By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Fourth Quarter 2019 Key Takeaways

Among global equity markets, larger-cap U.S. stocks were once again at the top of the leader board. The S&P 500 Index posted gains in every quarter and surged 9% in the fourth quarter to end the year at an all-time high. Its 31% total return was its second-best year since 1997. (It was up over 32% in 2013.) Smaller-cap U.S. stocks rose 25.4% for the year.

Foreign equity markets were also strong. European stocks gained 9.9% in the fourth quarter and 24.9% for the year. After struggling in the third quarter, emerging-market (EM) stocks shot up almost 12% in the fourth quarter and returned 20.8% for the year, as trade war concerns lessened.

The core bond index was flat in the fourth quarter but gained 8.6% for the year. This was its best annual return since 2002. Below-investment-grade bonds also fared well in 2019. High-yield bonds gained 14.4% and the floating-rate loan index rose more than 8.6%.The emerging market local currency bonds index was higher by 13.5% in 2019.

Why did both stocks (risky assets) and bonds (defensive assets) appreciate sharply in 2019? The key driver was the Federal Reserve’s sharp U-turn toward accommodative monetary policy. This was followed by other central banks across the globe. Coming into 2019, the Fed was indicating it expected to continue to raise interest rates. This led investors to fear that higher rates could tip the U.S. and global economies into recession, bringing an equity bear market with it. The ongoing U.S.-China trade conflict didn’t help matters. The Fed’s green light allowed risk assets to move higher while concerns over continued rising rates essentially disappeared.

Ultimately, the Fed ended up cutting rates three times in the second half of 2019. Late in the year, it also started expanding its balance sheet again via purchases of Treasury Bills in order to boost banking system reserves and inject liquidity into the short-term lending markets. Other major central banks also cut rates and/or provided additional stimulus to the markets during the year. This lessened recession fears.

Meanwhile, inflation (and inflation expectations) remained at or below central bank targets. This lifted concerns that interest rates would be hiked anytime soon, and the bond market rallied.

U.S. equity investors responded to the Fed policy reversal and stimulus much as they have during the past 10 years—by bidding up stock prices and valuations. A détente in the U.S.-China trade war late in the year (the “phase one” deal) was an added boost to market sentiment. Importantly, earnings growth did not drive U.S. stocks higher; the majority of the S&P 500’s return came from expanding valuations. Thus, the valuation risk in U.S. stocks, which we’ve highlighted for some time now, has only gotten worse. Therefore, future return expectations for stocks should be somewhat constrained.

There are reasons to be cautiously optimistic for financial markets in 2020: Monetary policy is easy, recession risks seem to be receding, and some geopolitical risks have abated. That said, we are watching a number of potential short-term risks. Given we think recent positive developments have largely been incorporated into prices and valuations are stretched for U.S. stocks and bonds, markets are particularly vulnerable to any disappointment or negative surprise. If that comes to pass, we stand ready to take advantage of any potential opportunities that come of that volatility.

Fourth Quarter 2019 Investment Letter

Market and Performance Recap

Our portfolios generated strong returns for 2019, a bullish year for nearly all financial markets. The positive broad-based returns marked a dramatic (and welcome) turnaround from 2018, a year in which nearly all asset classes faltered.

This year’s surprising returns were fueled by a U-turn in monetary policy, as policymakers shifted gears to support a weakening global economy. After tightening financial conditions (raising short- term rates) four times in 2018, the Federal Reserve reversed course and began implementing a more dovish monetary policy (lowering short-term rates three times). Other major central banks also cut rates or provided additional stimulus to the markets via quantitative easing during the year, lessening global recession fears.

U.S. stocks rose in every quarter and surged an additional 9% in the fourth quarter as the United States reached a tentative “phase one” trade agreement with China. The S&P 500 Index’s 31% total return was its second-best year since 1997. (Bested only by 2013’s 32% gain.) Smaller-cap U.S. stocks rose 25.4% for the year.

Foreign markets were also strong. European stocks gained 9.9% in the fourth quarter and 24.9% for the year. After a weak third quarter, emerging-market (EM) stocks shot up nearly 12% in the fourth quarter and returned 20.8% for the year.

The 10-year Treasury yield dropped from 2.70% at the start of the year to as low as 1.45% in September, ending the year at 1.92%. Investment-grade bonds gained nearly 9%. Credit markets also rallied amid this supportive monetary policy environment: high-yield bonds earned 14.4% and the floating-rate loan index rose 8.6%.

What’s Next for 2020?

After a year like 2019, the obvious question looking ahead is how much higher can equities go? For many years, assets have been flowing into U.S. stocks on the back of a strong U.S. dollar and the United States’ perceived safe-haven status relative to other global economies. In this respect, 2019 was largely an exclamation point on the decade’s investment pattern.

As we look ahead to financial markets in 2020…

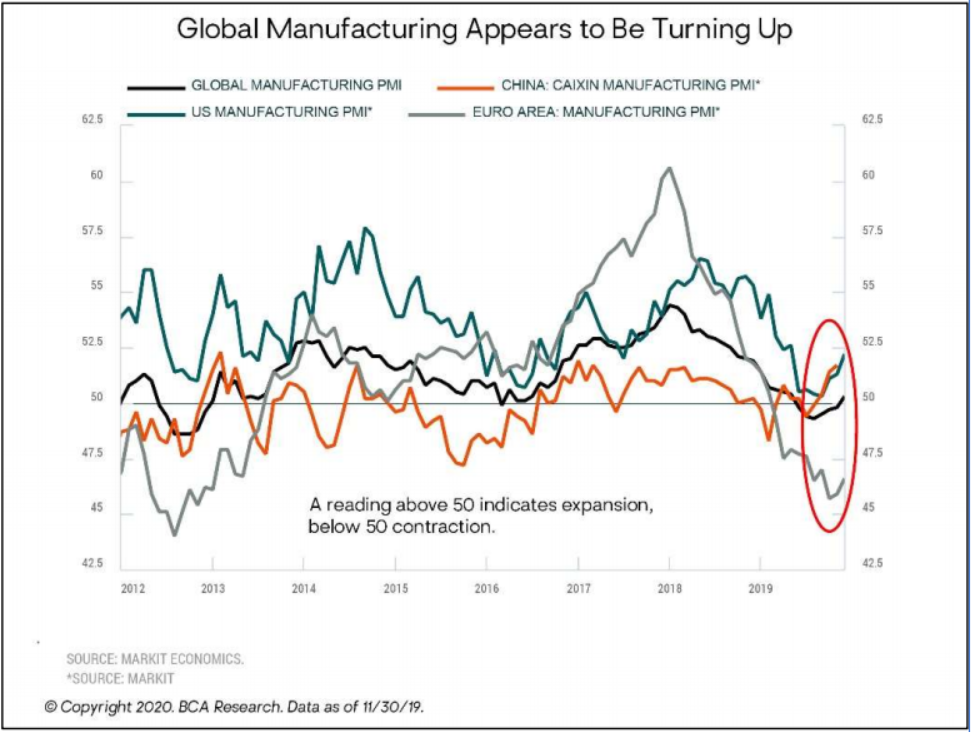

there are reasons to be cautiously optimistic for financial markets. Accommodative central bank monetary policy and easier financial conditions should continue to support at least a modest rebound in global economic growth. As just one point of reference, the Global Manufacturing Purchasing Managers’ Index (PMI) has risen for four consecutive months and inched into

expansion territory (above 50) in November. Along with reduced U.S.-China trade risk, this suggests the global economy may be on the rebound. The U.S. consumer also remains in good shape as ongoing labor market strength, wage growth, and low interest rates should continue to support consumer spending and the housing market. These are all positive trends which suggest further asset appreciation is quite possible.

However, this modestly positive outlook is consistent with the consensus view, meaning that financial markets have already responded positively to these developments. The risk of an unpleasant market surprise or deterioration in the macro environment in 2020 shouldn’t be ignored. A critical question is always, “What’s in the price?” In this regard, we note that it wasn’t corporate profit growth that drove U.S. stocks higher in 2019.

Reported earnings for the S&P 500 were actually flat over the first three quarters, and mid-single- digit percentage growth is projected for the fourth quarter. The lion’s share (roughly two-thirds) of the S&P 500’s 31% return came from a sharp expansion in valuations. We believe such

stretched valuations leave U.S. stocks particularly vulnerable to disappointment or negative surprises in the macro environment. If companies do not deliver earnings growth in 2020, stocks will be a greater risk in portfolios.

So, we’re going to devote a bit more column space to risks in the macro environment, as the more positive aspects of the global economy have already been priced in. As we have been adopting a moderately defensive posture, it behooves us to enumerate the reasons why.

1. U.S. trade wars. Yes, the phase 1 trade deal with China is a welcome relief. But trade relations with China are still strained, with many tariffs still in place. Furthermore, as President Trump has an affinity for protectionist trade policies, he could well reset his attention to the EU, as he has decried their trade policies during his presidency. We’re potentially out of the frying pan and into the proverbial fire.

1. U.S. trade wars. Yes, the phase 1 trade deal with China is a welcome relief. But trade relations with China are still strained, with many tariffs still in place. Furthermore, as President Trump has an affinity for protectionist trade policies, he could well reset his attention to the EU, as he has decried their trade policies during his presidency. We’re potentially out of the frying pan and into the proverbial fire.

2. Slow wage growth. Continued slow wage growth has the upside of containing inflation, and maintining the likehihood of dovish Fed policy. But the downside of slow growth is obvious—it’s slow growth in the economy.

3. The yield curve. We are pleased that the yield curve has uninverted, as the inverted yield curve preceded each of the past seven US recessions. However, uninverting hasn’t eliminated the recession risk—the yield curve also regained its upward slope prior to the 1990, 2001, and 2008 recessions.

4. Geopolitical risks. Brexit, Iran, North Korea, Hong Kong-China, US election uncertainty…so far, markets have taken these geopolitical risks in stride, and while that’s likely to continue, we’d again emphasize that global political stability is already priced into markets, and that unexpected deviations will have repercussions.

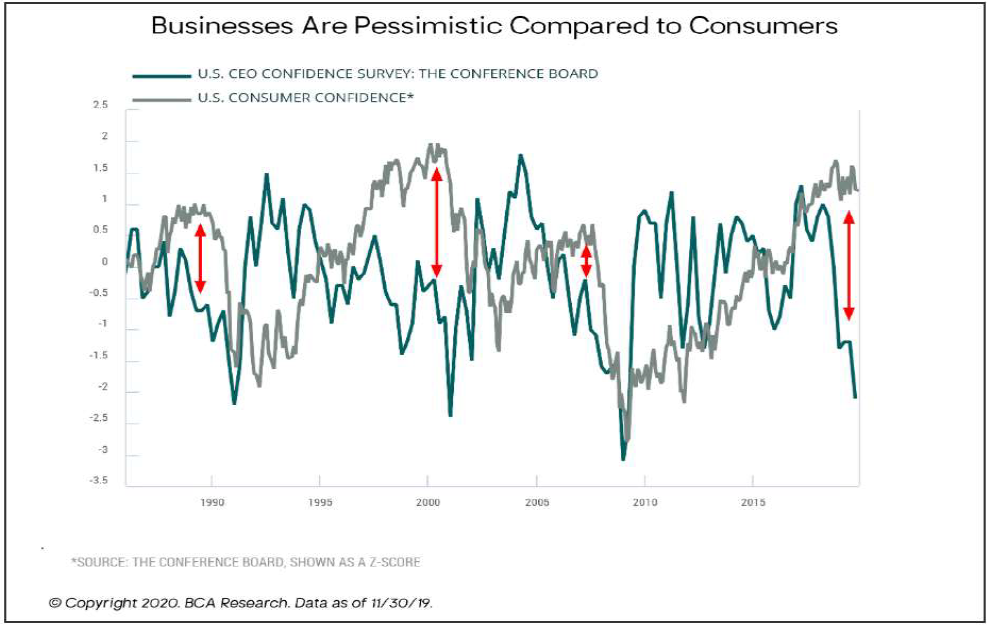

5. Falling CEO confidence. CEO confidence is already at recessionary levels. If US consumer views start aligning with CEO views, as they have historically, economic performance is likely to suffer throughout the global economy. The markets have been amazingly resilient to geopolitical shocks over the last few years, but it is difficult to know what news could see the markets react in a much more negative manner.

We’re not projecting a recession for 2020. But we believe markets have been sanguine about global risks as valuations have risen to unusually high levels. There is a modest but very real risk of geopolitical shocks or relatively weak economic news, and we believe it is prudent to balance upside capture with mitigation of downside risks.

Portfolio Positioning and Outlook

While we watch and weigh the ramifications of short-term risks, it’s important to reiterate that we don’t invest based on 12-month market forecasts. The uncertainty is too high and the unknowns too many. More important and most relevant for our investment process is our outlook for the next several years, not months. In this respect, our assessment of the risks and opportunities remains consistent with what it’s been over the last few years..

With U.S. stocks expensive and high risk, we continue to see more attractive investment opportunities elsewhere: in foreign stocks, flexible bond funds, and selected alternative strategies.

Should the positive global growth outlook for 2020 play out, we’d expect foreign stocks to outperform U.S. stocks, given their higher cyclicality, superior valuations, and sensitivity to overall GDP growth. Receding Brexit uncertainty should also help prop up European markets, in particular. Furthermore, to the extent the U.S. dollar weakens in this environment—due to it being a counter- cyclical currency—that will help foreign stock returns (for dollar-based investors).

Our tactical exposures to flexible bond funds and alternative strategies run by skilled managers are particularly attractive in this environment given their ability to actively manage their portfolio risk exposures (e.g., dialing down risk when the reward is not commensurate) and take advantage of market inefficiencies and opportunities when they appear. Not only do these strategies provide valuable portfolio diversification, but we also expect them to deliver better medium-term returns than a traditional mix of U.S. stocks and core investment-grade bonds.

These tactical opportunities are relatively attractive, but none of them are without their own risks. There are very few table-pounding, valuation-based fat pitches in the investment markets these days. Ten-plus years of unprecedented central bank stimulus and interest rate repression have inflated the prices of most financial assets, if not the actual global economy.

Given this backdrop—weighing the shorter- and medium-term risks and return opportunities and considering the economic fundamentals versus financial market valuations—we think the wisest course for balanced investors continues to be a broadly diversified, moderately defensive posture.

As always, we appreciate your confidence and trust in us. We wish everyone a happy, healthy, and peaceful New Year.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment.

Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back