By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Jobs Report was great… Now we just need more of them.

Economic forecasters had one of their biggest whiffs when they predicted 8.5 million job losses in the June unemployment report and a rise in unemployment to 19.8%1. Instead, the Bureau of Labor Statistics reported an increase of 2.5 million jobs, and a fall in the unemployment rate to 13.3%. The forecast was off by an astonishing 11 million jobs.

The most likely reason for this forecasting error was the unexpectedly fast impact of the Paycheck Protection Program passed by Congress. Essentially, the program provided small business loans that would not need to be paid back if they were mostly spent on rehiring and retaining employees. Economists expected to see a major employment impact from this program beginning in June; instead, the big numbers started a month early. About two thirds of the job gains came from restaurants and retail stores, which were key beneficiaries of the Paycheck Protection Program2.

But what does one fantastic month mean for the path of economic recovery as a whole? First, the employment surge means that concerns about permanent job losses should be lessened slightly. Our hope has always been for a v-shaped recovery, in which jobs revive as fast as they disappeared, and this report provides evidence that a piece of the recovery looks to be v-shaped. Fast recovery is particularly important because the longer the economic slump, the more likely it is that temporary job losses will become permanent.

Markets certainly welcomed the strong employment report, as the S&P rose about 3% that Friday, and the 10- year bond market yield climbed to over 0.9%. The rally continued on the ensuing Monday, bringing the S&P 500 into positive territory for 2020 before a pullback later in the week.

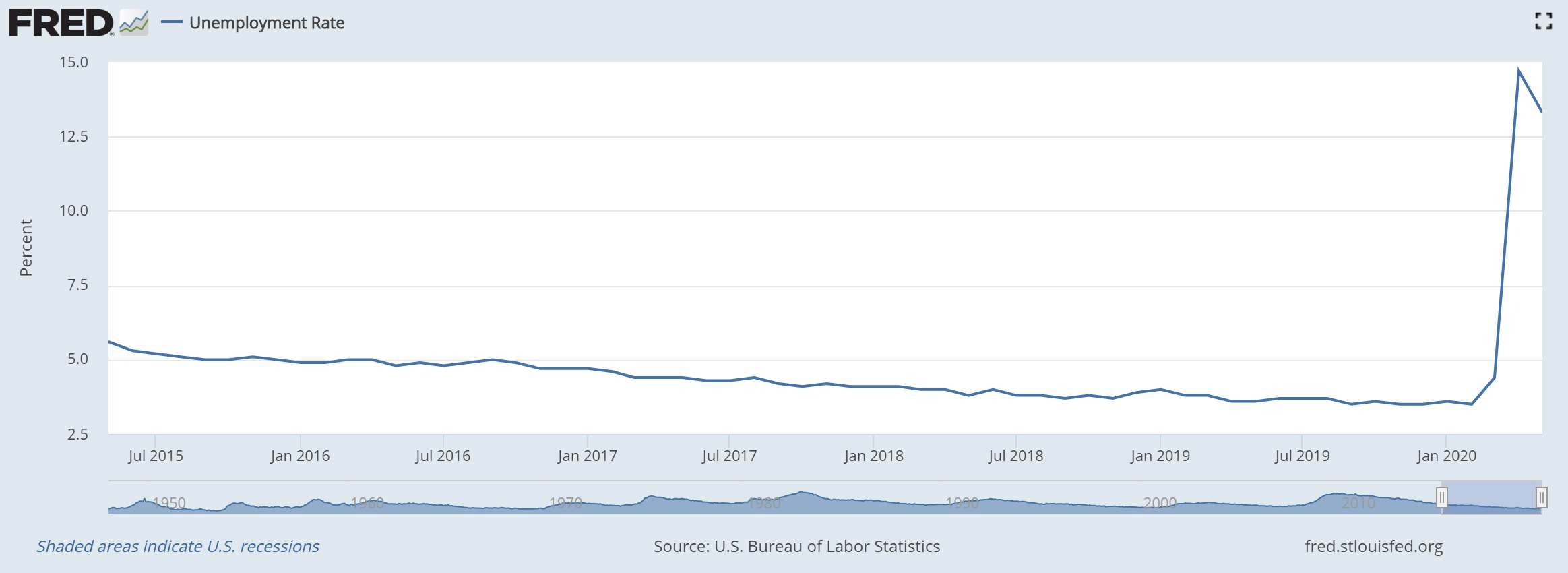

But while trends are good, the current levels of unemployment are still very high. As the chart below shows, at this point we’ve only recovered a small fraction of the jobs lost in the preceding months.

On the surface, we expect strong job numbers going forward for the next month or two, from both the ongoing impact of the Paycheck Protection Program and from businesses reopening as states continue to relax coronavirus restrictions. However, with new coronavirus cases still in excess of 10,000 per day, the economy is unlikely to fully recover until caseloads fall, treatments improve, or a vaccine is found. In the interim, we will likely need an additional measure of government aid for businesses and employees still hampered by COVID-19, and for states and localities whose budgets have been devastated by revenue shortfalls due to this (hopefully) brief but very intense recession.

1 https://twitter.com/Neil_Irwin/status/1268882554821672960

2 https://www.washingtonpost.com/business/2020/06/05/unemployment-rate-wrong/

The material in this work is proprietary to and copyrighted by Peak Advisor Group and is used by JMS Capital Group Wealth Services LLC with permission.| Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. | Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.| The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.| All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.| The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index. | The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.| Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.| The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998. | The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.| The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.| International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.| Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.| Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.| Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.| Past performance does not guarantee future results. Investing involves risk, including loss of principal.| You cannot invest directly in an index.| Stock investing involves risk including loss of principal.| The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.| There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.| Asset allocation does not ensure a profit or protect against a loss.| Consult your financial professional before making any investment decision.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

‹ Back