By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Fourth Quarter 2020 Key Takeaways

Once again, as abnormal as 2020 has been, as we still sit months away from widespread COVID vaccine implementation, as our politics grows ever more embittered, markets have continued to shrug off national and global events as they look forward to the future. Macroeconomic recovery has slowed, and employment gains stalled in December. But the tested efficacy of multiple coronavirus vaccines promises a quashing of the pandemic at some point in 2021. Investors know this, and markets respond accordingly.

During the fourth quarter the S&P 500 gained over 12%, with this surge leaving the S&P 500 up over 18% for the year. As one would expect, the rising stock tide lifted many boats, with the Russell 2000 gaining 31%, international stocks rising over 16%, and emerging markets advancing nearly 20% for the quarter.

Fixed income markets also had a steady quarter, with core US bonds up about 0.7%, and the global agg posting gains of over 3% as well. Longer term yields continued to remain historically low, though the 10-year rate did increase in Q4 2020 from 0.69% to 0.93%. In the credit markets, after dropping over 12% in the first quarter, high-yield bonds gained nearly 6% last quarter, and ended the year up almost 5%. Floating rate loans recovered strongly as well, gaining over 3% in Q4 2020, ending the year up a little over 1%.

On the macroeconomic front, the near-term economic damage from the coronavirus pandemic was severe. The commerce department reported that US GDP shrunk 31.4% on an annualized basis (meaning about 8% for the quarter) between April and June. 3rd quarter GDP made up much of the deficit, but 4th quarter GDP is expected to come in at only 4%, which is typically a strong number but in this case likely insufficient to put GDP growth in positive territory for 2020. Macroeconomic catchup growth in 2021 is likely to be strong, given continued fiscal relief, dovish monetary policy, and expected widespread vaccine distribution. On the labor front, US unemployment has fallen considerably from its peak, but progress stalled in December with the resurgence of COVID cases, leaving the unemployment rate at 6.7%

Given the demonstrated effectiveness of multiple vaccines, the economy appears well positioned for recovery as 2021 unfolds. Many states and countries have struggled with the massive logistics of getting enough shots in arms to provide herd immunity. Time is of the essence—the faster this is accomplished, the quicker and stronger the recovery will be, not to mention the thousands of lives saved in the process. President Trump signed another coronavirus relief bill that should help bridge the gap between now and herd immunity; President Biden has promised additional stimulus, and with Democratic control of the House and Senate, it is plausible that an additional relief measure will be signed and implemented.

So there are grounds for much of the market’s optimism, though we will point out that valuations have become quite frothy in recent weeks. In fact, we could be in for a repeat disconnect in 2021 between markets and the economy (and larger world). In 2020 the economy sank, people masked and isolated, while the stock market soared. At some point in 2021 we expect economic recovery, the unmasking of people, but…the market’s future is cloudy, simply because it has run so far, so fast ahead of current economic conditions. We are not predicting a bear market, but we are acknowledging that a correction or retrenchment is possible, and having benefitted from the post-March market revival, we are working to implement a balanced portfolio positioning at this time.

Fourth Quarter 2020 Investment Letter

Thanks largely to supportive monetary and fiscal policy, both in the United States and globally, markets have generally recovered their COVID-19-induced losses, with US stocks, as denoted by the S&P 500, and emerging market stocks paving the way with each garnering an 18% return for 2020; international markets trailed but still gained 8% for the year. After a 30% decline in a record 30 days in the first quarter, US stocks climbed over 60% since bottoming out on March 23rd.

Given how quickly and strongly markets have run up, we have concerns about the paths of returns going forward. US valuations are quite high, and bond yields remain low. The Biden administration may be able to provide additional stimulus via another covid relief measure, but it’s unclear whether such a bill can pass through Congress. Vaccine effectiveness is high, which is excellent news, but markets have already priced in high expectations of the future, so future gains may be more constrained in 2021. As we’ve misplaced our crystal ball, we would argue that it’s important to be prepared for various states of the world, and that is best done with a well balanced, well diversified portfolio.

Fourth Quarter 2020 Market Update

In March markets plunged with astonishing rapidity; in the nine months since they have recovered with equally astonishing speed. The S&P 500 ended 2020 up over 18%. In Q4 2020, some categories whose recovery had lagged behind the S&P 500’s, such as small caps, developed international, and emerging markets, experienced major gains and closed the performance gap considerably; small caps ended up nearly 20% for the year, developed international almost 8%, and emerging markets over 18%. If we look under the hood, however, there are still some major return differences among styles and sectors this past year. While the large cap/small cap 2020 performance gap disappeared after Q4, the growth/value gap remained—growth returned over 35% in 2020, while value returned less than 5%. There are large sectoral differences as well in 2020 returns, exacerbated by COVID—energy ended the year down by 1/3, whereas consumer discretionary rose by 1/3 and technology was up over 43%.

Both the global and US aggregate bond posted positive returns in Q4 2020, continuing a strong year for these asset classes—the global agg finished 2020 up nearly 9%, and the US agg up 7.5%. The 10-year rate rose modestly for the quarter, settling at 0.93% at the end of December. Volatility, as measured by the VIX, spiked briefly prior to the election, but calmed afterwards—it continues to occupy a middle ground, far below its peak in March but above pre-COVID levels.

Update on the Macro Outlook

We’ve had a significant amount of recovery from this recession—3rd quarter GDP growth was over 33%, and unemployment is well off its peak—but we still have a long way to go. The Fed’s monetary support, combined with the March stimulus bill, and the additional COVID relief bill in December, has alleviated much of the recessionary pain; in fact many households are financially better off than were at the beginning of 2020. However, the recovery has been uneven, and is potentially more K-shaped than V-shaped—many sectors and individuals are doing quite well, but particular sectors, such as restaurants, bars, and energy are doing poorly, and there is a risk of great suffering among those firms and employees. The unemployment rate has improved, but at 6.7% remains nearly double the unemployment rate of a year ago. The hope is that the December stimulus will help households and businesses to stay afloat until COVID is no longer a dominant concern; the Biden administration is also pursuing an additional relief bill, which if passed may create additional job opportunities in 2021 and beyond.

Fortunately, scientists have developed multiple effective vaccines to combat coronavirus. The current challenge is getting shots in arms—to vaccinate enough of the population to provide herd immunity. With the vaccine regimen currently requiring 2 doses, hundreds of millions of shots will be needed. The US, like many countries, has gotten off to a slow start with vaccine distribution, but appears to be picking up speed. The sooner people can go out without the threat of serious illness, the sooner the economy can achieve a broad recovery. In the interim, continued fiscal and monetary support for the economy, some targeted, some widely distributed, should help.

Of course, though coronavirus has correctly dominated the news, there are many other sources of market uncertainty as well. It remains to be seen whether the Biden administration will be able to cool tensions between the US and China, and to settle disputes regarding intellectual property and trade. Increased polarization in society, as demonstrated by the Capitol storming on January 6th, may yield dysfunctional governance, with the Presidency, Congress, and the courts pushing and pulling in different directions. The threat of debt and inflation, while exaggerated for many years, still needs monitoring, as debt and deficits have risen to new highs.

Portfolio Positioning

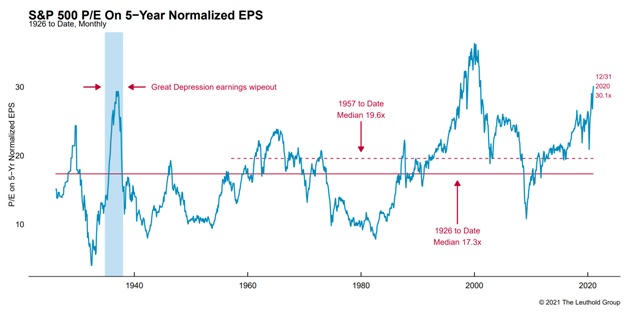

The global market recovery has been remarkable, but as noted it has not been evenly distributed. The weight of the top 10 stocks in the S&P 500 is now 28.6% of market capitalization, which is the highest that number has been in at least 25 years. The S&P 500’s surge was largely driven by technology, particularly the FANMAG stocks (Facebook, Apple, Netflix, Microsoft, Amazon, Google). The S&P 500 as a whole also has valuations at their highest level since the 2000 tech bubble.

While we are not yet at tech bubble territory, we are concerned that large cap stocks may have subdued returns over the medium term. We’re appreciative of their role in the market’s rise, and they certainly maintain a role in our diversified portfolio, but given how fast and far US stocks have grown in nine months, we feel that some portfolio de-risking is in order.

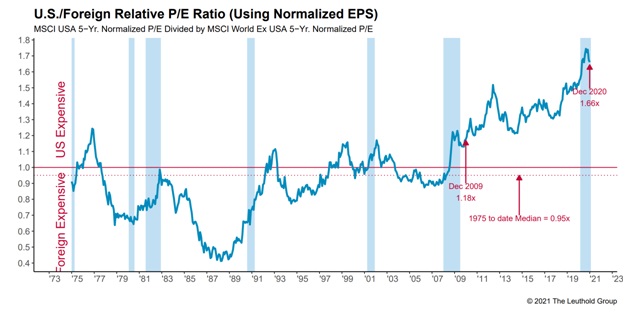

Even after a strong 4th quarter, international stocks and emerging markets still have more attractive valuations at this point in time, as do small caps and value stocks, relative to large caps and growth stocks. While credit sensitive areas of the bond market have performed extremely well off the March 2020 lows, investors should be cautious with many of these market segments moving forward. Particularly, high yield bond’s and floating rate bank note’s attractive yields may no longer justify the increased risks within bond portfolios as spreads have come in significantly. We are reducing exposure to these segments in most portfolio strategies.

We continue to recommend a broadly diversified portfolio. In the short run, we are cognizant of potentially higher short term uncertainty--therefore we are maintaining somewhat larger ballast in the form of cash and fixed income investments. We are also looking to add exposure to alternative strategies that limit downside in cases of market turbulence. In addition to taking profits from more volatile credit segments of the bond market, we believe it is prudent to look to reduce exposure to large growth companies as the segment has run far ahead of the broad market in the last several years.

Closing Thoughts

It appears the light is at the end of the coronavirus tunnel. We are hopeful that vaccination will proceed sufficiently quickly to enable increasing normalization of life and the economy as we progress through spring and summer. With respect to markets, we still see some relative upside in stocks, given the government’s intent to continue to support the economy. Bond yields look to remain low indefinitely but we would not be surprised to see some small short-term moves to higher interest rates if the recovery strengthens further. Given stretched valuations, we believe a moderate approach (with a shift towards safety) makes the most sense in the coming months.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment.Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back