By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Fourth Quarter 2022 Key Takeaways

2022 was an ugly year for markets, but the 4th quarter at least provided a measure of relief that recovered losses to an extent. We’ve witnessed bear markets, but what made 2022 historic is that bond performance also cratered as stocks fell. High and persistent inflation induced central banks to raise rates sharply, and this rising rate environment caused severe damage to both equities and fixed income markets around the world. The path of inflation in 2023 will likely be a major factor in stock and bond performance in 2023; while there are signs that inflation may have peaked, it remains to be seen how fast and how far inflation could fall in 2023, whether disinflation will occur alongside a recession, and how severe any such recession will be. The Fed has raised rates with unprecedented speed, but 2023 may bring even greater challenges—if economic damage starts to accumulate, how long will the Fed persist with high interest rates? If inflation is falling but still elevated, will the

Fed hold off any easing until inflation is near 2%, or will it be more flexible in adjusting rates? Both the labor market and GDP have held up well despite declining fiscal stimulus and restrictive monetary policy, so perhaps the Fed can avoid a painful tradeoff between inflation and unemployment. Hopefully the 4th quarter recovery will continue in 2023, but inflation, slowed growth in China, trade disputes, the Russian invasion of Ukraine, divided US government, and an impending transition to a greener economy all impose their own sets of challenges.

Markets recovered a significant fraction of their earlier losses in Q4 2022. The S&P 500 rose 7.6% in the quarter, developed international gained 17.4%, emerging markets climbed 9.6%, and the Russell 2000 rose 6.2%. Unfortunately, all these gains came after an exceedingly grim nine months, so the year‐end numbers are still dismal. For the year 2022, the S&P 500 fell 18.1%, developed international dropped 14.1%, emerging markets declined 20.0%, and the Russell 2000 ended down 20.5%.

While equity performance sagged in 2022, bonds had their worst year in decades, as aggressive tightening by central banks devalued preexisting bonds by huge margins. The 4th quarter brought some relief, with the US aggrising 1.9%, developed international increasing 7.3%, and high yield gaining 4.2%. But for the year the bond market suffered a historical bloodbath, with the US agg plunging 13.0%, high yield falling 11.4%, and developed international dropping an astounding 19.4%. The damage accrued with the sharp increases in interest rates by central banks, including the Fed’s total rate hike of 4.25% in 2022. US Treasury rates, while roughly stable in Q4 2022, rose precipitously during the year—at the end of 2021, the 2‐year, 10‐year, and 30‐year rates were 0.73%, 1.52%, and 1.90%, but by the end of 2022, these rates ballooned to 4.41%, 3.88%, and 3.97%, respectively.

On the macroeconomic side, the economy has continued to hold up surprisingly well against the onslaught of rate increases. It’s not hard to find predictions of an impending recession, and one may yet be in the cards, but so far GDP and employment numbers have proved to be quite resilient. Q3 GDP growth was an annualized 3.2%. Forecasts for Q4 GDP growth have become increasingly optimistic as well, as positive growth is expected over that period. Payroll growth has shown continued strength and the unemployment rate has fallen to 3.5%. Inflation may have peaked, but has a long way to fall to get near the Fed’s 2% target.

Q4 may have marked the end of the bear market, but the way ahead remains highly fluid. Economic resilience makes a recession less likely (and more mild if one does occur), but also enables the Fed to tighten further and to hold rates high for longer. A sharper recession would crimp markets but may also find a more responsive Fed, especially if inflation is strongly trending downward. The path of inflation will likely have a deep impact on monetary policy and market outcomes, but it’s difficult to characterize this path—we’re in the midst of our first inflationary spike in decades, and there’s simply not much precedent to rely on. Rather than hazard a guess, we would again advocate for a balanced portfolio—bonds are much more viable than they were a year ago, and after the 2020‐2021 runup and 2022 bear market, equities have room to run in almost any direction.

Fourth Quarter 2022 Investment Letter

The fourth quarter of 2022 was a silver lining in an otherwise very dark year for investments. The pace of rate hikes by the Fed has begun to slow, and inflation has started to wane, though it remains well above target. Markets have largely priced in the Fed’s efforts to cool the economy. We are hopeful that the worst is over; however, the timing and extent of equity and bond market recovery is significantly contingent on the path of inflation over the coming months.

Fourth Quarter 2022 Market Update

Q4 2022 represented a good ending to an otherwise awful year. The S&P 500 gained 7.6%, developed international 17.4%, emerging markets 9.6%, and the Russell 2000 6.2%, but these categories nonetheless finished 2022 with returns of ‐18.1%, ‐14.1%, ‐20.0%, and ‐20.5%, respectively. In terms of style, growth stocks bore the brunt of the bear market, with large growth, midcap growth, and small growth losing 29.1%, 26.7%, and 26.4%, respectively. Value fared somewhat better, with small value declining 14.5%, and large value slipping only 7.5%. Given the bear market it’s also unsurprising that most sectors fared poorly in 2022, with the notable exception of energy stocks. Energy gained over 65% in 2022, but the only other sector in positive territory was utilities at less than 2%. All other sectors fell, most by double digits, with communication services falling almost 40%, consumer discretionary sinking 37%, technology dipping 28% and real estate declining 26%.

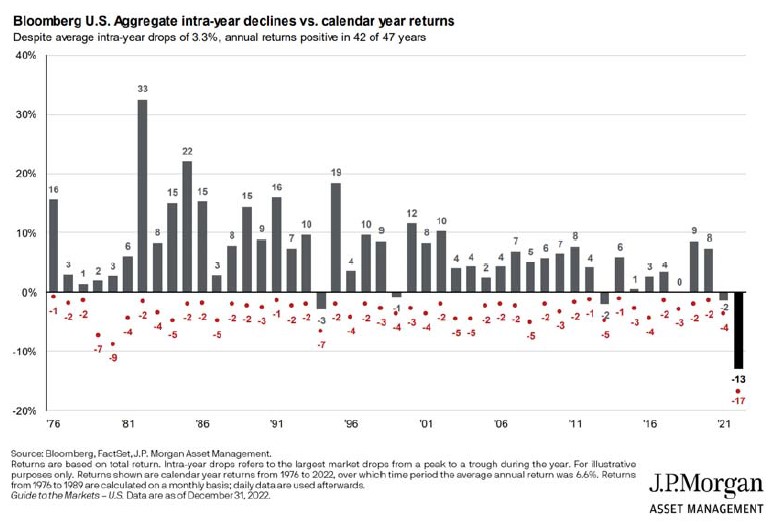

If equities struggled in 2022, bond markets cratered, as central banks around the world hiked interest rates in response to the surge of inflation. For the past 47 years, the US agg only had 4 losing years, with the worst of those years coming in at ‐3%. In 2022 US agg performance obliterated that mark, plunging an astonishing 13% for the year. 2022 was simply the worst year for bonds in decades:

Other areas of the bond market plummeted somewhat less, with high yield declining 11.1% in 2022 and municipal bonds falling 8.5% for the year. The one silver lining going forward is that yields are up sharply, so bonds now provide greater promise as a source of steady income. The VIX remained elevated relative to its pre‐pandemic quiescence, but this moderate degree of choppiness may be the norm for the near term, as markets are buffeted by macroeconomic, global, and financial events.

Update on the Macro Outlook

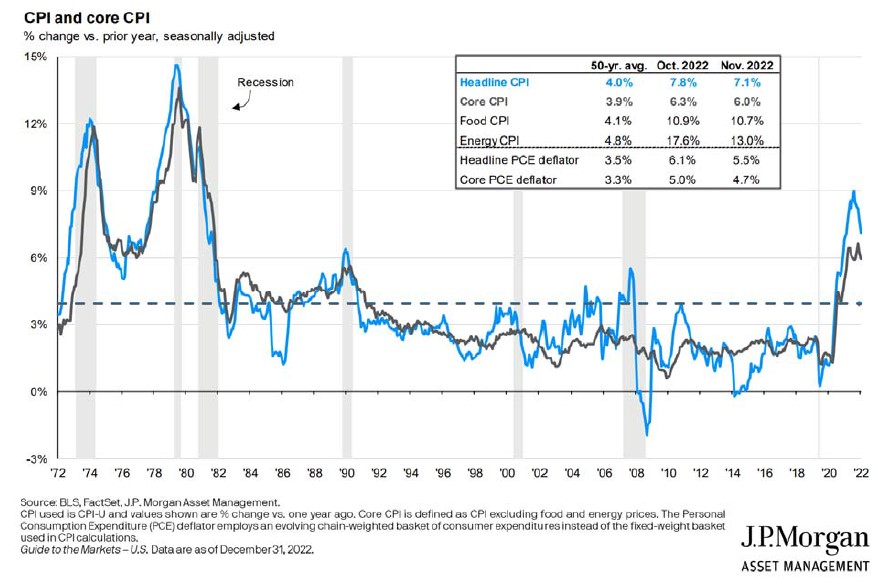

Inflation cast its long shadow over markets in 2022, and the path of inflation will likely remain a major factor driving market movements in 2023. We are hoping that in a few months we won’t need to be writing a quarterly inflation summary, but that’s the reality we’re in right now.

Through a series of rate hikes, the Fed increased the federal funds rate by 4.25% in 2022. Where do we currently stand on inflation?

Headline inflation has come down, in large part thanks to falling energy prices. Core inflation may have peaked, but remains well above target. But monetary policy typically takes time to work its way through the economy, so the Fed appears to be taking a “wait and see” approach, as emphasis shifts from further rate hikes (market expectations are for just a 25bp rate hike at the next FOMC meeting) to maintenance of elevated rates through 2023.

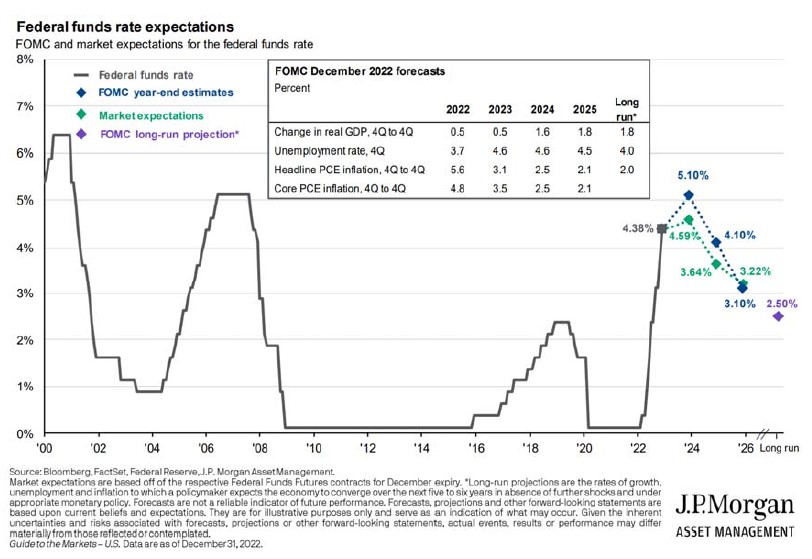

However, there is a modest disconnect between market expectations and Fed projections on the path of the federal funds rate for the next two years:

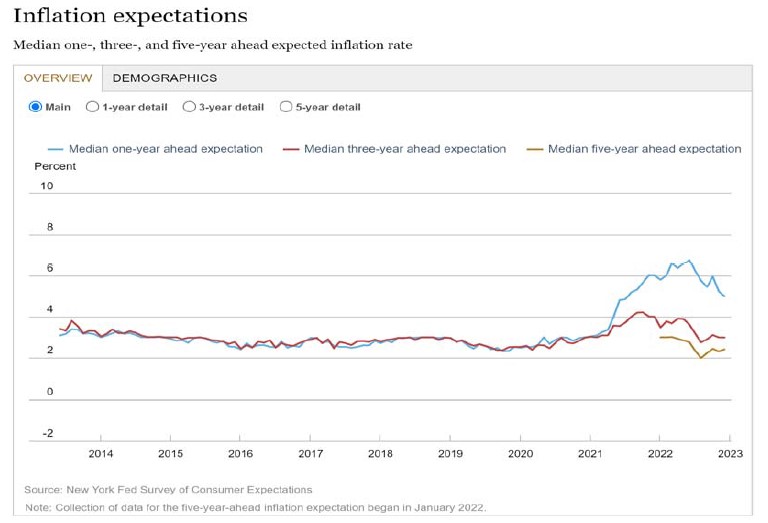

Fed expectations are for the federal funds rate to remain at over 5% at the end of this year, and over 4% at the end of 2024; market expectations are for the federal funds rate to be about 50bp lower at each of these points in time. The Fed could be erring on the side of hawkishness so as to temper inflation expectations. Markets may be anticipating the potential for rate cuts should the economy tip into a significant recession. Note also that the Fed expects core inflation to fall to 3.5% by the end of this year and 2.5% by the end of next year, with the unemployment rate rising, but only to 4.6%. From these figures, if a recession does occur in the US, it would appear likely to be mild. Longer‐term inflation expectations are still in check:

The 10‐year breakeven inflation rate, which indicates market expectations of inflation over the next 10 years. is also currently 2.3%, which is only marginally above the Fed’s target.

So inflation is very high right now, but both market participants and consumers expect inflation to normalize over the next few years. Fed hawkishness may be contributing to this confidence, so we don’t expect a dovish turn anytime soon. And economists don’t know much about how inflation expectations evolve (understandably, since the post‐COVID economy has taken us into uncharted territory), so it’s impossible to know how stable these inflation beliefs are. The Fed’s slowing pace of rate hikes would indicate that it is taking time to see if the recent core disinflation continues over the coming months. GDP growth was positive in Q3 2022 and is expected to remain so for Q4 2022, while the unemployment rate is still only 3.5%. Whether this means a recession is forestalled or merely delayed is unknown, but the resilience of the economy is a promising sign.

So far the mild winter in Europe has reduced the economic fallout that was expected from the curtailed supply of Russian natural gas. Amidst signs of public discontent China ended its zero‐COVID policy, and while COVID cases are apparently surging in the short term, reduced restrictions could unshackle the Chinese economy in the longer run. On the pessimistic side, the US may yet again stumble into a debt ceiling crisis, as the US has currently hit its debt limit and the Treasury Department has been doing its customary “extraordinary measures” to keep paying the bills over the next few months. Hardline Republicans in the House of Representatives would like to extract a sizable ransom in exchange for raising the debt ceiling; the Biden administration isn’t interested in negotiating. So, come June, we may once again be caught up in the throes of a possible debt default.

Portfolio Positioning

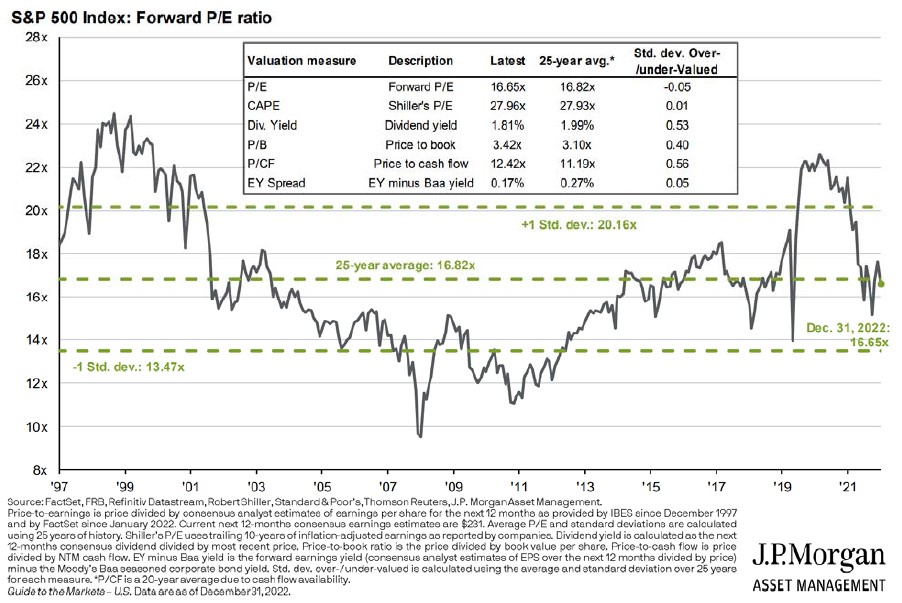

After bidding good riddance to 2022, we can see that following the bond market plunge and bear market in equities, valuations are now reasonable, even after the partial recovery in Q4 2022:

Because of the runup in stocks over the past several years, the bear market of 2022 has resulted in normalization of valuations rather than in bargains across the equities sphere.

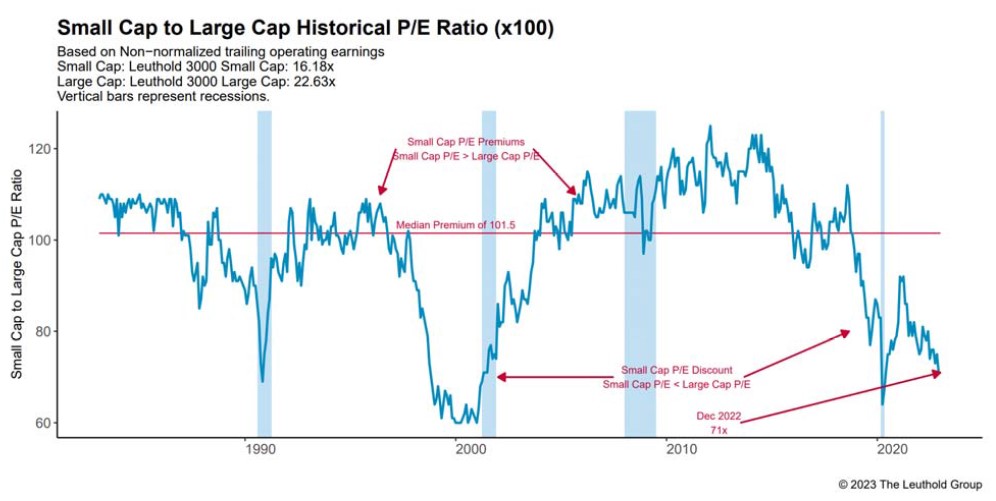

In the short term, we slightly favor value over growth. Nonetheless, while we anticipate the Federal Reserve raising rates in the first part of 2023, recent data suggests the possibility it pauses hikes by mid year. This could bring about a snap back for growth focused stocks, so we want a reasonable balance. As shown above, when comparing small cap stocks to their large counterparts, the small cap stocks are as relatively cheap as they’ve been since the depths of the COVID pandemic and cheaper than at any other point absent their lows following the tech bubble in 1999. This valuation gap would suggest the likelihood for relative performance gains for small cap stocks over large cap stocks in the coming years. While it is difficult to predict if such gains will materialize in 2023, portfolios that are underweight in small cap stocks should look to add to that allocation on weakness. To a slightly lesser extent midcap stocks tell the same story, and should carry at least a baseline allocation in equity portfolios moving forward. On the foreign stock side, good relative value can still be seen versus large cap US stocks. However, the sharp rally in the 4th quarter of 2022 removed some of the relative value offered in the international markets. Still, given that a significant valuation differential remains between domestic large caps and foreign stocks, it is reasonable to expect some positive relative performance over the next market cycle.

The silver lining to an extremely painful year in the bond markets is that current yields are significantly more attractive than they were a year ago. While the risk of rising interest rates still exists, it appears that the largest amount of pain is in the rear view mirror. For the first time in well over a decade, savers are now being rewarded with money market rates in excess of 3.5% and short‐term Treasury yields above 4%. Even more attractive yields can be found on the credit side of the bond market. While it makes sense for bond investors to take advantage of these yields, it would be prudent to diversify credit risk across multiple asset classes, including high yield bonds, emerging market bonds, and various mortgage securities. While recent data suggests the economy is stronger than many assumed heading into 2023, the possibility for increased defaults in certain segments of the economy make diversification and risk management of the utmost importance. Given the higher yields across most bond segments, it is our hope that the fixed income side of portfolios will not be a headwind to overall returns over the next 12‐18 months.

Closing Thoughts

Given the weaker baseline in stocks and higher yields for bonds, there is the potential for a bounceback year for markets in 2023 after a poor 2022. Much depends on whether central bank efforts to curb inflation prove successful, and at what economic cost. So far in the US, early trendlines show some promise, as inflation has begun to cool without an increase in unemployment. What is unknown is the economy’s response (and any Fed counter response) to a period of sustained high rates. Moreover, the US government needs to be at least minimally functional under divided government, with Democrats holding the Presidency and Senate, and Republicans holding the House. A brief government shutdown in late 2023 from failed budget negotiations would not be surprising, but a debt default in summer could have major market repercussions. We hope the market recovery seen in the last quarter of 2022 is a harbinger of better times ahead, but this outcome is likely to be contingent on a continuing decline in core inflation that enables the economy to achieve a relatively soft landing.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events ‐ as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back