quarter, down from 1.92% at year-end.

Turning to the credit markets, high-yield bonds have taken it on the chin, dropping over 12%. Investment-grade corporate bonds have also been far from immune, having lost over 5%, with many segments of the investment grade bond market sliding even more (with some losing an excess of 10% in a very short period).

Our allocations to lower-risk fixed-income and diversified alternative strategies have helped blunt the impact of the equity losses. But even this level of diversification has not been able to completely counter a steep and quick equity downturn as numerous bonds and alternatives still took hits amidst the panic selloff in March as liquidity disappeared from the markets.

The near-term economic damage from the United States’ and other countries’ response to the coronavirus outbreak now looks almost certain to be severe. GDP is expected to sharply contract, potentially by historic proportions, and unemployment is expected to rise to levels never seen before.

The depth and duration of the recession (and the speed of the recovery) depend on the effectiveness of our medical and policy responses. A medical resolution is a “known unknown.” But the Federal Reserve and other major central banks seem to be all-in to support markets. At the same time, Congress and the Trump administration seem to be in agreement that massive stimulus needs to occur on the fiscal side to deal with this crisis, perhaps even above and beyond the $2 trillion stimulus passed in March.

Yet when stock prices—or any asset’s prices—drop, forward-looking returns rise. Our outlook for long term U.S. stock returns improved with their cheaper valuations. So, in mid-March in many portfolio strategies we added stock exposure, using a portion of the proceeds from sold positions in the liquid alternatives group.

While the news may sound dark and hopeless at times, remember that this too shall pass. The world has faced many challenges and economic downturns and has always come out the other side. We are all facing unique risks and unknowns today, but we will bet on our resilience.

First Quarter 2020 Investment Letter

We are living through an extraordinary period in history that none of us will ever forget. The impact on our families, communities, and country has been profound. While several weeks ago we had reason for cautious optimism that the coronavirus might be largely contained to China, it is now obvious that is not the case. The United States and world are now facing the dual threats of a health crisis and an economic crisis. Both need to be fought with monumental government policy responses and individual behavioral changes.

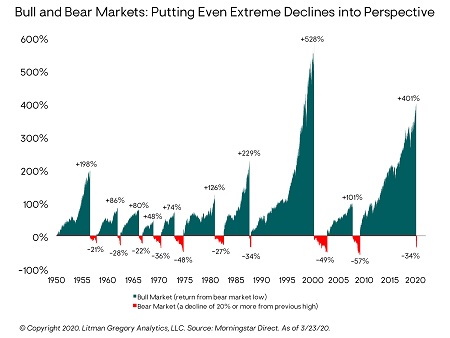

We’ve frequently said that recessions and bear markets are inevitable phases within recurring economic and financial market cycles. We’ve also said there is always the risk of an unexpected “external shock” to the markets and economy (e.g., a geopolitical conflict or natural disaster). Investors need to be prepared for both to happen, but their precise timing is consistently unpredictable.

It’s one thing to say it and another to actually live it. But we will get through this crisis period. Things will improve and recover. Most importantly, we sincerely hope you and yours are able to remain healthy and manage well through this challenging period.

First Quarter 2020 Market Update

As we noted above, the first quarter of 2020 has proven to be unprecedented for financial markets. U.S. stocks fell into a 20% bear market in the shortest time ever. They continued to drop and declined 30% in a record 30 days! Volatility, as measured by the VIX, reached its all-time high on March 16. Oil’s 25% drop on March 9 was its biggest one-day drop since the 1991 Gulf War. Finally, 10-year and 30-year Treasury bond yields fell to all-time lows of 0.54% and 0.99%, respectively!

Again, as of the market close on March 31st, the S&P 500 fell nearly 20% year to date, even with a late-March rebound. Smaller-cap U.S. stocks fared even worse, falling 32%. Foreign stocks also suffered significant drawdowns, as developed international stocks fell 23% and emerging-market stocks plunged 24%.

In the fixed-income markets, core bonds have gained 3%, once again playing their key role as portfolio ballast against sharp, shorter-term stock market declines. The 10-year Treasury yield on March 31st was 0.70%, down from 1.92% at year-end. In contrast, higher-risk floating-rate loans and high-yield bonds have suffered outsized losses, given the lack of liquidity in the bond market during March, with both dropping over 10%. Investment-grade corporate bonds have not escaped unscathed either, losing over 5%.

Finally, some of our alternative strategies, while not completely shieldling portfolios from losses, nevertheless mitigated damage from the equities downturn. We used the opportunity to exit these alternative strategies to add some money to stocks at more attractive valuations, to add to segments of the bond market that were disproportionately punished when liquidity left the bond markets, and to provide cash for short term needs.

Update on the Macro Outlook

We entered the year with an outlook for a moderate rebound in the global economy (especially outside the United States) on the back of reduced U.S.-China trade tensions and extensive global central bank monetary accommodation. We now believe the most likely outcome is that the U.S. economy is headed into recession in the second quarter. It is likely to be a punishing one, with a sharp contraction in GDP and an unprecedented rise in unemployment. However, the actions of the Federal Reserve and Congress to provide multiple measures of liquidity and stimulus could ameliorate the short-term pain and help stimulate longer-term recovery.

The short term impact of the coronavirus to the US and global economy looks to be severe. The decline in US GDP for the second quarter is likely to be massive, with projections from Wall Street showing a range of about -10% to -35% annualized.

The depth and duration of the recession—and the strength and timing of the ensuing recovery—depend on two key variables:

- The effectiveness of our medical response and social policy efforts in flattening the curve

- And the speed and effectiveness of our fiscal, monetary, and regulatory policy response.

One lesson learned from the 2008 global financial crisis is that a policy response needs to be significant and executed quickly. Governments need to make a credible commitment to “do whatever it takes” to support the economy and prevent a negative spiral from taking hold. As of this writing, the Federal Reserve and other major central banks seem to have gone all-in to support the fluid functioning of credit, lending, and financial markets, and their critical role as the “plumbing” of the real economy. Congressional Republicans, Democrats, and the Trump administration all seem to be in agreement that massive actions need to occur quickly. On March 27th, Congress passed, and the president signed into law, a $2 trillion stimulus package.

Portfolio Positioning

When you diversify across asset classes and consider a variety of potential scenarios, there will always be leaders and laggards in your portfolio. Some positions, like U.S. stocks, work well in strong up environments like we experienced last decade, while we have incorporated others that benefit portfolios during tougher times like the start to the 2020s. Put together, they build resiliency and protect a portfolio from betting on a single outcome, which can be a disastrous financial result if the opposite happens.

Our liquid alternative strategies, on the whole, held up relatively well during the market selloff from mid-February to mid-March. The basket lost a fraction of what equity markets lost – doing their job as lower risk portfolio diversifiers. In mid-March, we exited these holdings to raise a significant amount of cash in the majority of portfolios. A portion of this cash was used to purchase broad stock exposure at the more attractive stock market valuations created by the rapid stock selloff in the prior weeks and maintain upside on those funds. From the remaining cash, money was added to an array of bond strategies that had come under some pressure as the lack of liquidity in numerous fixed income segments had created downward price pressure. With the Federal Reserve stepping in as buyers in many areas of the bond market, we believe that prices will slowly begin to recover in the coming quarters and purchases at these levels set up to be attractive when looking more than one year forward.

Closing Thoughts

During these historic times, it is paramount to stay disciplined and recognize when emotion rears its head in investment decision making. If we invest based on emotion, we are very likely to exit the market after it has already dropped meaningfully, locking in losses. By the time the discomfort and worry are gone, the market will already be much higher. That is not a recipe for long-term investment success.

Global markets have endured severe challenges and economic downturns in the past and have always weathered the storm. Attempting to time the market’s tops and bottoms is a fool’s errand; however, incrementally adjusting portfolio allocations in response to changes in asset class valuations, expected returns, and risks can be highly rewarding to long-term investors.

Global markets have endured severe challenges and economic downturns in the past and have always weathered the storm. Attempting to time the market’s tops and bottoms is a fool’s errand; however, incrementally adjusting portfolio allocations in response to changes in asset class valuations, expected returns, and risks can be highly rewarding to long-term investors.

The time to be adding to stocks and other long-term growth assets is when prices are low and markets—and most of us personally—are gripped by fear and uncertainty rather than complacency, optimism, or greed. It may seem like the market could just keep dropping with no bottom in sight. But that is exactly where research, analysis, patience, experience, and having a disciplined investment process come most into play.

The precipitating event for the recent volatility is something none of us have experienced before: a global pandemic and an extreme societal response. One in two Americans now live under lockdown (and maybe more by the time you read this). Our medical infrastructure could be overwhelmed. We are probably already in a global recession. Facing this dual medical and economic crisis, the situation may get worse before it gets better. We would love to be wrong. But it will get better.

The future is uncertain but our investment playbook remains the same: diversify; balance long-term returns with short-term risks; buy low into fear, sell high into greed. Stay the course.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment.Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back