By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Promise of Good Stewardship: Dan Rooney & ESG Investing

Dan Rooney, the Master Builder

Earlier this month, Pittsburgh lost one of its civic icons with the passing of Steelers owner Dan Rooney. Rooney reached the pinnacle of success as a team builder, as he helped transform the Steelers from a laughingstock into a 6 ‐time Super B owl champion, but he was arguably equally famous for his humility and stewardship of the NFL as a whole. Rooney was instrumental in ensuring good governance at the NFL—from owners, as shown by his understanding that the competitive balance derived from revenue sharing would best grow the league— to players, whose trust in Rooney helped maintain a strong record of labor peace—to coaches, in which under the “ Rooney Rule” minority coaching applicants were better able to get their foot in the door with NFL Teams. Rooney’s life and character illustrate that success, including financial success, is derived not only from business acumen, but also from goo d business practices.

Similarly, in the investment world, there has been increasing evidence that success in business is linked to good governance practices in corporations. What may be surprising, though, is that better corporate performance has been associated with strong environmental, social and governance (ESG) practices.

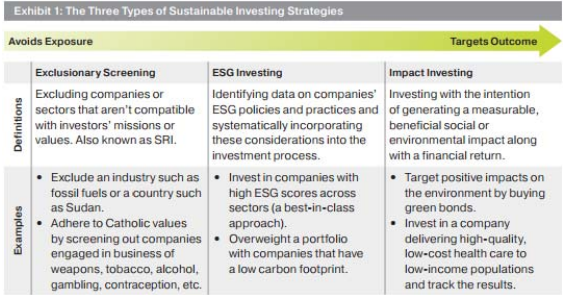

If this finding is counterintuitive, it may be in part be cause ESG in vesting has been lumped in with socially responsible investing (SRI) and impact investing. While there is no hard and fast rule for delineating these strategies, Exhibit 1 helpfully divides sustainable investing strategies into 3 categoriesi.

The 3 Categories of Sustainable Investing

The first category is exclusionary screening, or SRI. This investment philosophy excludes certain companies or sectors that are incompatible with an investor’s values or goals. The last category is impact investing, which tends to be specific, targeted investments seeking a particular social or environmental impact, in addition to a financial return. At JMS Wealth Services, we are well aware of these investment arenas, and have helped clients construct their portfolios around specific principles. As far as expected returns or risk from such investment styles go, we believe that these depend upon the specific details of the investment strategy—broad exclusionary screening has a greater impact on a portfolio than narrow screening, for instance. Impact investing can be quite narrowly focused, which could open up the possibility of higher returns, but also higher risk.

In this article we will focus mostly on the second type of sustainable investing strategy, which is ESG investing. We do this in large part because ESG investing is more broadly practiced across the investment world, and because it has been more closely studied with respect to its return and risk profile.

What is ESG?

Firms that evaluate companies’ ESG practices provide both a qualitative and quantitative assessment of about 100 specific ESG‐related issues. With respect to environmental issues, evaluators may look at greenhouse gas emissions, raw materials sourcing, and waste production and disposal. With respect to social issues, assessors examine companies’ labor management practices, health and safety measures, and the impact of their products on consumers. With respect to governance, ESG evaluators assess executive compensation relative to industry peers, business ethics safeguards, minority and gender hiring, and shareholder rights.

Who Reports ESG?

In 2011, only 20% of S&P 500 companies published sustainability reports; by 2015, 81% did. A large number of third party firms are gathering data on companies’ ESG practices as well, including MSC, Thomson Reuters, and Bloomberg. Analysts and shareholders have become increasingly active in evaluating firms by ESG scores, often seeking to spur companies to reach higher ESG standardsii.

Who Cares About ESG?

Millennials. A 2014 US Trust survey found that 67% of Millennials—vs 36% of Baby Boomers—believe investments “are a way to express social, political, and environmental values.”iii And in a 2015 TIAA survey, 90% of affluent Millennials said they were interested in realizing competitive returns while also promoting positive social and environmental outcomesiv. Given that $30 trillion in wealth will be transferred from Baby Boomers to Millennials over the coming decades, ESG investing is here to stayv.

But isn’t an earthy, crunchy, hippie style of investing doomed to be a pathetic failure when compared to a self‐ interested and laser focused strategy designed to simply make money?

Apparently not.

Deutsche Bank examined 2,200 studies of sustainable investing and found positive correlations between strong ESG practices and corporate financial performance for companies in every region of the world. The positive correlations held up across equities, bonds and REITsvi.

Oxford University researchers combined the findings of 200 empirical ESG studies and discovered that 88% of the research showed that solid ESG practices result in better operational performance of firms, which ultimately translates into cash flows, and 80% of the research showed that stock price performance of companies is positively influenced by good sustainability practicesvii.

An AQR study published in February of 2017 found that ESG exposures may be informative about the risks of individual firms, as it appears that ESG exposures may inform investors about the riskiness of securities in a way that complements (and is not fully captured by) traditional statistical risk modelsviii.

AQR’s findings dovetail with earlier work by Calvert Investment and Harvard researchers, who found that ESG issues were not widely understood or quickly incorporated into stock prices, thereby creating an opportunity for alpha (excess returns). In fact, over the past 20 years, companies ranked in the top 10% for ESG factors have significantly outperformed those ranked in the bottom 10%ix

The Bottom Line

Oppenheimer Funds has a great quote about ESG investing: “Sustainable investing isn’t about changing the world; it’s about understanding how the world is changing.”

At JMS Capital Group Wealth Services, we have an understanding of ESG investing, and can tailor your investments to suit your values. As we have demonstrated, investing with emphasis on ESG principles does not appear to raise portfolio risk or lower returns—in fact, historical experience would indicate that the opposite is more likely. A further benefit of ESG investing is that it reduces the temptation to chase returns, since if you have an investment plan that aligns with your principles, it is easier to abide by it even during periods of underperformance.

And coming full circle, we believe that principles and values are what ultimately give you the best chance at doing your best in any walk of life. In that spirit, we will end this missive the way we began, with a tribute to Dan Rooney, as relayed by Sports Illustrated’s Peter King. King writes about a year in which the Steelers announced that they were not raising ticket prices, and several NFL owners were unhappy, feeling that Rooney was not doing his fair share to increase league‐wide revenue. Rooney’s response was as crisp as a Terry Bradshaw spiralx: “I’m not concerned about your share. You’ve got money—we’ve all got enough money. I’m concerned about our fans and their ability to afford the tickets.”xi

Growing the product or protecting the brand can yield better long‐run returns than trying to squeeze every last immediate dollar out of customers. Dan Rooney took the long view with respect to the NFL, and as Saturday’s Earth Day celebrations would suggest, it may be wiser to take the longer, more sustainable view with respect to environmental, social and governance factors—and it might even be better for your portfolio as well.

— JMS Team

i Source: Oppenheimer Funds: “Understanding ESG Investing”, by Sharon French, CIMA, February 15, 2017.

ii Source: Oppenheimer Funds: “Understanding ESG Investing”, by Sharon French, CIMA, February 15, 2017.

iii Source: 2014 U.S. Trust Insights on Wealth and Worth Survey.

iv Source: Oppenheimer Funds: “Understanding ESG Investing”, by Sharon French, CIMA, February 15, 2017.

v Source: Accenture: “The ‘Greater’ Wealth Transfer: Capitalizing on the Intergenerational Shift in Wealth”, 2016.

vi Source: Oppenheimer Funds: “Understanding ESG Investing”, by Sharon French, CIMA, February 15, 2017.

vii Source: “From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance,” University of Oxford and Arabesque Partners,

September 2014.

viii Source: AQR: “Assessing Risk through Environmental, Social, and Governance Exposures”, February 24, 2017.

ix Source: “The Financial and Social Benefits of ESG Integration: Focus on Materiality,” Calvert‐Serafeim Research Series, Calvert Investments, June 2016.

x Source: Ben Roethlisberger, for all the Millennials reading this.

xi Source: “On Dan, Dean, and the Draft”, Peter King’s Monday Morning Quarterback, in Sports Illustrated, April 17, 2017.

Disclosure:

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

‹ Back