By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Central Banks and Interest Rates

When the Fed meets this week, it is expected to implement yet another rate hike, but only by a quarter of a percentage point. Given that the Fed has already raised rates by 4.25% since last March, and that there are signs that inflation may have peaked, it is understandable that the Fed may now be more interested in observing the impact of its previous rate increases rather than hiking further at a rapid clip.

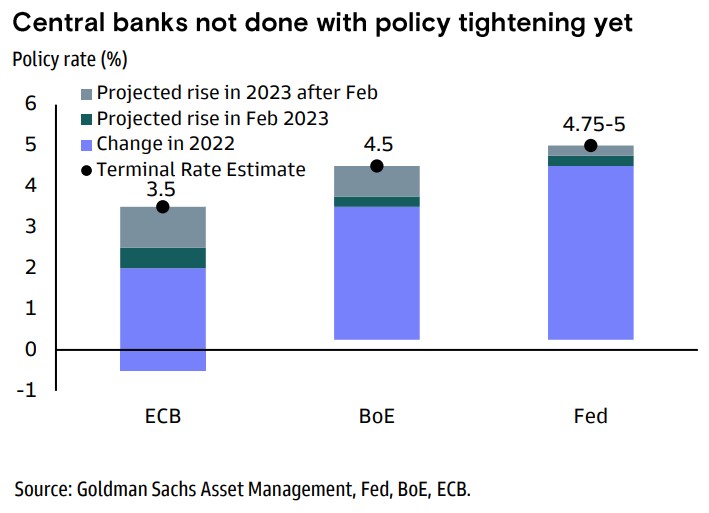

However, inflation has been a global phenomenon, and it’s worth checking to see how some of the rest of the developed world has responded. Goldman Sachs issued a nice summary in their latest fixed income update. The key chart is below:

The Fed tightened much more in 2022 than did the European Central Bank (ECB), with the Bank of England in between. The black dots, along with the gray and green bars below them represent additional tightening that Goldman Sachs believes is forthcoming. Goldman Sachs anticipates that the Fed is nearly done raising rates, with only 2 25bp increases left on the horizon. European Central Banks are projected to raise rates an additional 1.5%, which will close much of its gap with the Fed. Given that inflation in Europe is currently slightly higher than in the US, more aggressive European tightening would not be surprising.

Still, it is worth noting that if policy rates peak at 5% or less, they will be a far cry from the nearly 20% rates seen in the US in the early 1980s. In fact, if—and this is a big if—inflation cools sufficiently with central bank policy rates at 3.5-5%, then there’s a good chance the global economy will have contained inflation with a relatively soft macroeconomic landing. The question then would be whether rates would remain around 5%, or decline significantly, perhaps even to the unusually low levels seen across most of the past two decades.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back