By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Third Quarter 2020 Key Takeaways

As much as we are still mired in the COVID‐19 crisis, not to mention 2020 election mudslinging, markets have largely continued to shrug off the coronavirus as it looks forward to the future. There is an unusual disconnect right now between public life, the macroeconomy, and the market. Public life is still nowhere near normal, and with coronavirus cases exploding in Europe and rising yet again in the US, life won’t be normal again for many months. The economy is continuing to recover, but the pace of recovery has slowed considerably. The market, meanwhile, continues to grow apace.

During the third quarter the S&P 500 gained almost 9%, and as of September 30th, this surge had the S&P 500 up over 5% for the year. As one would expect, the rising stock tide lifted many boats, with small caps gaining 5%, large caps gaining 9%, international stocks rising almost 5%, and emerging markets advancing nearly 10% for the quarter.

Fixed income markets also had a steady quarter, with core US bonds up about 0.6%, and the global agg posting gains of nearly 3% as well. Yields continued to show remarkable stability, with the 10‐year yield holding between 0.50% and 0.80% for the entire period, and closing at 0.69% as of September 30th. In the credit markets, after dropping over 12% in the first quarter, high‐yield bonds continued making up ground in Q3, up over 4% over that span. Floating rate loans recovered strongly as well, gaining over 3% in Q3 2020. Overall, high yield and floating rate loans are still down 1% and 2%, respectively, as of September 30th.

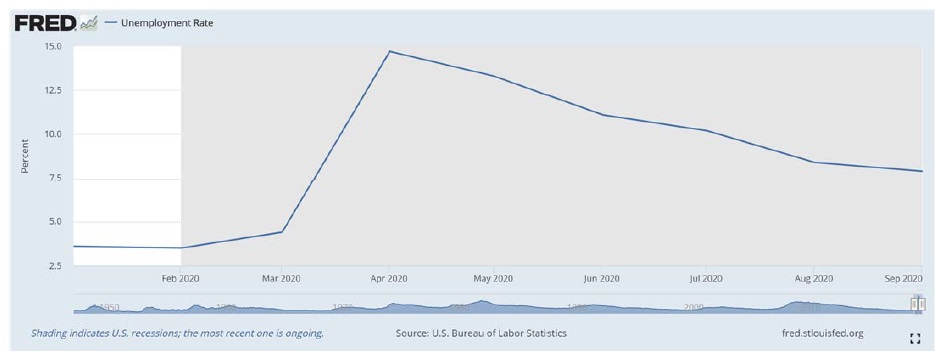

On the macroeconomic front, the near‐term economic damage from the coronavirus pandemic was severe. The commerce department reported that US GDP shrunk 31.4% on an annualized basis (meaning about 8% for the quarter) between April and June. Fortunately, GDP is expected to have rebounded about 30% in the quarter that has just ended, but 4th quarter expectations are more muted. Overall, while the economic fallout could have been worse, both US and global growth are expected to be negative for 2020. On the labor front, US unemployment has continued to fall, but job growth is accumulating more slowly now, leaving unemployent stubbornly high at 7.9%.

The shape of the recovery will depend on our ability to beat COVID‐19. On the plus side, vaccine and therapeutics testing continues apace, and fiscal support from the government combined with monetary intervention from the Fed has blunted the financial impact of coronavirus on millions of Americans. On the negative side of the ledger, coronavirus caseloads have mushroomed, recent economic indicators suggest that the recovery is slowing, and any additional stimulus has to pass through two choke points—an agreement between President Trump and Nancy Pelosi, then passage by a Republican US Senate with many members averse to a large stimulus.

Remember, though, that markets are very much forward looking, and their continued revival suggests the view that the COVID‐19 nightmare, however overwhelming it can be at times, will come to an end. But getting through the next few months may be a very bumpy ride—we’re facing the ups and (currently) downs of coronavirus news, uncertainty and potential chaos with respect to the US Presidential election and its impact, and more.

Third Quarter 2020 Investment Letter

Thanks largely to supportive monetary and fiscal policy, both in the United States and globally, markets have generally recovered their COVID‐19‐induced losses, with US stocks paving the way with over a 5% return for the S&P 500 as of September 30th, and international and emerging markets down modestly at ‐7% and ‐1%, respectively. After a 30% decline in a record 30 days in the first quarter, US stocks climbed over 50% since bottoming out on March 23rd.

While markets are in a vastly improved position, we do have concerns about the paths of returns going forward. US valuations are high, bond yields are low, additional stimulus is in question, and coronavirus vaccine progress, while promising, is still far from certain. Markets have already priced in fairly high expectations of the future, so we do expect some choppiness for the remainder of 2020. As we’ve said before, it’s important to be prepared for various states of the world, and that is best done with a well balanced, well diversified portfolio.

Third Quarter 2020 Market Update

In March markets plunged with astonishing rapidity; in the six months since they have recovered with equally astonishing speed. The S&P 500 ended Q3 2020 up over 5% year to date. Most broader categories—small caps, large caps, developed international, and emerging markets—climbed a similar percentage over the past 3 months. If we look under the hood, however, there are major return differences among styles and sectors this year. For instance, large growth has an over 20% return this year, in large part thanks to technology stocks, whereas small value is still down over 20% as of September 30th. By sector, energy is down over 48% YTD, and financials over 20%, whereas consumer discretionary has returned over 23% and technology 28%.

Both the global and US aggregate bond posted positive returns in Q3 2020, continuing a strong year for these asset classes—the global agg is up nearly 6%, and the US agg nearly 7%. The 10‐year rate has once again held steady for the quarter, settling at 0.69% at the close of September. Volatility, as measured by the VIX, didn’t change in much in Q3—it’s occupying a middle ground, far below its peak in March but still well above pre‐COVID levels.

Update on the Macro Outlook

We’ve had a significant amount of recovery from this recession—3rd quarter GDP growth is expected to be impressive, and unemployment continues to fall—but we still have a long way to go. The Fed’s monetary support, combined with the March stimulus bill, has alleviated much of the recessionary pain; in fact many households are financially better off than were at the beginning of 2020. However, the recovery is starting to appear more Kshaped than V‐shaped—many sectors and individuals are doing quite well, but particular sectors, such as restaurants, bars, and energy are doing poorly, and there is a risk of great suffering among those firms and employees. Employment has rebounded, but we’ve still only recovered about half of the job losses since March, and the pace of job growth has slowed, as seen in the chart below. We’ve probably picked off much of the lowhanging fruit in terms of employment recovery; much of the remaining excess unemployment is concentrated in industries more directly affected by COVID‐19.

The US economy is still relying on the same one‐two punch for its ultimate recovery. First, continued monetary and fiscal support for the economy, potentially targeting more finely those sectors and individuals most acutely affected by COVID‐19. Second, continued preventative measures, combined with improved COVID‐19 treatments, until an effective vaccine becomes widely distributed.

Therapeutics and vaccine trials have shown significant promise, helping ease market fears of a more severe downturn. The Fed and other central banks continue to indicate they will be all‐in on providing monetary support through the coronavirus, and it is possible that the House and Senate will come to an agreement on additional aid for workers and businesses bearing the brunt of COVID‐19. The long‐term prognosis for defeating coronavirus is promising, but the short‐term challenges for the United States remains high.

On top of the pandemic we still have many preexisting sources of uncertainty, including souring US‐China relations and the November election. The country and the world have a lot on their plate right now.

Portfolio Positioning

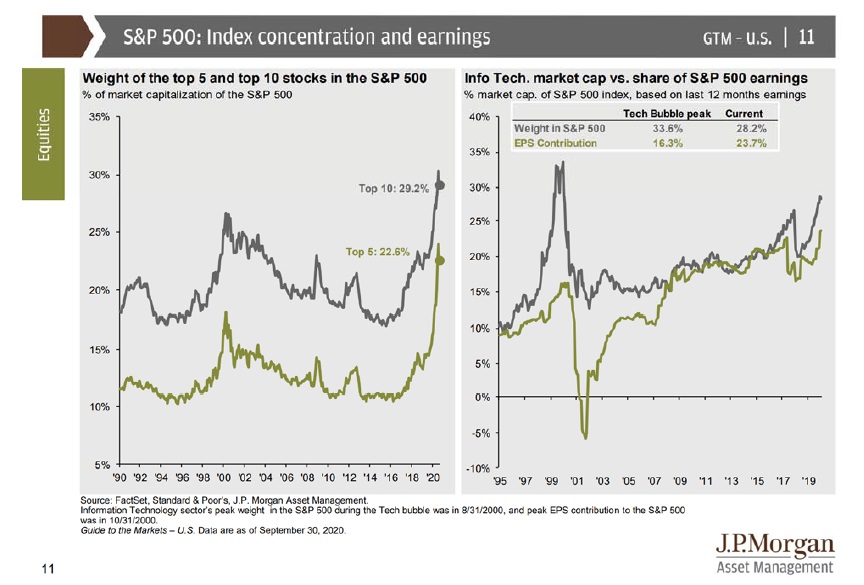

The S&P 500’s recovery over the past 6 months has been remarkable, but we should note that it has been a very tech heavy surge. The FANMAG stocks (Facebook, Apple, Netflix, Microsoft, Amazon, Google) have powered the S&P 500’s upturn, and are a major reason that US large caps have made gains for the year, while international funds are still down, and emerging markets are roughly flat.

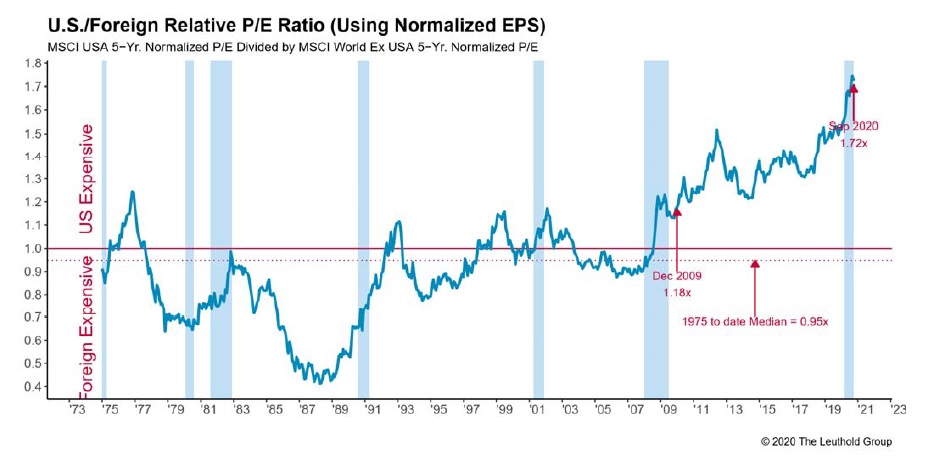

While not as extreme as the tech bubble (note that earnings are stronger for tech now than they were then), the explosion in tech stock prices has raised concerns for us as to whether such growth is likely to continue. We’re appreciative of their role in the market’s rise, and they certainly play a role in our diversified portfolio, but given how fast and far US stocks have grown in six months, we feel that some portfolio de‐risking is in order.

International stocks and emerging markets simply have more attractive valuations at this point in time, as do small caps and value stocks, relative to large caps and growth stocks. Despite low yields, bonds offer greater safety at this time than do equities. Moreover, areas such as high‐yield, floating‐rate and some multi‐sector approaches that target segments such as non‐agency mortgages and asset‐backed securities can boost yield within bond portfolios.

The approaching US elections may also provide additional market volatility in the coming weeks. As of this writing it is clear that Biden is favored to win over Trump, but there’s significant uncertainty‐‐a modest polling error in Trump’s favor could yield a nail‐biter election that’s litigated heavily in the courts, whereas a modest polling error in Biden’s favor would likely result in a landslide. Furthermore, while the House is likely to stay in Democratic hands, Senate control is up for grabs, which is critical because any significant legislative accomplishments by a potential President Biden would require Democrats to regain control of the Senate.

While a Trump versus a Biden presidency would have differentiated effects on various market sectors, we would like to emphasize that over history markets have grown steadily under both Republican and Democratic administrations. To cite the most recent and obvious example, US equities have performed quite well under both the Obama presidency and the Trump presidency.

So we continue to recommend a broadly diversified portfolio. In the short run, we are cognizant of potentially higher short term uncertainty‐‐therefore we are maintaining somewhat larger ballast in the form of cash and fixed income investments. In some portfolio strategies, we have added an exposure to a volatility ETF which can help protect a portfolio if we witness a spike in negative volatility around the election. Besides providing greater safety, these portfolio positionings provide the ability to be proactive if the market backslides.

Closing Thoughts

We anticipate continued volatility in the remainder of 2020 as the markets navigate the fight against COVID‐19 and the upcoming U.S. election. While some upside remains in stocks given the unprecedented stimulus from the government and low bond market yields, we believe a moderate approach (with a bit of a shift towards safety) makes the most sense until we get more clarity on several fronts. Valuations appear even more stretched for many stock market winners this year than they did a quarter ago, while the harder hit stocks have clear hurdles given the current economic reality. Positions in areas such as small cap value, developed international, and emerging market stocks all appear attractive in terms of potential to add value over U.S large caps in the coming years. However, if we witness another leg down in stocks this year, these areas will likely see declines greater than those of core U.S. stocks. With the Federal Reserve supporting bonds on many fronts, we believe diversifying across numerous, higher‐yielding bond categories will improve returns over core bonds moving forward (though core bonds will likely offer more protection if we see a market pullback in the last 2 months of 2020).

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment.Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back