By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Economic Snapshots

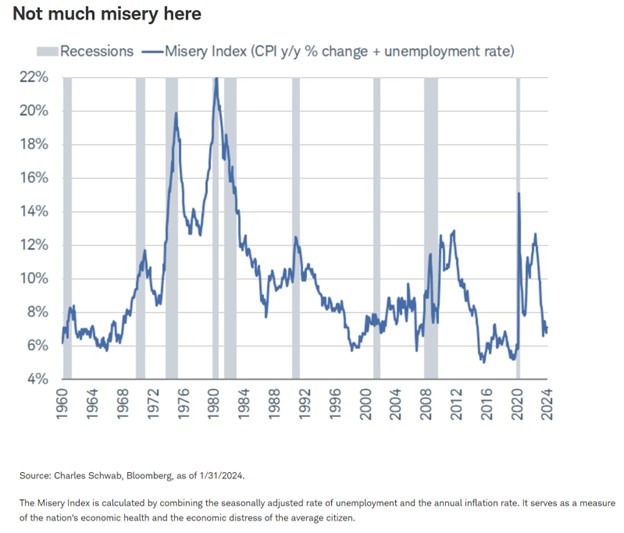

Despite the inflation headaches of the past three years, the US economy has proven quite resilient to this point, and we’re currently nowhere near the economic crisis of the 1970s:

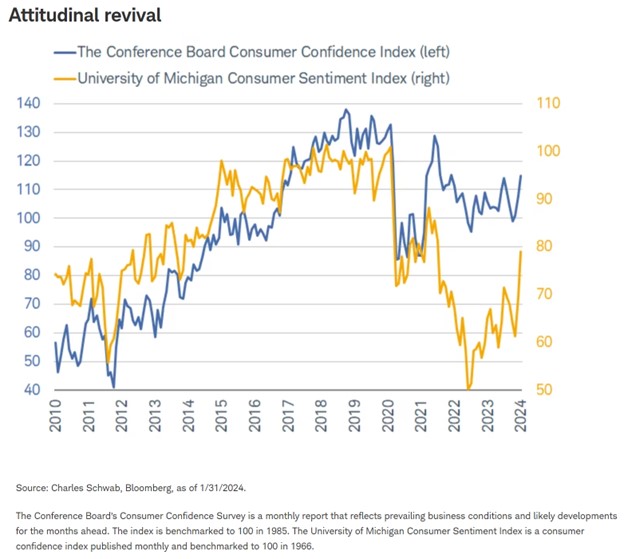

The misery index, which equals the sum of the year-over-year inflation rate and the unemployment rate, remains quite low by historical measures. After collapsing during the inflation spike, consumer sentiment has rebounded significantly in recent months:

The consumer sentiment index tends to move with inflation, whereas the consumer confidence index is more closely correlated with labor market conditions. As inflation has fallen, we’ve seen the gap between the two indices narrow considerably.

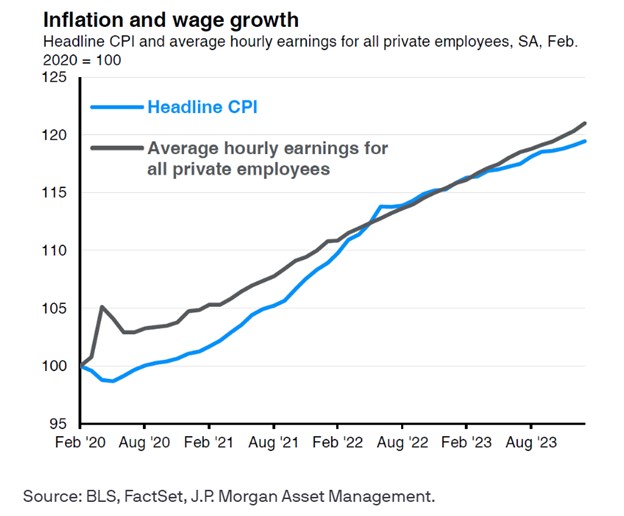

Despite continued elevated inflation, wage growth has neutralized much of inflation’s damage:

After-inflation wage growth is still lower than it was 3-4 years ago, though it has been improving as inflation has fallen.

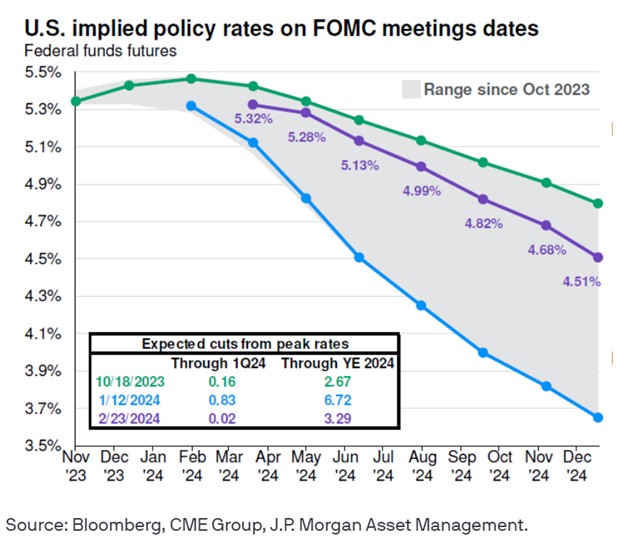

With both GDP growth and the labor market continuing to exhibit surprising strength in the opening weeks of 2024, the Fed has taken a cautious stance with respect to intiating rate cuts. The bond market has whipsawed in recent months, with expectations of the Fed keeping rates higher for longer shifting to a more dovish stance, then turning back again to a more hawkish view as the Fed indicated that a March rate cut was unlikely. The disparity between market and Fed projections grew quickly than shrunk almost as rapidly:

The overall outlook for rates is still for rate reductions, just delayed and at a slower pace than previously anticipated. The economy’s continued strength gives the Fed more runway to maintain higher rates to blunt inflation, but if the economy weakens unexpectedly, the Fed should have the flexibility to pivot to a more accommodative regime fairly quickly.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back