By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Bull or Bear?

We don’t have ironclad expectations on market performance for the upcoming year. Valuations are elevated for the S&P 500, and the strong returns for that index in 2023 was heavily driven by a handful of tech stocks. Inflation has fallen, and rate cuts are likely in store this year, but markets have already priced in this most or all of this good news. We don’t have a crystal ball, but Barry Ritholtz has issued a useful summary of likely issues that could move markets up or down this year.

On the bull side, Ritholtz observes that the S&P 500, despite all its gains in 2023, has nonetheless been flat over the past 2 years due to the downturn in 2022, suggesting that there is still room for markets to run. Macroeconomic indicators have shown promise as well—inflation is down, housing inflation (according to Ritholtz) has likely been overstated, and the Fed has indicated it expects to cut rates 3 times in 2024. Ritholtz notes that following a big up year, markets gain an average of 9.7% during the following year, if recession years are excluded. That’s a big if, but the US economy appears more poised to stick a soft economic landing that was expected by economists a year ago.

On the bear side, Ritholtz points out that the impact of monetary policy tends to accrue over time, so that the full effects of the 550bp increase in the Federal Funds rate over the past two years likely have not been seen yet. A recession may merely have been delayed so far, but not averted. The inverted yield curve is also consistent with an impending recession. Growth is slowing in the developed world and China, and the Magnificent Seven stocks that have propelled the S&P 500 over the past year may sputter. Geopolitical concerns, whether with the Middle East, Russia and Ukraine, or China and Taiwan, may become more heated as well.

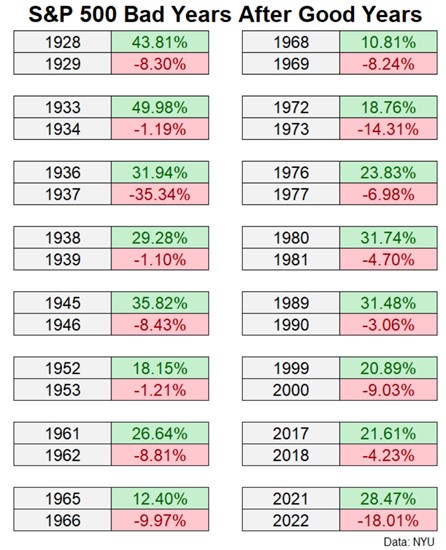

Ben Carlson has 2 simple charts that show S&P 500 performance after strong years of double-digit gains. First, the bad news:

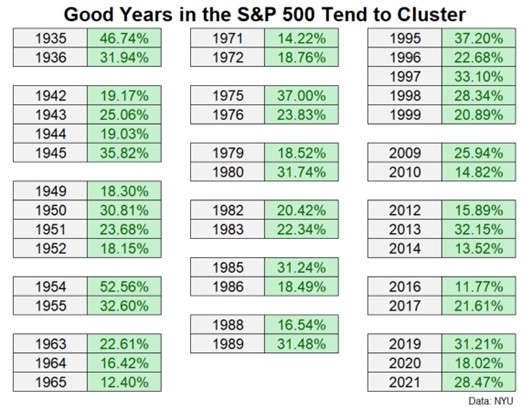

Now, the good news:

Even after a strong year, markets are more likely to rise than fall in the subsequent year. Momentum could play a role, or strong multiyear performances could also simply reflect the historical truism that markets tend to rise over time. Carlson’s summary is also a reasonable framework on how to view 2024—“Many times good returns are followed by good returns but sometimes good returns are followed by losses.”

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back