By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Humility and Investing

We advocate for diversified portfolios, in large part because participation in many areas of the market can give many opportunities for financial gains. The flip side is that diversified portfolios also help limit losses in the event of one particular area of investment performing poorly. Financial professionals who go out on a limb may have the misfortune of seeing that limb snap from underneath them.

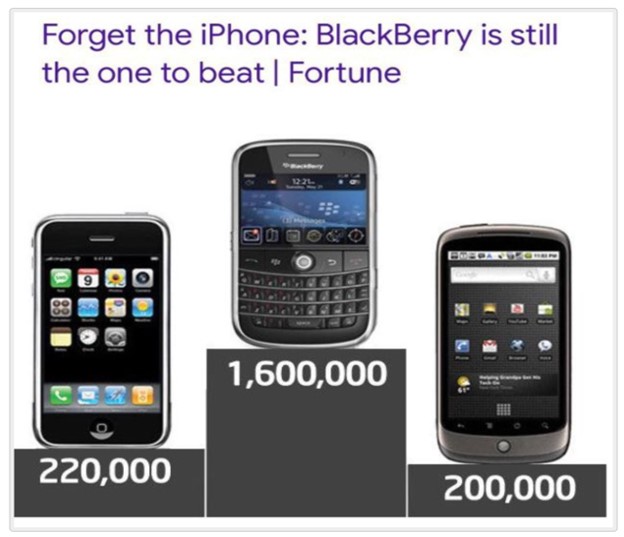

Barry Ritholtz highlights a specific case from 16 years ago. In 2007, Fortune Magazine’s cover story was:

Source: Fortune Magazine via Barry Ritholtz

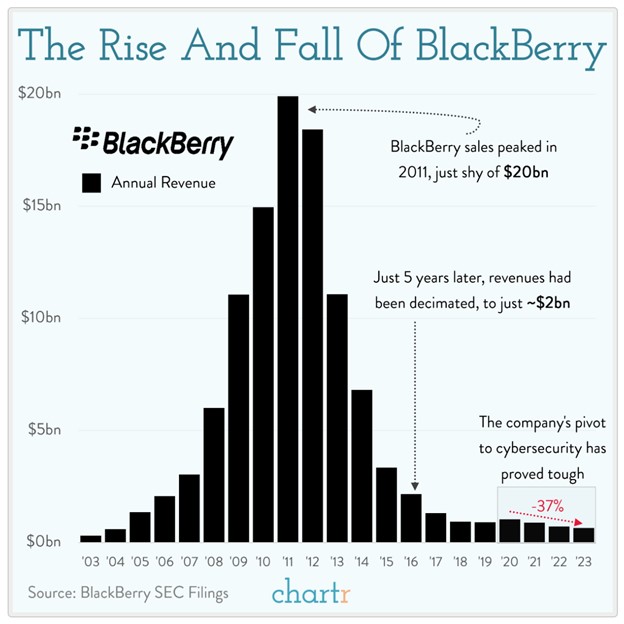

At the time, the idea of BlackBerry fending off the iPhone wasn’t a ludicrous proposition. You might remember President Obama’s fondness for his BlackBerry, or BlackBerry CEO Jim Balsillie’s efforts to buy (and perhaps relocate) the NHL’s Pittsburgh Penguins. Ritholtz includes a chart that both details BlackBerry’s fall and shows why BlackBerry’s prospects still seemed promising as of 2011:

Hindsight is 20/20, but it is difficult to make accurate predictions in real time. It’s immensely challenging to pick winners and losers, and it’s typically safer to invest broadly, relying on a rising tide lifting all (or most) boats. Smart investors can still make very bad individual calls, with Mitt Romney providing another example in 2012. During an October Presidential debate Romney criticized the Obama administration, which had provided grants and tax breaks to renewable energy companies, for picking losers. Who were these loser companies? Romney mentioned Solyndra, a bankrupt solar panel manufacturer, but unfortunately also cited another company that had received $465 million in loans from the Department of Energy. This company has fared considerably better than Solyndra, as Tesla now has a market capitalization of around $750 billion.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back