By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

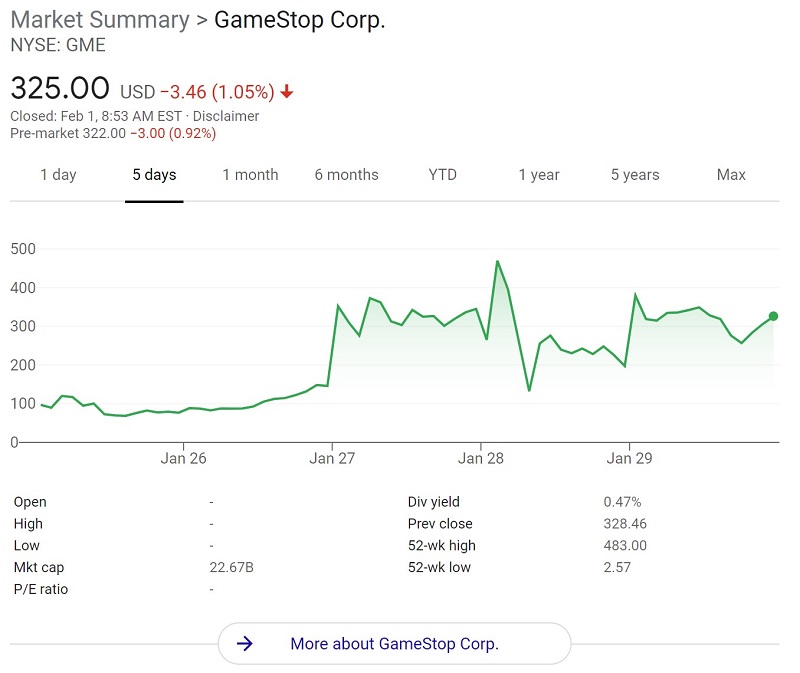

What’s Up with GameStop?

Source: Google Finance

Source: Google Finance

Well, that escalated quickly.

If a group of Redditors dislike hedge funds, dislike the idea of shorting a gaming company that has sentimental value for many, dislike the idea of shorting a company in general, they can…buy up the stock, buy up call options on the stock, push up the stock’s price, squeeze out the hedge funds. And in so doing, they set the internet ablaze with a morality play--the triumph of good over evil, small investors over hedge funds, have-nots over the haves, right?

Maybe, but whatever the backdrop, Gamestop simply looks like a speculative bubble to us. There’s been no fundamental change in the gaming market that would suggest Gamestop’s stock price should have risen from under $19 per share at the end of 2020 to $325 per share at the end of last week.

Is there any harm in the bubble? If you’re in early and get out at the top, you’ll make a lot of money. If you’re the last one in and the bubble pops, you’ll lose a lot of money. We’re more concerned about potential spillover effects to the broader markets—for example, hedge funds may sell FANMAG stocks, depressing their prices, to raise cash to close out their short positions. With the S&P 500 dropping over 3% last week, we’re watchful, but market moves of 3% in a week are not uncommon, and are in and of themselves no cause for alarm. So far, in early Monday trading, the S&P 500 is up 50 basis points, and Gamestop is down 17%, so the bubble has been deflating, at least for now.

As for investing in Gamestop, we’ll subscribe to the excellent Matt Levine’s view of speculative investing, as expressed at https://www.bloomberg.com/opinion/articles/2021-01-28/knowing-when-to-sell-gamestop-stock-at-the-top-is-impossible. Levine writes: “We have discussed before the sort of creaky U.S. rules around who can buy what sorts of risky investments, and I have proposed a simple standard. I call it the “Certificate of Dumb Investment.” Under this standard, anyone can buy diversified low-fee mutual funds to their heart’s content, but to buy dumb stuff—private placements but sure let’s say also volatile meme stocks—you have to go down to the local office of the Securities and Exchange Commission and sign a form saying that you know that what you’re doing is dumb, you know you will probably lose all your money, and you forfeit forever any right to complain.”

Gamestop is a fun story to follow, but not a roller coaster we’re looking to ride.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back